The CML Close - Stocks down, inflation worries, home purchases plummet, commodity prices rise to all time high - 06-08-2022

Markets

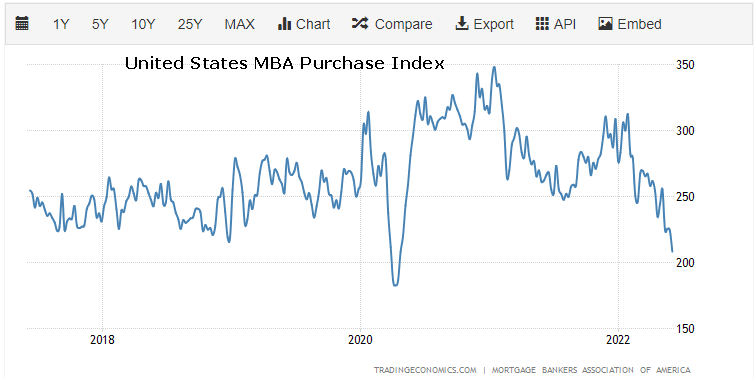

Stocks were down on inflation worries with CPI and Core CPI data out this Friday. Home purchases have sunk to a two year low and commodity prices are at an all time high.

| • SPX | 4,115.77 | -44.91 | (-1.08%) |

| • NASD | 12,086.27 | -88.96 | (-0.73%) |

| • DJIA | 32,910.90 | -269.24 | (-0.81%) |

| • R2K | 1,890.83 | -28.73 | (-1.50%) |

| • VIX | 24.02 | no change | (0.0%) |

| • Oil | 122.60 | +3.19 | (+2.67%) |

• Bloomberg Commodity Spot Index has risen to new all-time high.

• The MBA Purchase Index in the United States decreased 7.1% to 208.20 points in the week ended June 3rd 2022. It is the lowest reading in two years.

• The World Bank cut its global growth outlook.

Headlines of the Day

Stocks Slip as Inflation Fears Linger

U.S. consumer price index data due on Friday loom large as investors fret over how the Federal Reserve will handle inflation.

Stagflation Danger Sees World Bank Cut Global Growth Outlook

Pain of high inflation, slow growth could persist for years. Lender reduces 2022 economic growth forecast to 2.9%.

Oil Tops $120 as US Inventory Data Highlights Fuel Supply Crunch

Gasoline inventories dropped over 800k barrels last week: EIA. Prices haven’t peaked as China’s demand set to rebound: UAE.

America’s Inequality Problem Just Improved for the First Time in a Generation

The collective wealth of the bottom 50% of households has nearly doubled in two years.

Economic Data Results for 6-8-2022

United States MBA Mortgage Applications

Mortgage applications in the US continued to fall heading into June, as mortgage rates march higher, housing prices remain elevated and housing inventory is low. The MBA Market Composite Index sank 6.5% to hit its lowest level in 22 years in the week ended June 3rd.

United States MBA Purchase Index

The MBA Purchase Index in the United States decreased 7.1% to 208.20 points in the week ended June 3rd 2022. It is the lowest reading in two years.

United States Wholesale Inventories

Wholesale inventories in the US increased 2.2 percent from a month earlier to $861.8 billion in April of 2022, slightly above an initial estimate of 2.1 percent and after a 2.7 percent rise in the previous month. It was the 21st straight month of gains, as both durable goods (2 percent vs 2.4 percent in March) and nondurable (2.4 percent vs 3.3 percent) stocks increased.

Bloomberg Commodity Spot Index

Bloomberg Commodity Spot Index has risen to new all-time high.

Economic Data Due Tomorrow on 6-9-2022

Initial Jobless Claims

Continuing Jobless Claims

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated."