The CML Close - Stocks dropped, inflation cools, spending cools, metals are in deflation - 06-30-2022

Markets

Stocks dropped but the Fed's most watched inflation gauge came in lower than estimates, fell for the third straight month and is at the lowest level in six-months.

The price of metals on commodity exchanges are plummeting signaling deflationary pressures, for now.

| • SPX | 3,785.38 | -33.45 | (-0.88%) |

| • NASD | 11,028.74 | -149.16 | (-1.33%) |

| • DJIA | 30,775.43 | -253.88 | (-0.82%) |

| • R2K | 1,701.36 | -18.01 | (-1.05%) |

| • VIX | 28.84 | +0.68 | (+2.41%) |

| • Oil | 105.88 | -3.90 | (-3.55%) |

• Core PCE, the Fed's preferred inflation came in lower than expected for the May reading out today.

• Metals are in a deflationary trend, quickly eroding inflationary prices.

• Personal spending in the US came in lower than estimates and was the weakest reading of the calendar year.

Headlines of the Day

Dow Drops as Brutal First Half of 2022 Draws to an End

The stock market likely won’t move sustainably higher until it is more certain that the rate of inflation is decelerating quickly.

Tech Is at Risk as J.P. Morgan Lowers Estimates

J.P. Morgan tech analysts moved to lower their financial expectations for all companies in their coverage.

Metals Set for Worst Quarter Since 2008 on Global Downturn Angst

The LME metals index is down 23% since the end of March. Tin led losses, but copper and aluminum have also crashed.

The market’s worst first half in 50 years has all come down to one thing

A multitude of factors conspired to generate the stock market’s worst first-half since 1970, all centering on inflation.

Bank of America’s Crypto Users Shrunk by 50% in Bear Market

Crypto comprises less than 1% of US household financial assets. Sentiment toward cryptocurrencies has soured, says BofA.

Economic Data Results for 6-30-2022

United States PCE Price Index Annual Change

The personal consumption expenditure price index in the United States increased 6.3% year-on-year in May of 2022 versus estimates of 6.4% after hitting a record high rate of 6.6% in March.

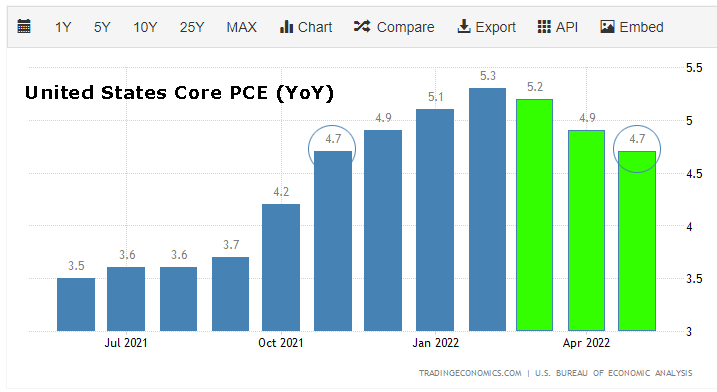

United States Core PCE Price Index Annual Change

The core PCE Price Index inflation, the preferred gauge of inflation by the Fed, eased to 4.7 percent in May of 2022 from 4.9 percent in the prior month, the lowest in six months and slightly below market expectations of 4.8 percent.

United States Personal Spending

Personal spending in the US edged up 0.2% month-over-month in May of 2022 versus estimates of 0.4%, the weakest gain so far this year.

United States Chicago PMI

The Chicago PMI fell to 56 in June of 2022 from 60.3 in May, below forecasts of 58. It is the lowest reading since August of 2020.

Economic Data Due Tomorrow on 7-1-2022

ISM Manufacturing PMI

ISM Manufacturing Prices

Construction Spending

ISM Manufacturing New Orders

"

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated."