| • SPX |

4,023 |

+93.78 |

(+2.39%) |

| • NASD |

11,805.00 |

+434.04 |

(+3.82%) |

| • DJIA |

32,195.94 |

+465.64 |

(+1.47%) |

| • R2K |

1,795.64 |

+56.25 |

(+3.23%) |

| • VIX |

28.96 |

-2.81 |

(-8.84%) |

| • Oil |

110.28 |

+4.15 |

(+3.91%) |

• Actual Q1 2022

reported buybacks amount to $250 billion and has already set a new 12-month record of $953 billion, eclipsing the prior record of $882 billion set in Q4 2021. There still remains 14% of S&P 500 companies to report earnings.

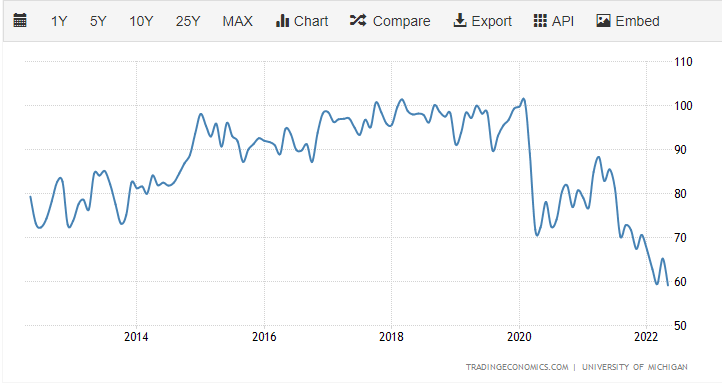

• Consumer sentiment as measured by the Michigan survey fell across all major measurements and were well below estimates

data shows. The 59.1 reading is the lowest in more than 10-years.

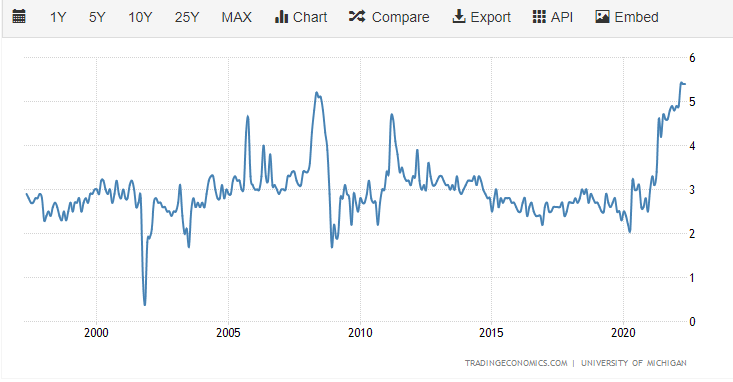

• Inflation expectations for 5 years out remained unchanged at 3.4% while consumer expectations for 2022 remained unchanged at 5.4%, equaling the highest

expectations in 25 years.

Headlines of the Day Investors exhibit panic-like buying as stock market bouncesStock market internals suggest investors are exhibiting panic-like buying behavior as the market indexes rally, according to the Arms Indexes of both major exchanges. The Arms is a volume-weighted breadth measure that compares the ratio of advancing stocks to declining stocks to the ratio of advancing volume to declining volume, in order to gauge the intensity of the market's move. The Arms tends to fall below 1.000 when the market rallies, and many technicians believe a decline below 0.500 implies panic-like buying of rising stocks. In afternoon trading on Friday, the NYSE Arms was at 0.410 and the Nasdaq Arms was at 0.313.

The 10-Year Treasury Yield May Have Peaked. It Makes Stocks Look Better. What might seem like a rare piece of good news for stocks comes from the bond market. The soaring yield on 10-year Treasury debt looks as if it may have hit its high point, or be close to it. If that is true, both growth stocks and dividend-paying names would benefit.

Beef prices climbed 24% in second quarter, with chicken up 14% Rising prices for livestock, animal feed, freight and labor have raised costs for the owner of Hillshire Farms and Ball Park hot dogs, which it has thus far been able to pass along to customers.

Major China Developer Sunac Defaults as Debt Crisis Spreads Firm failed to pay dollar bond coupon before grace period end. Development fuels concern that crisis spreading to safer firms.

Russian Inflation Spikes to 20-Year Record on War and Sanctions Annual inflation hit 17.8% in April, slightly below forecasts. Central bank has been cutting rates as demand weakens

Economic Data Results for 5-13-2022 United States Michigan Consumer Sentiment The University of Michigan consumer sentiment for the US fell to 59.1 in May of 2022, the lowest since August of 2011, from 65.2 in April and below market forecasts of 64, as Americans remained concerned over the inflation.

United States Michigan Consumer Expectations The Michigan consumer expectations subindex in the United States fell to 56.3 points in May of 2022 from 62.5 points in April, below market expectations of 63, but still above the 54.3 reading in March of 2022.

United States Michigan 1-Year Inflation Expectations Michigan Inflation Expectations in the United States remained unchanged at 5.40 percent in May from 5.40 percent in April of 2022 equaling the highest level seen in more than 25-years.

United States Import Prices Import prices in the US were flat in April, following an upwardly revised 2.9% jump in March and lower than market forecasts of a 0.6% rise. It is the first time so far this year that import prices have not risen.

Economic Data Due Monday on 5-16-2022 United States NY Empire State Manufacturing Index

Get The CML Close - End of Day Market Wrap

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated."