Google Stunned the World and Growth is Raging

Fundamentals

PREFACE

There was a time about a year ago that the narrative surrounding Alphabet's Google (NASDAQ:GOOG) was bearish. The thesis was simple: there was no more growth to be had in advertising and the giant had run into a wall of poor innovation.

We're here to tell you that the narrative is still too bearish. Growth avenues have opened, innovation is taking hold, and the stock may well be on its way to yet higher highs. Here is the breathtaking reality of Google's new found growth and one new segment that has everybody stunned.

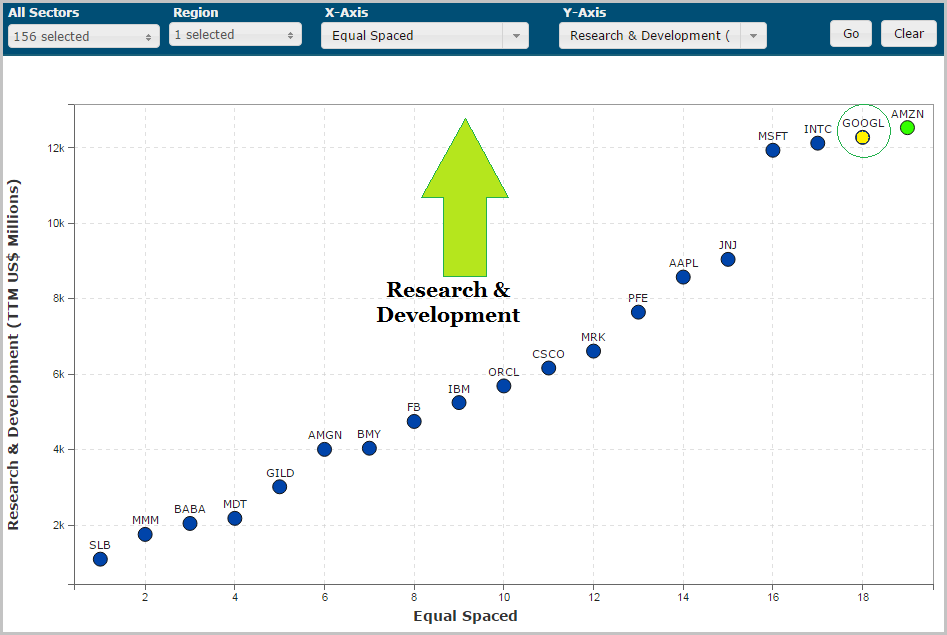

Google has been pouring money into research and development (R&D). In fact, if we take every company in every sector that trades on North American exchanges, Google spends the second most on R&D:

THEME 1: ADVERTISING

Nearly 80% of Google's revenue comes from advertising and desktop is still a major contributor. While Facebook (NASDAQ:FB) generates 97% of its revenue from ads, fully 80% of revenues come from mobile.

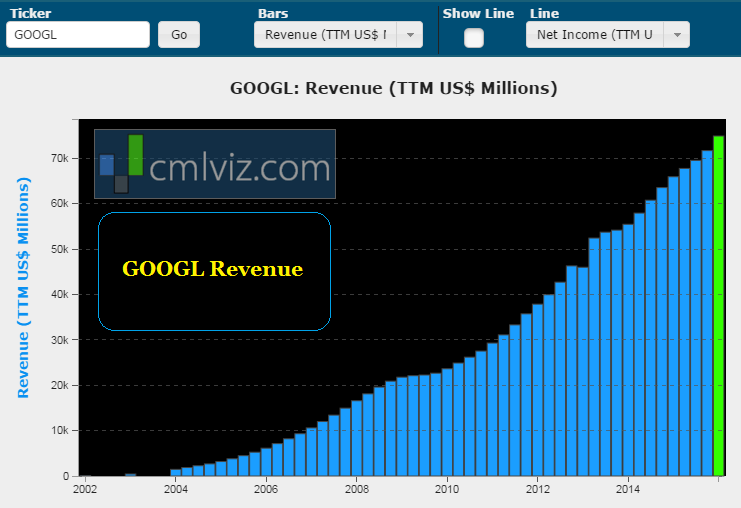

It's this battle that the mainstream media has focused on, which is a disservice to Google's other properties. Let's first look at Google's revenue (TTM) trend through time:

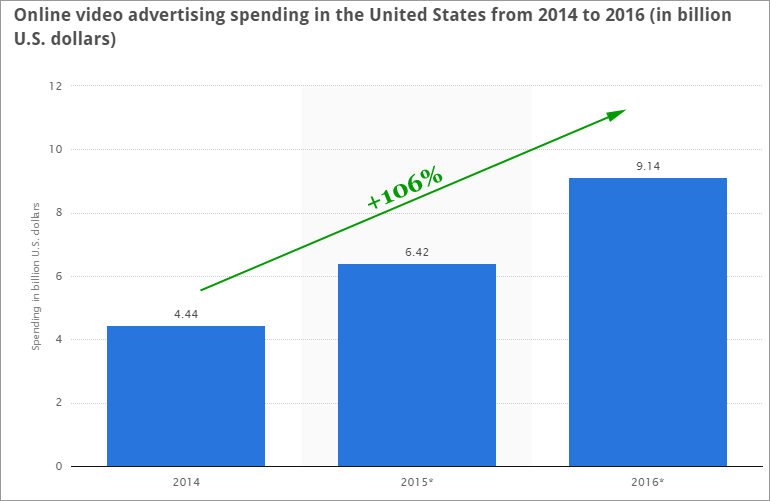

Next, let's look at the fastest growing piece of online advertising, and that's online video.

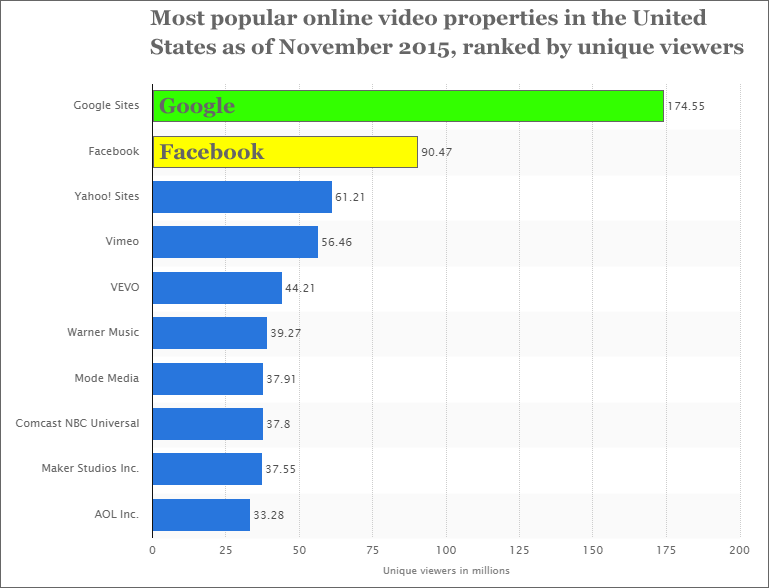

While Facebook claims it receives 8 billion video views a day, we know that Google's You Tube has more viewers aged 18-49 on mobile alone than any U.S. cable network. In fact, we can rank the top used video sites from our friends at Statista:

And here is the revenue growth that's being generated:

It's this new area that shows the greatest growth and it's a world that Google has solid footing.

But, if you know Google at all, you're probably asking about Search -- after all, that is the company's ecosystem. Search advertising revenue grew just 5% in 2014 and that is exactly when the "Google growth is dead" narrative began to sound rather accurate. It turns out, this technology marvel has a few trick sup its sleeve.

To read the full growth that Google is experiencing and how it's happening, we refer you to the CML Pro dossier, but suffice it to say: growth is back.

This alone is enough to start wringing our hands in anticipation of a Google rise, but it's actually not the only area that is starting to scare the entire technology world. We'll get to that in theme number five.

First, we move to streaming video on demand.

THEME 2: SVOD

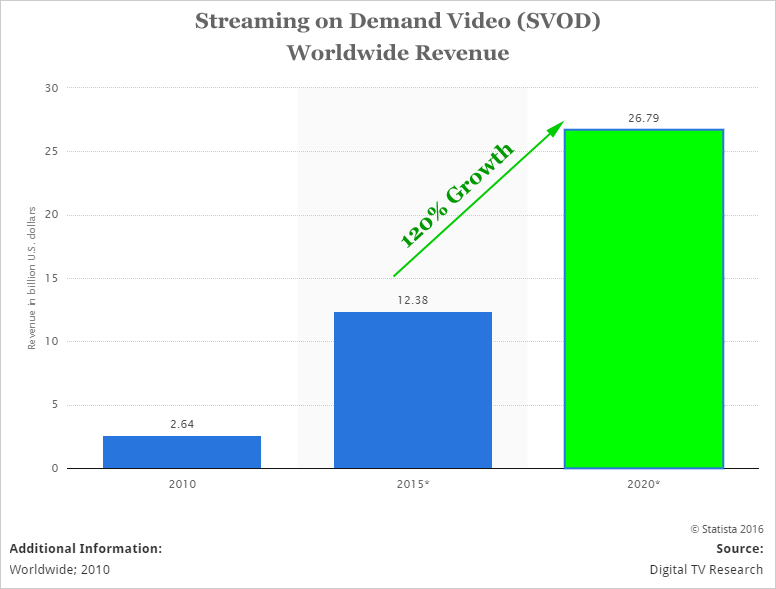

This is an easy one to miss, but let's not. Streaming video on demand (SVOD) is one of the great transformative shifts we are realizing as a populace. Here's how that theme plays out over the next several years via Statista"

SVOD worldwide revenue will grow from $12.4 billion in 2015 to nearly $27 billion within five-years. There's no doubt that Netflix (NASDAQ:NFLX) is the undisputed king, reaching over 90% penetration of households that have access to SVOD in the United States. Amazon's (NASDAQ:AMZN) Prime has 40% penetration.

But Google has released its YouTube Red service and the company is very quietly creating original content and releasing new films from other studios under its subscription service. When we take into account the absolute colossal size of YouTube’s free service, we see a clear path to a growing business through YouTube Red.

THEME 3: VIRTUAL REALITY

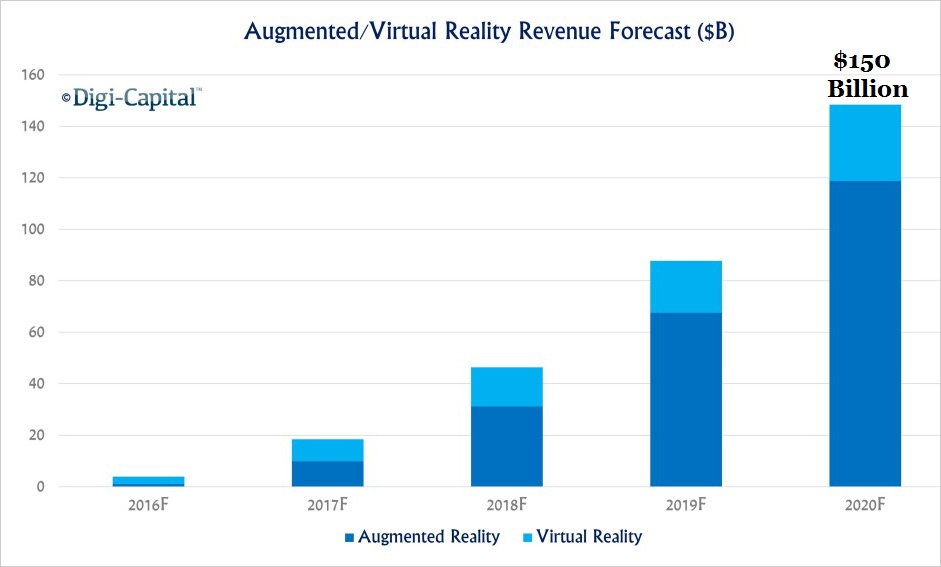

The Virtual Reality / Augmented Reality market is one whose "customer base looks increasingly like all of humanity" according to Dave Thiel at Forbes, and he's right. Here's how the growth looks to play out over the next several years:

Google also recently created a virtual reality department, headed by Clay Bavor (source: recode.net). Bavor was previously in charge of Google's experimental, low cost "Cardboard" device that allowed users to mount smartphones as VR devices.

GOOGLE CARDBOARD

We also can't forget that Google has already made one huge bet in the space of augmented reality with their Google Glass line. While they proved to be too early for mass market appeal, they've undoubtedly learned from the failures and successes of this effort.

THEME 4: SELF-DRIVING CARS

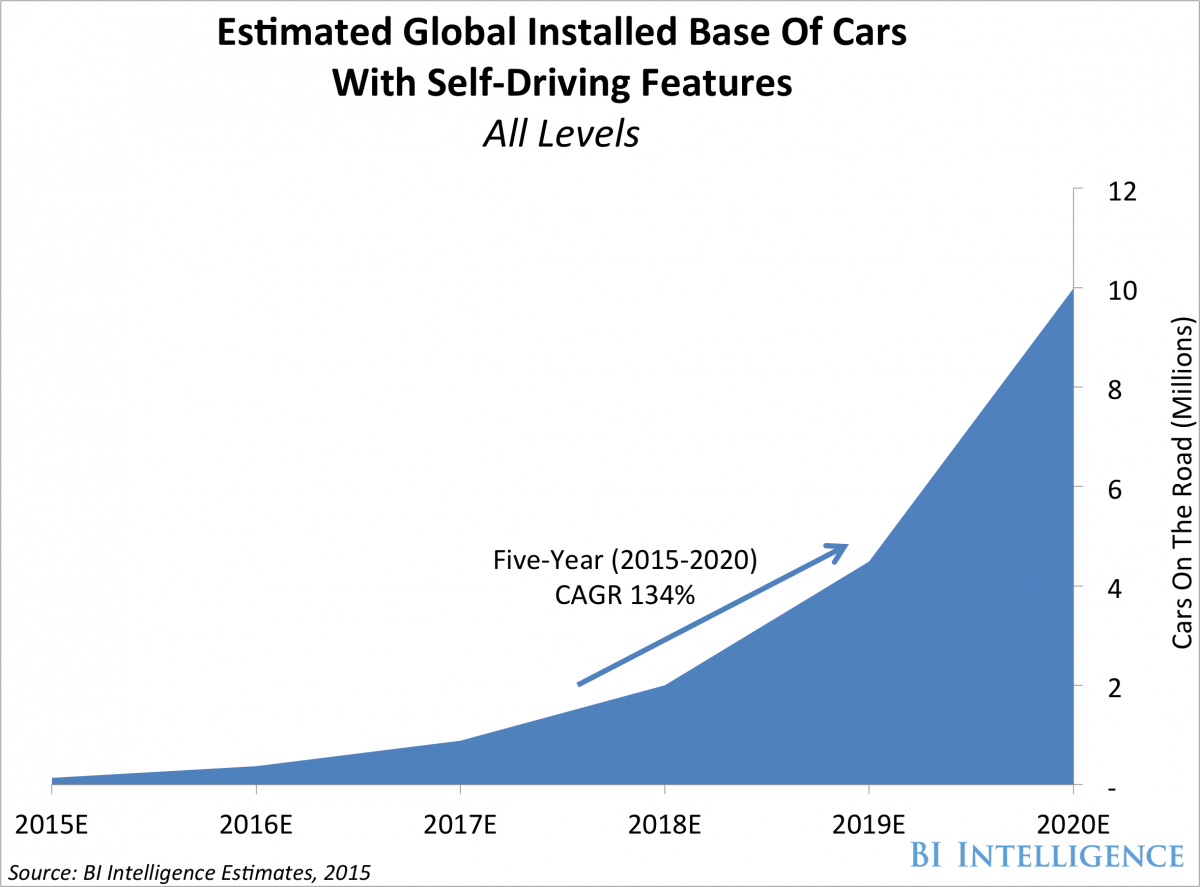

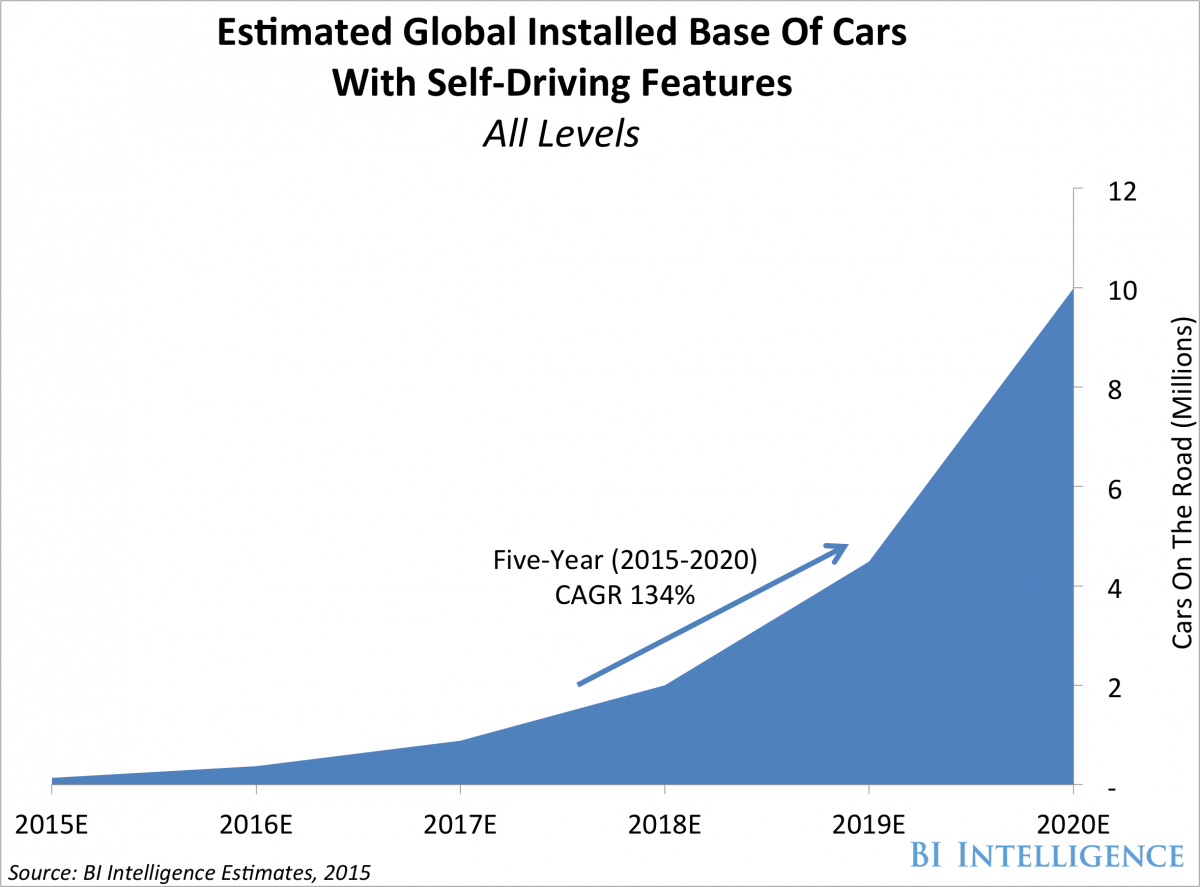

Google may be the most famous of all the tech gems for its self-driving aspirations. While Tesla (NASDAQ:TSLA) is a marvel and Apple will simply change the world with its car, Google is going about it slightly differently. Here is a growth in vehicles with self-driving features:

CARS WITH SELF-DRIVING FEATURES

We're looking at 134% compounded-annual-growth rate for the next five years ending at 10 million cars by 2020. But Google wants to create totally self-driving cars -- not a vehicle which features self-driving capability. The company is already lobbying politicians to not only get laws changed and approved, but more importantly, to begin the process of getting the idea of totally self driving vehicles into the mental vernacular of society.

This is a long play, but one with an enormous upside.

THEME 5: THE SECRET GIANT

I'm not sure many people even thought of Google when it came to this thematic shift and I'm sure nobody knew it was making waves as large as it has. Buy news broke Friday of a huge uptick in business in this segment, and it opens up humongous opportunity for Google that no one saw coming.

For the full Google dossier which breaks open this new business line and Google’s jaw dropping success, we direct you to CML Pro and the comprehensive dossier we have on Google, which goes yet further into not only this new business line, but several others.

SEEING THE FUTURE

There's so much going on with Google we can't cover it all in one report - it spans seven different thematic shifts in technology and it will battle Amazon, Facebook, Netflix and Apple for decades. But, to find the 'next Google' or 'next Apple,' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

The author is long Apple shares both in his personal account and family owned accounts.

Thanks for reading, friends.

Please read the legal disclaimers below and as always, remember, we are not making a recommendation or soliciting a sale or purchase of any security ever. We are not licensed to do so, and we wouldn’t do it even if we were. We're sharing my opinions, and provide you the power to be knowledgeable to make your own decisions.

Legal The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.