The CML Close - Stocks rise on dropping commodity prices and weak economic data - 06-24-2022

Markets

Stocks rose on poor sentiment and falling commodity prices which may lead to a less aggressive Fed and faster disinflation.

| • SPX | 3,911.74 | +116.01 | (+3.06%) |

| • NASD | 11,607.62 | +375.43 | (+3.34%) |

| • DJIA | 31,500.68 | +823.32 | (+2.68%) |

| • R2K | 1,765.74 | +54.06 | (+3.16%) |

| • VIX | 27.23 | -1.82 | (-6.27%) |

| • Oil | 107.06 | +2.79 | (+2.68%) |

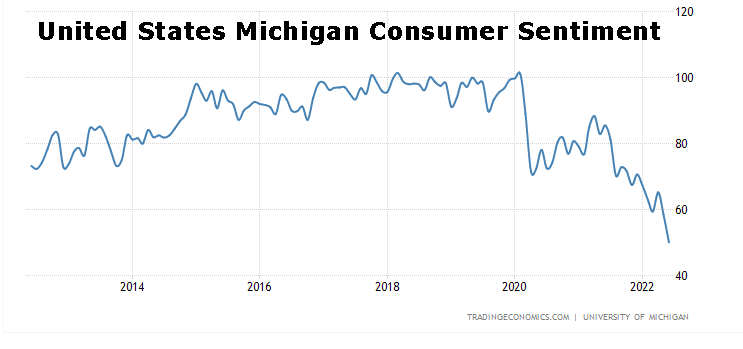

• The University of Michigan consumer sentiment was downwardly revised to a record low.

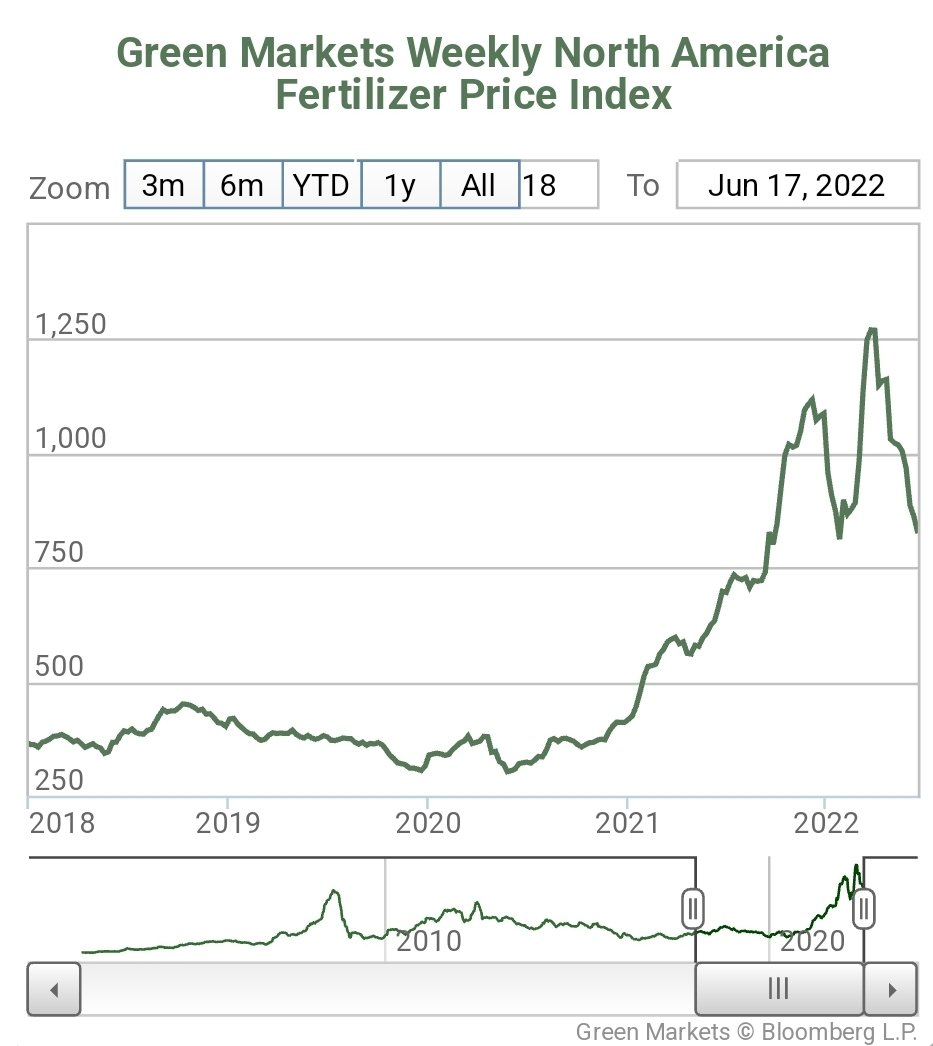

• Weekly North American fertilizer index is dropping and concerns that fertilizer supplies from Russia would be completely shut off haven’t panned out.

• Cotton futures prices have been in free fall.

• Economist says housing correction is coming.

Headlines of the Day

Stocks Rally as Fears Over Aggressive Rate Hikes Ease

The stock market extended its recent rally on Friday, as fears over the Federal Reserve’s aggressive interest rate hiking plan are easing. Economic data certainly isn’t disrupting that narrative.

The prospect of a fertilizer shortage that threw farmers and crop markets into disarray and pushed up food costs globally may be over

Meanwhile, concerns that fertilizer supplies from Russia would be completely shut off haven’t panned out.

Stock Funds See Exodus as Recession Fears Grip Investors

Equity funds see $16.8b outflows while $23.5b exits bonds. Capitulation this year has been in bonds, not stocks: Hartnett.

Global Commodity Shock Enters Next Phase With Recession Test

Skyrocketing prices pose challenge for consumers, governments. Shockwaves from Russia’s war still shaking raw materials.

‘Coast to Coast’ Housing Correction Is Coming, Says Moody’s Chief Economist

US home prices will likely fall in the most overvalued markets, projects Mark Zandi. But it will fall short of a crash.

Economic Data Results for 6-24-2022

United States Michigan Consumer Sentiment

The University of Michigan consumer sentiment was downwardly revised to a record low of 50.0 in June of 2022, from a preliminary reading of 50.2.

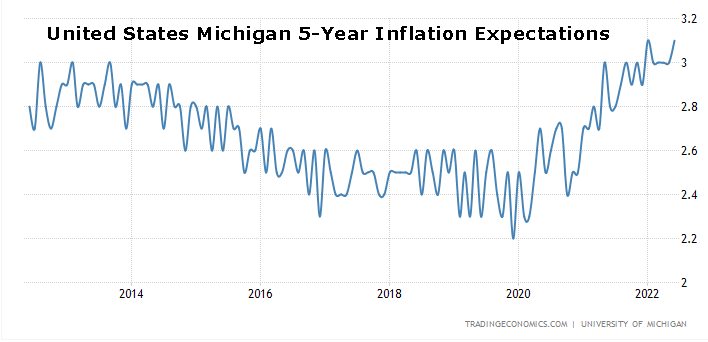

United States Michigan 5-Year Inflation Expectations

Michigan 5 Year Inflation Expectations in the United States increased to 3.10 percent in June from 3 percent in May of 2022.

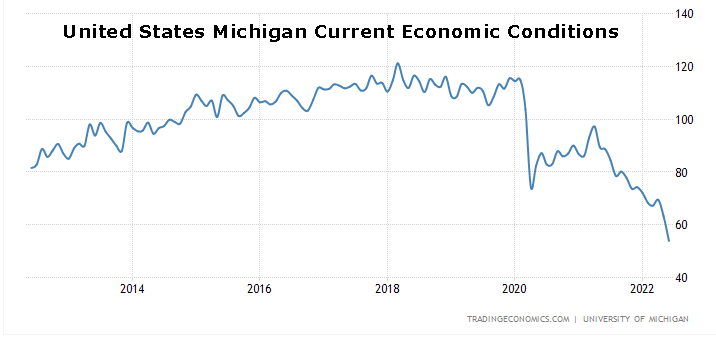

United States Michigan Current Economic Conditions

The University of Michigan Current Economic Conditions subindex in the United States decreased to an all-time low of 53.80 points in June from 63.30 points in May of 2022, a final reading showed.

New Home Sales

New home sales in the United States rose 10.7% from a month earlier to a seasonally adjusted annual rate of 696,000 in May of 2022, above market expectations of 588,000.

Economic Data Due Monday on 6-27-2022

Pending Home Sales MoM

Durable Goods Orders

United States Dallas Fed Manufacturing Index

"

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated."