The CML Close - Stocks dropped, good inflation news, optimism is... pessimistic - 06-14-2022

Markets

Stocks were mostly down, though NASDAQ rose slightly on the day. Crude oil fell as did VIX.

Inflation data on the producer side actually turned out better than expected and small business optimism is dropping.

| • SPX | 3,735.48 | -0.38% | (-0.38%) |

| • NASD | 10,828.35 | +19.12 | (+0.18%) |

| • DJIA | 30,364.83 | -151.91 | (-0.50%) |

| • R2K | 1,707.83 | -6.77 | (-0.39%) |

| • VIX | 32.69 | -1.33 | (-3.91%) |

| • Oil | 118.74 | -2.19 | (-1.81%) |

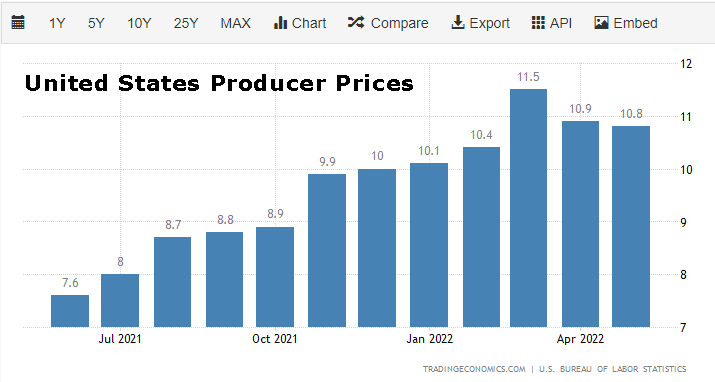

• Annual producer inflation (PPI) fell for the second consecutive month.

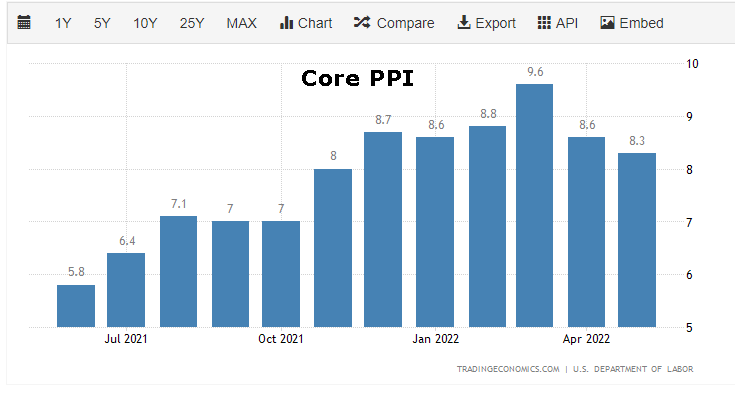

• Annual Core PPI fell significantly more than estimates.

• The IBD/TIPP Economic Optimism Index in the US fell to its lowest since August 2011.

Headlines of the Day

Stagflation Fears Surge and ‘Sentiment Is Dire’ in BofA Survey

Global growth optimism at a record low in fund manager survey. Investors are long cash, US dollar and are short bonds, tech.

Inflation Data Likely Push Fed to Consider 75 Basis-Point Hike

A 75 basis-point move would be largest hike since 1994. Powell previously signaled a half-point hike was probable.

The Housing Market Is Slowing Down. There’s Some Hope for Buyers.

Recent data show home sales have slowed as higher mortgage rates and still-rising home prices push some buyers to the sidelines. All eyes are now on indicators of supply and demand to see whether those conditions will last.

Most factories in Shanghai resume work as Covid controls ease, ministry says

Factories in two of economic hubs have mostly resumed work as the impact of Covid subsides, said China's Ministry of Industry and Information Technology.

There Might Be a Recession, but It Won’t Be Long, Wall Street Says

Of course, a deep downturn might still be avoided. But it might also pay to remember that no one saw the 2008-09 financial crisis getting as bad as it did, either.

Economic Data Results for 6-14-2022

United States Producer Prices Change (PPI)

Annual producer inflation in the US edged slightly lower to 10.8% in May of 2022 from 10.9% in April and a 21-year high of 11.5% hit in March.

Core PPI

The producer price index for final demand less foods and energy in the United States rose by 8.3 percent from a year earlier in May of 2022, easing from a revised 8.6 percent increase in the prior month and below market expectations of an 8.6 percent rise.

United States IBD/TIPP Economic Optimism Index

The IBD/TIPP Economic Optimism Index in the US fell to 38.1 in June of 2022 from 41.2 in the previous month, the lowest since August 2011. The six-month outlook for the US economy declined 2.6 points to 30.6, the lowest since July 2008; and the gauge of support for federal economic policies sank 2.7 points to 37.4, the lowest since September 2015.

United States Nfib Business Optimism Index

The NFIB Small Business Optimism Index in the United States edged down to 93.1 in May of 2022, the lowest since April of 2020, and compared to 93.2 in April. The share of owners expecting better business conditions over the next six months hit a record low.

Economic Data Due Tomorrow on 6-15-2022

Retail Sales YoY

Retail Sales Ex Gas/Autos

NY Empire State Manufacturing Index

Retail Inventories Ex Autos

NY Empire State Manufacturing Index

MBA Mortgage Applications

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated."