The CML Close - End of Day Wrap - 05-19-2022

Markets

Large cap indices fell while small caps rose on the day. The VIX fell and Crude rose.

Consumer psychology is falling. Existing home prices fall.

| • SPX | 3,900.79 | -27.89 | (-0.58%) |

| • NAS | 11,388.50 | -29.66 | (-0.26%) |

| • DJIA | 31,253.13 | -236.94 | (-0.75%) |

| • R2K | 1,780.56 | +5.72 |

(+0.32%) |

| • VIX | 29.36 | -1.53 | (-4.94%) |

| • Oil | 111.42 | +1.83 | (+1.67%) |

• Barron's reports that while the jury is out on whether the Fed can successfully rein in inflation at a 40-year high without causing a recession, an encouraging number of economists see inflation peaking, and remain confident that the Fed will avoid a policy misstep.

• Governments are struggling with fallout from China’s trade weight and the U.S. is coordinating with allies on a unified approach to China.

Headlines of the Day

Cratering Markets Blowing a Bigger Hole in Consumer Psychology

To the extent there’s a pullback, it’s a ripple, says Paulsen. But when stocks are down like this, it can weigh on sentiment

New York Fed Warns of Worrisome New Pressure on Global Supply Chain

New York Fed releases April update to its new logistics gauge. Slower euro-area, Chinese delivery times affect April reading.

Target's Earnings Were About More than Target

Target’s disappointing earnings confirmed that consumers are still spending, but they are buying fewer discretionary items such as clothing and home goods and paying more for food and other items because of inflation. Lower-income shoppers aren’t the only ones feeling pinched.

Goldman, JPMorgan Strategists See Recession Fears as Overblown

Market is pricing a recession, but it’s not inevitable. Other strategists see stock slump as only just beginning.

Retail U.S. gasoline prices, already at a record high of $4.576 a gallon on Wednesday, could surpass $6 a gallon this summer

Retail U.S. gasoline prices, already at a record high of $4.576 a gallon on Wednesday, could surpass $6 a gallon this summer because the amount of supply in storage has dwindled amid rising demand for gas, said Natasha Kaneva, head of global commodities research at J.P. Morgan.

Economic Data Results for 5-19-2022

United States Jobless Claims

The 4-week moving average of US jobless claims, which removes week-to-week volatility, was 199,500 in the week ended May 14th, an increase of 8,250 from the previous week's revised average. The previous week's average was revised down by 1,500 from 192,750 to 191,250.

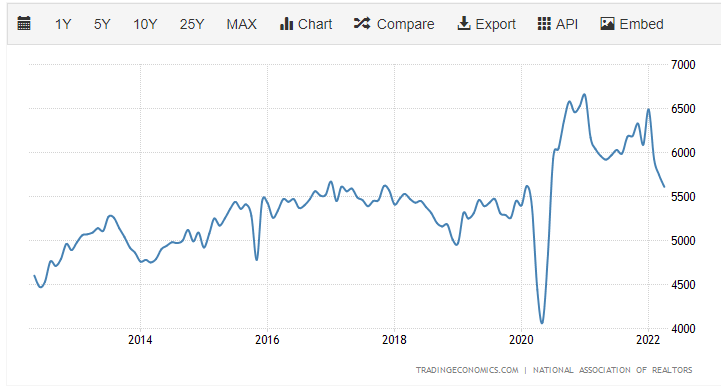

United States Existing Home Sales

Existing home sales in the US declined by 2.4% to a seasonally adjusted annual rate of 5.61 million in April of 2022, the lowest since June of 2020 and slightly below forecasts of 5.65 million. Sales went down for a third consecutive month, in another sign the housing market is cooling, as higher home prices and mortgage rates have reduced buyer activity.

Get The CML Close - End of Day Market Wrap

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated."