Apple's Risk and Marvelous Future in Four Stunning Charts

Fundamentals

PREFACE

The narrative surrounding Apple (NASDAQ:AAPL) has turned decidedly bearish. The company will have its first year-over-year sales decline this quarter. Looking yet one quarter further, the bearish tone turns yet more cacophonous, with seemingly limitless reports of suppliers cutting production.

Here's the thing though, a stock price isn't based on the next two quarters -- it's focused on free cash flow into perpetuity. Here are the images that define Apple today, and then the images that will define Apple in the future.

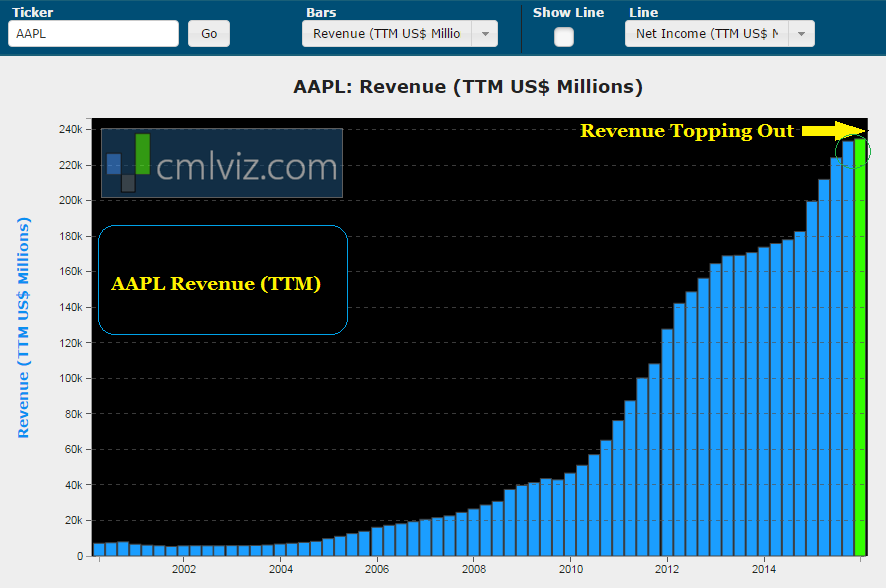

CHART 1: REVENUE

First, we look at revenue (TTM) for the last sixteen years:

APPLE REVENUE

That topping off will turn back down to a lower level as of next quarter and the quarter after that

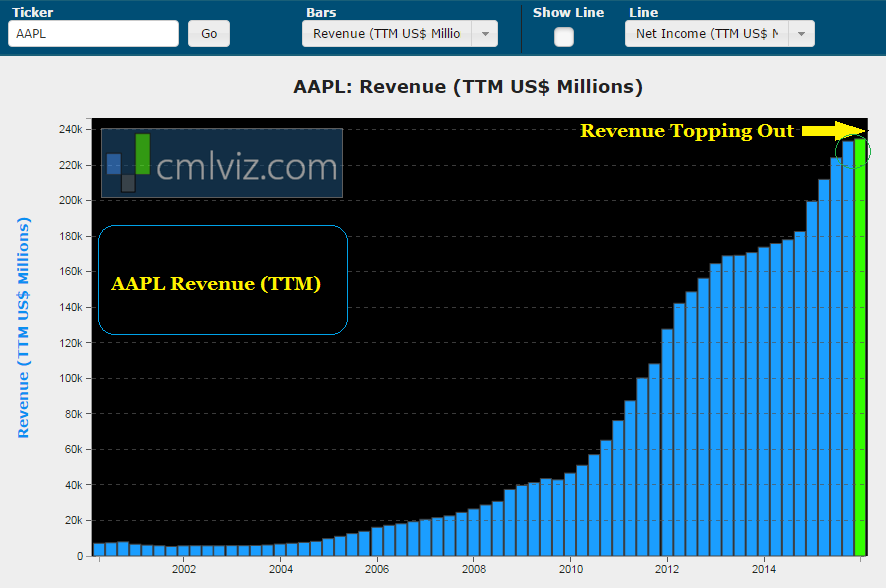

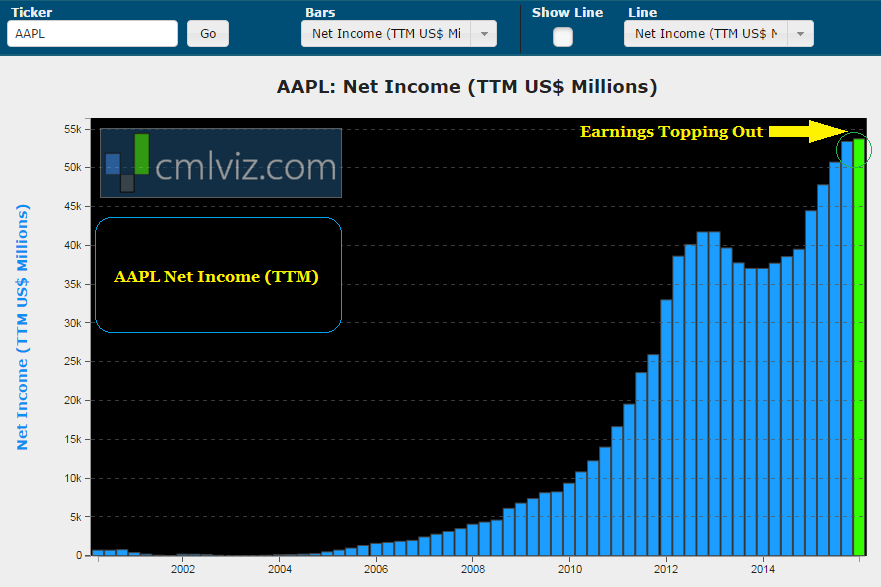

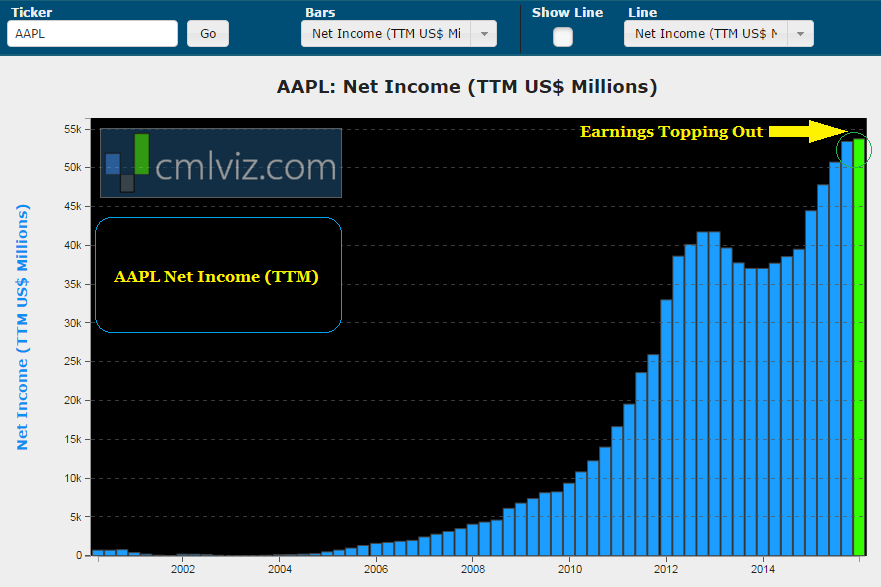

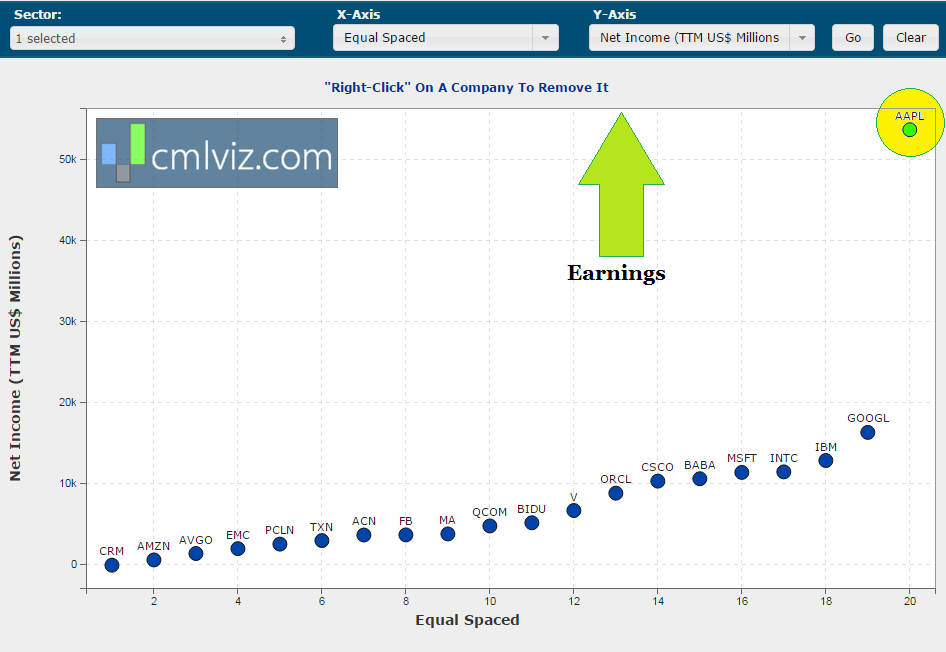

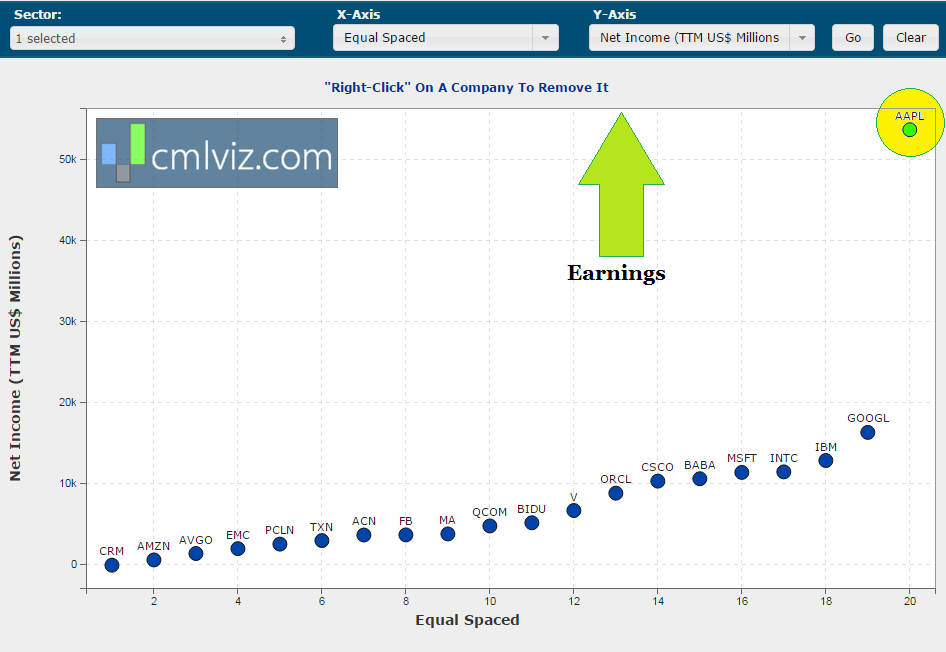

CHARTS 2 & 3: NET INCOME

Now, we look at net income (TTM), which is a fancy way of saying after tax earnings, for the last sixteen years:

APPLE EARNINGS

Again, that topping off will turn back down to a lower level as of next quarter. We can do the same comparison with net income as we did with revenue for Apple versus its peers:

MEGA CAP EARNINGS

We can see that Apple's net income towers above every other technology firm, and even Alphabet (NASDAQ:GOOG) pales in comparison.

But, that's all in the past -- here is the future, and it's quite bright for Apple, regardless of the bearish narrative.

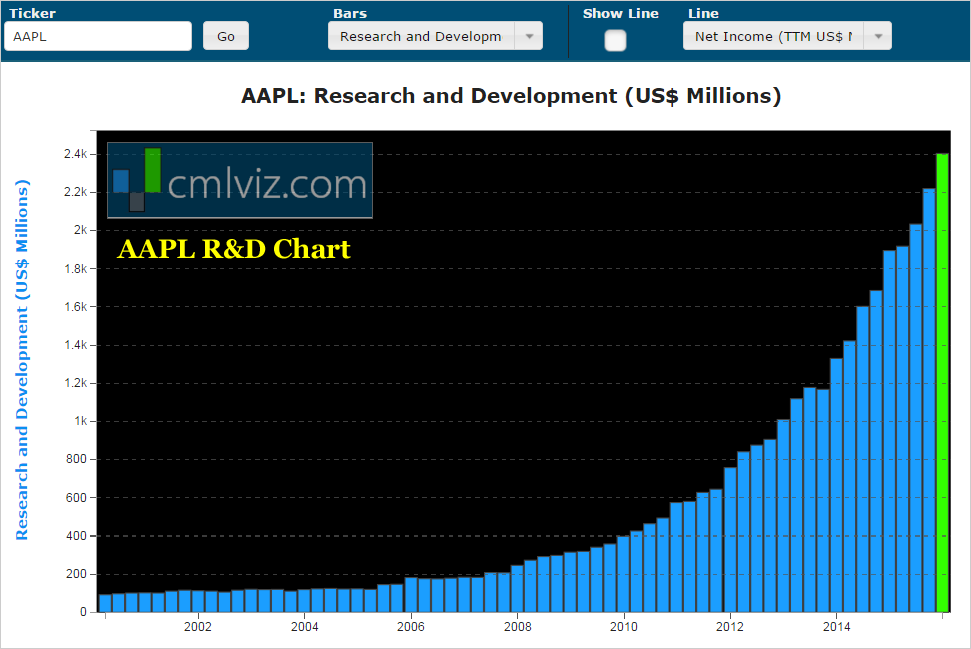

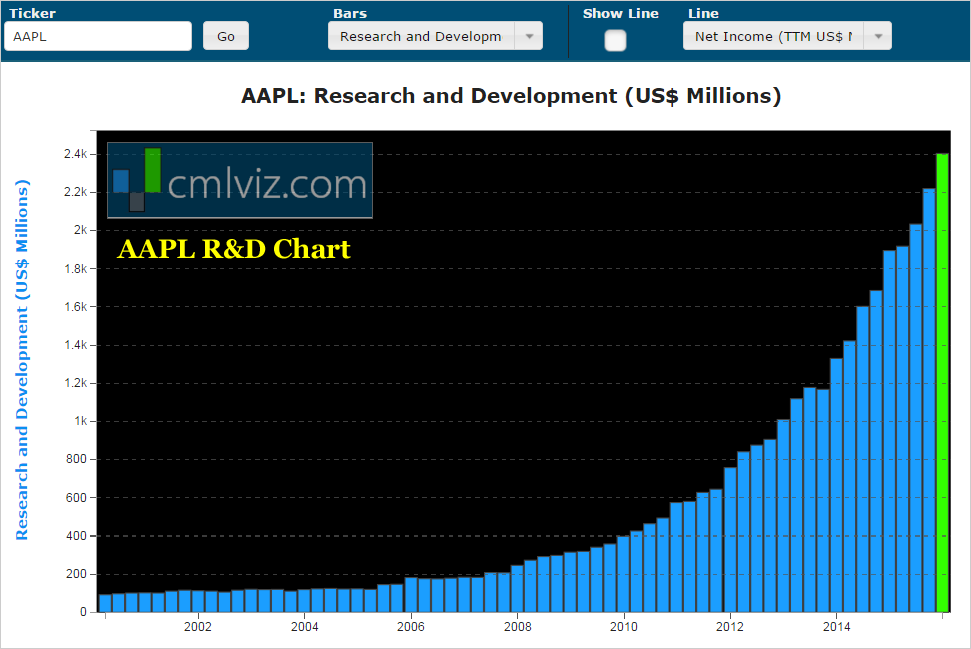

CHART 4: R & D

Apple has been pouring money into research and development (R & D). Here is the trend, and then we'll get to the marvelous opportunities coming up because of this investment:

APPLE R & D

CHARTS: THE FUTURE #1

Let's look beyond the rather myopic view of the next two quarters, into a future that properly reflects Apple's growth prospects. We'll start with the smartphones -- iPhone is the bread and butter of this firm, for now.

Smartphone growth in general is actually quite substantial. In fact, by 2020 forecasts call for 6 billion people to own a smartphone. Today, there are just 2.6 billion. Let's take this analysis just a few steps forward before we move on to the next opportunity. Two facts we should be aware of:

1. Consumers that are switching from Android phones to iPhones has never been greater. Here's a quote from Apple's CEO Tim Cook from the last earnings call:

"We recorded the highest rate on record for Android switchers last quarter at 30 percent."

2. Fact number two is actually frighteningly little known. Here it is: Business Insider tells us that "teenagers are heavy smartphone users — many spend six hours a day on their phones — and Apple's iPhone remains their brand of choice." And then they wrote this:

69% of teenagers surveyed are currently iPhone users. That's the highest interest in the iPhone among teenagers since at least 2013.

We'll stop but add a quick mention that there is a tectonic shift occurring in India where Apple has already doubled its market share in 3-months in the second largest smartphone market in the world. In fact, virtually all models with all carriers [are] out of stock at Apple's retail stores in the United States for the iPhone SE. Demand is also exceeding supply internationally.

In all, it's easy to recognize that while the few quarters will be tough for Apple, longer-term, the iPhone is still a massive profit center and it literally has never been more relevant with respect to Android switchers and power using teenagers.

CHARTS: THE FUTURE #2

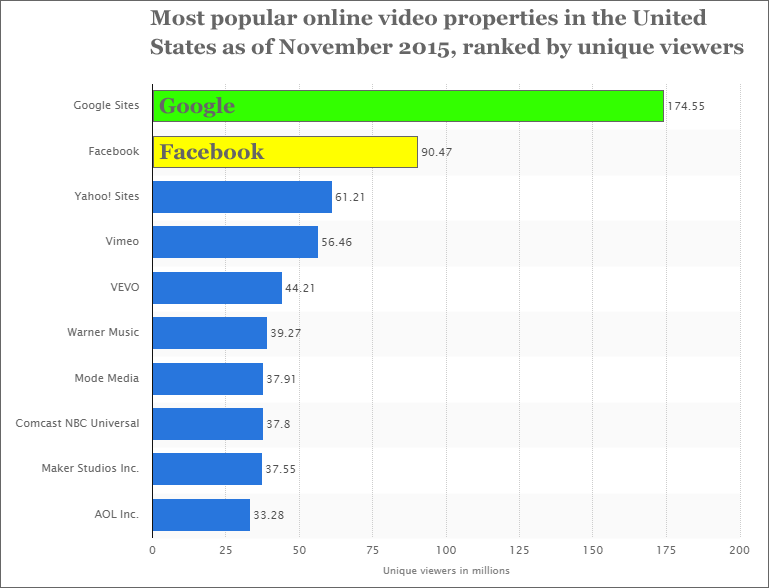

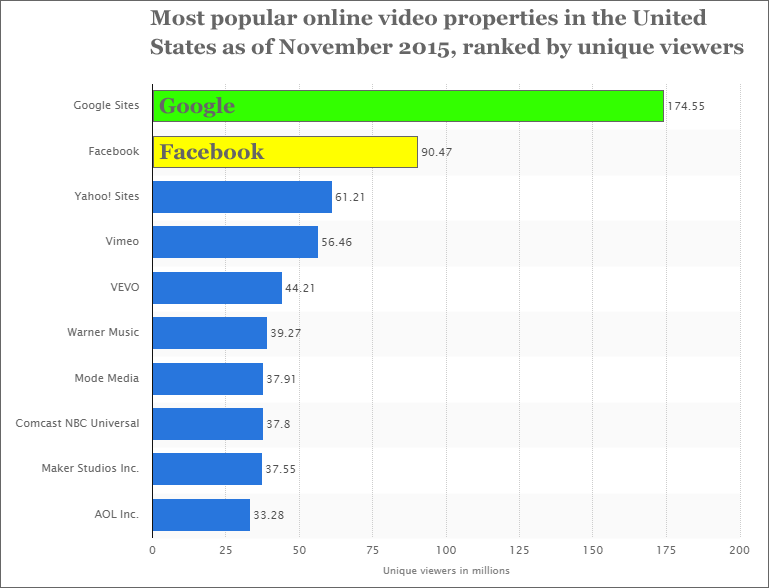

iPhone speak can get repetitive -- but here is one new platform that has been totally misunderstood: The Apple TV. Apple recognizes the video war -- which rages on three fronts:

1. Streaming video on demand (SVOD): This is Netflix (NASDAQ:NFLX) and Amazon's newly announced stand-alone SVOD service, which used to be married to Amazon Prime membership.

2. Online Video: This is where Google's YouTube is just crushing it with more viewership on mobile alone for people aged 18-49 than any other cable network in total. It's also home to Facebook's (NASDAQ:FB) massive push where the firm announced eight billion video views a day.

MOST POPULAR ONLINE VIDEO SITES

3. Cable TV: There are 133 million households in the United States alone with a cable TV subscription and 75% of those people watch TV everyday (Source: AYTM).

Check out what Apple is doing:

APPLE TV DESKTOP

Apple wants to control the central being of our entertainment and digital lives.

"Think of Apple's fourth-generation box as a way to turn your TV into a giant iPhone."

Source: WSJ

Source: WSJ

Apple is rumored to be working on a subscription TV service, one that would serve as a replacement for traditional pay-TV providers at about $40 a month and this is how it works:

As the cable providers try desperately to stop the cord-cutting phenomenon they now allow subscriptions to their channels as apps. So, Apple is going to bundle the apps, like ESPN, HBO Go, Showtime, or whatever other cable networks we love – and it will also combine Netflix, Amazon Prime, YouTube and Facebook. Remember that image we showed you above -- look at those icons. Every other company video provider of any type is a visitor to the home that is Apple TV.

SVOD has approximately 100 million subscribers worldwide, cable has 133 million in the US alone and online video is impossibly large to measure. But Apple will be the connector, the bundler, the ecosystem and everybody watching video of any type on any medium is going to be writing checks to "Apple, Inc."

And just so we don't get too lost in what "might happen," here is a quote from Tim Cook on the last earnings call (emphasis added):

"We had our best quarter by far for Apple TV sales, and the number of apps developed for Apple TV is growing rapidly."

Source: WSJ

Source: WSJ

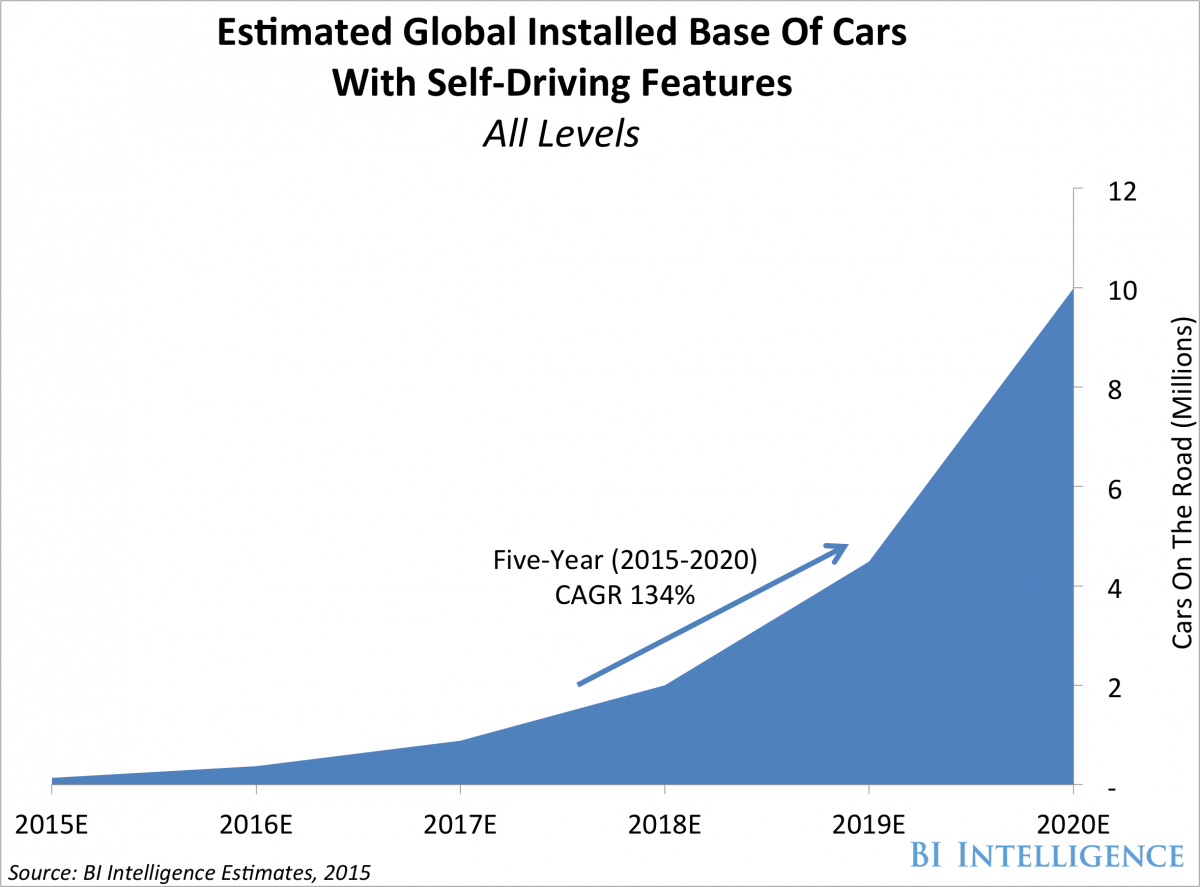

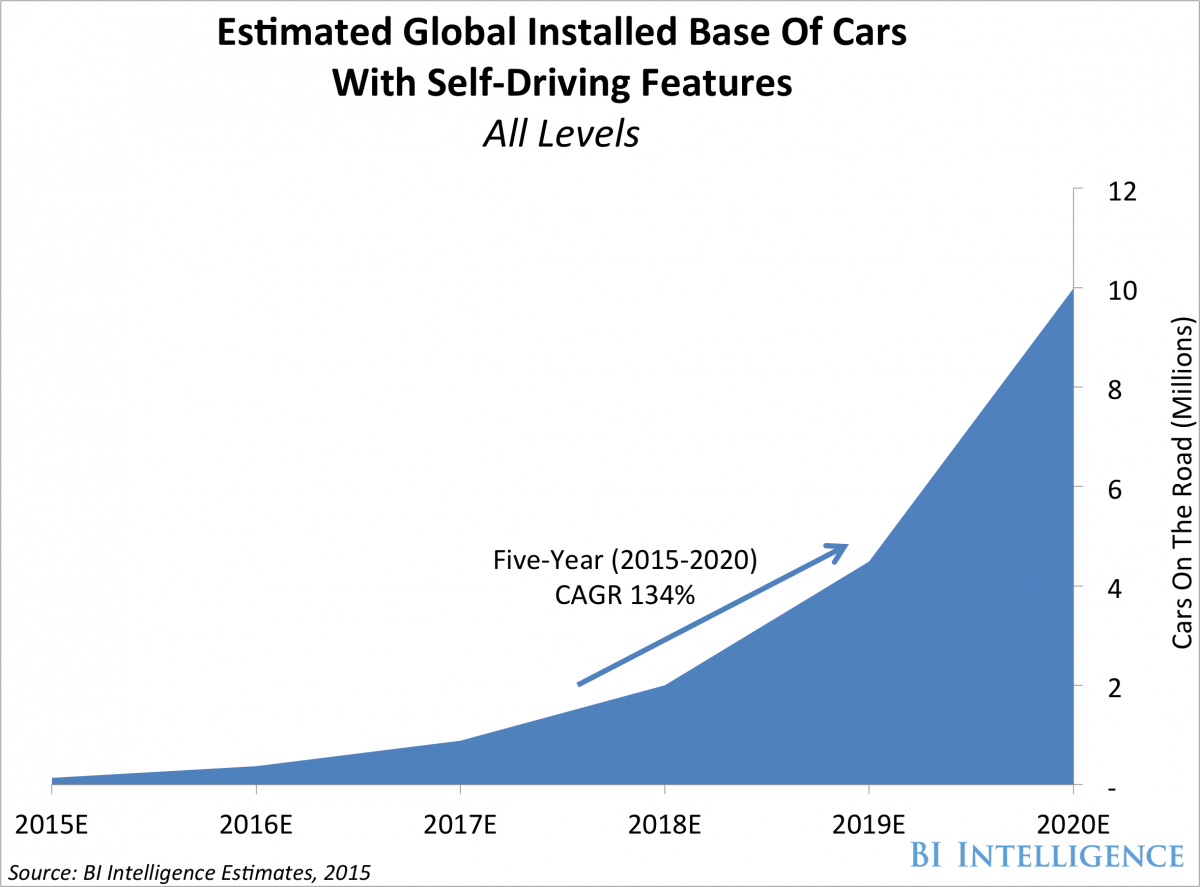

CHARTS: THE FUTURE #3

The Apple Car is coming -- it just is. The WSJ reported on it, Tesla's (NASDAQ:TSLA) Elon Musk has called it "an open secret," Capital Market Laboratories (CML) has reported on it, BMW freaked out about it and even Tim Cook, when asked directly about it, said "It'll be like Christmas Eve for a while." Here is the market for cars with self-driving features:

CARS WITH SELF-DRIVING FEATURES

CHARTS: THE FUTURE -- MORE

There's actually a lot more going on -- it's nearly impossible to cover in one report. Apple spans almost all of technology's transformative themes and looking one to two quarters in the future is not how to find a proper investment. In fact, to find the 'next Apple,' 'next Tesla,' or 'next FANG stock,' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.