Option Trading: Buy or Sell Straddles in Canada Goose Holdings Inc (NYSE:GOOS)

Canada Goose Holdings Inc (NYSE:GOOS) : Trading Straddles

Date Published: 2023-05-22Disclaimer

The results here are provided for general informational purposes from the CMLviz Trade Machine Stock Option Backtester as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.OPENING

As we look at Canada Goose Holdings Inc we note that deciding whether to buy or sell options (in this case a straddle) is probably the most important question when it comes to option trading. But a cursory analysis of a short straddle will miss the fine points required -- especially surrounding earnings.

There's a broader question we are looking to answer -- has owning options or selling options been the winner in Canada Goose Holdings Inc (NYSE:GOOS) .

Option trading is volatility trading, whether we mean it to be or not. If that sounds a little weird to you, we actually suggest you stop reading this article, and instead read our option primer: Understanding Option Skew -- What it is and Why it Exists.

If you're already on top of volatility and the impact it has on option trading and earnings -- let's get going.

STORY

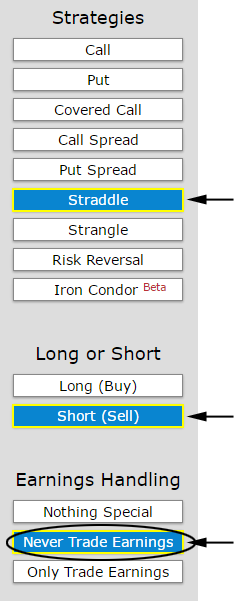

There's lot less luck involved in successful option trading than some people have come to know. We'll get specific with short straddles on GOOS. Let's look at a three-year back-test of a short straddle strategy with these quick guidelines:

* Test monthly options (roll the trade every 30-days).

* Avoid earnings.

* Examine the at the money straddles.

* Test a short straddle looking back at three-years of data.

We want to introduce how easy this is with the right tools but also how important it is to make sure you use them. Just tap the appropriate settings.

And now the findings.

RESULTS

If we did this short straddle in Canada Goose Holdings Inc (NYSE:GOOS) over the last three-years but always skipped earnings we get these findings:| short 50 Delta Straddle | ||||

| * Trade Frequency: 30 Days | ||||

| * Back-test length: three-years | ||||

| * Always Avoid Earnings | ||||

| Gross Gain: | $3,305 | |||

| Gross Loss: | -$2,611 | |||

| Wins: 23 | Losses: | 19 | ||

| Short Straddle Return: | 54.5% | |||

| Stock Return: | -17.5% | |||

| Option Out-performance | 72.0% | |||

First we note that the short straddle strategy actually produced a higher return than the stock 54.5% versus -17.5% or a 72.0% out-performance.

Selling a straddle every 30-days in GOOS has been a pretty substantial winner over the last three-years returning 54.5%. Even better, the strategy has outperformed the short straddle that was held during earnings.

GOING FURTHER WITH CANADA GOOSE HOLDINGS INC

That first step of analyzing a short straddle while avoiding earnings is nice -- but let's go deeper.

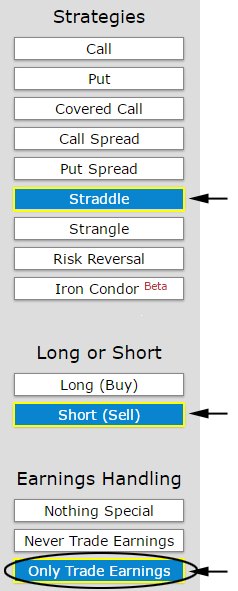

Let's look at the same analysis, but we will only look at earnings. Specifically, we will short the straddle two-days before earnings, then close the option position two-days after earnings.

Here are those results for the same short straddle:

| short 50 Delta Straddle | ||||

| * Trade Frequency: 30 Days | ||||

| * Back-test length: three-years | ||||

| * Only Trade Earnings | ||||

| Gross Gain: | $728 | |||

| Gross Loss: | -$1,271 | |||

| Wins: 6 | Losses: | 7 | ||

| Short Straddle Return: | -42.9% | |||

Selling an uncovered straddle in Canada Goose Holdings Inc during earnings was not only a loser, more importantly, it returned less than the same short straddle that avoided earnings. But, there's a bigger picture here.

Having historical analysis in hand before option trading maps the decision process about what to trade, when to trade, and even if the trade is worth it at all. Now let's go beyond Canada Goose Holdings Inc and trading short straddles to something that makes a difference in our trading lives.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.