Apple Watches as Facebook and Google War

Fundamentals

PREFACE

Market dominance is never secure in this era of disruptive innovation. None know this better than the current techno-rulers at Apple (AAPL) Facebook (FB) and Google (GOOGL).

Apple just reported that it's stepping aside from the advertising wars by leaving its iAd platform to be managed by content providers.

We are now left with Google and Facebook, the two most successful advertisers ever, to faceoff in an epic battle. But don't count Apple out -- the most powerful company in the world is watching -- closely.

THE WAR

The new battlefield is streaming video. We're in a winner-takes-all economy, and neither Facebook nor Google can afford to be tied for first. What could threaten Facebook's dominance? Answer: A competitor that take away the fastest growing segment of its engagement.

Instagram was a growing threat Facebook took down in Apr 2012. WhatsApp began exploding not long after, building a user base of 700 million+ users. In response, Facebook finally sliced off $19 billion in cash and stock to capture WhatsApp in February 2014, putting an end to the potentially existential threat.

Google has acquired over 180 companies with its largest acquisition being the purchase of Motorola Mobility for over $12 billion (Source: CrunchBase).

But Google and Facebook can't buy each other, and now the stage is set for a competitive battle the likes of which we have never seen before.

GOOGLE IS CRUSHING VIDEO

We already know that in the earnings report on 7-16-2015, Google disclosed that watch time for YouTube rose 60% in the quarter and the video service had more viewers aged 18-49 on mobile alone than any U.S. cable network.

The on-line video ad space is a growing one, and both Google and Facebook are trying to entice advertisers into the space.

BREAKING

A Citigroup report just came out from Mark May. Here's what we found out:

Our YouTube Tracker remained strong in 4Q15, and saw viewing growth of 74% y/y accelerating from last quarter's growth rate of 65%.

December 2015 also saw a new record high for views in a month with 54bn video views.

Source: BARRON'S

December 2015 also saw a new record high for views in a month with 54bn video views.

Source: BARRON'S

Last year's 65% growth was immense, but we are now seeing accelerating growth and for a company the size of Google, it's just breathtaking.

STAKES ARE RISING

The revelation about Google's growth with Youtube comes right after research that was published surrounding Facebook, that was equally awe inspiring. This is an actual data point published, not a forecast:

Facebook users watch 8 billion videos a day.

Google's Youtube had 1.25 trillion cumulative views through December 2015, and 144 billion in just the last three months according to that same Citibank report. We have finally reached the point where we are using metrics scaled by trillions.

We publish research that uncovers new opportunities every day.

Try CML Pro. No credit Card. No Payment Info. Just the Power.

MARKET SIZE

Facebook boasts 1.55 billion monthly active users (MAUs), it also has WhatsApp with 900 million MAUS, Facebook Messenger with 700 million MAUs and Instagram with over 400 million MAUs.

Not to be out done, Google has six properties with over 1 billion users: YouTube, Android, Search, Maps, Chrome, and Google Play.

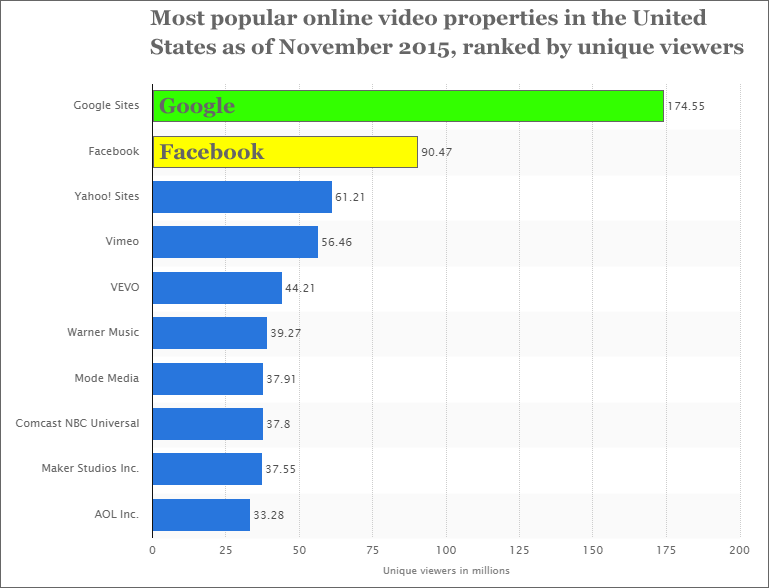

Google has 175 million unique video viewers across all Google Sites in just the U.S. alone. Facebook has 90 million. Here's a chart from Statista:

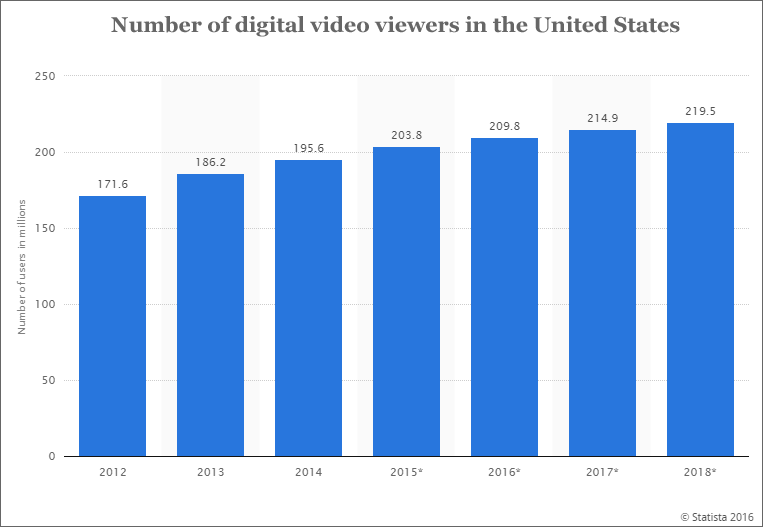

The battle is going to heat up as the low hanging fruit of straight line user growth is slowing. Here's the slowing trend of digital video viewers in the United States:

BOTTOM LINE

Both of these companies generate the lion's share of their revenue from advertising and online video advertising spending in the United States will hit $9.1 billion in 2016, up from $4.4 billion just two years ago. And remember, we are only discussing video advertising revenue.

To give you a measure of scale, Facebook's entire revenue across all platforms of all kinds of media in 2015 was just over $16 billion.

INNOVATION COSTS MONEY

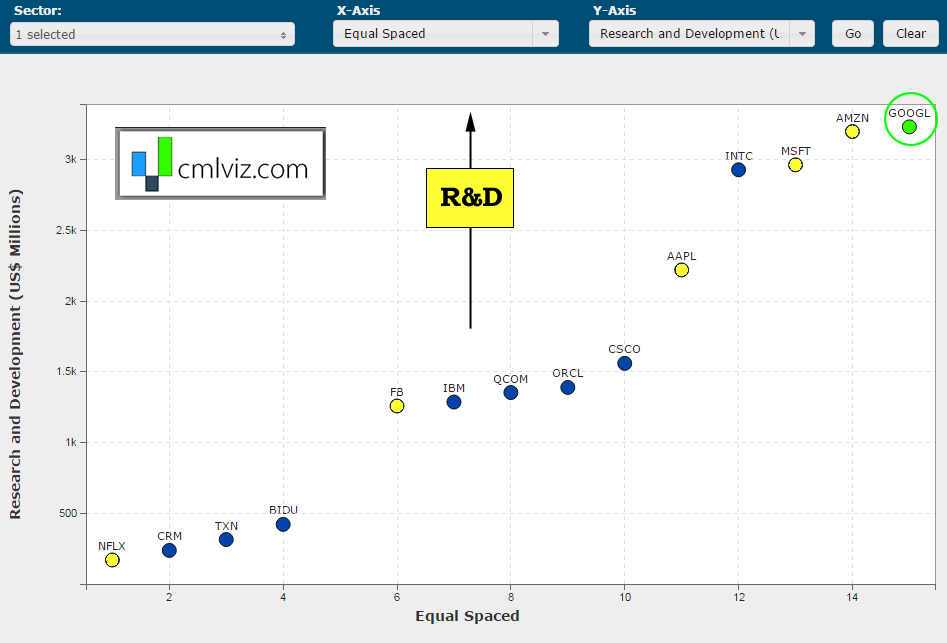

Next we chart the amount of research and development spent in the last quarter for all mega cap technology companies.

Google is not only spending more than Amazon, Apple, Intel and Microsoft, but it's also spending more than Pfizer, Gilead and any other company in any other industry in the world.

If we were to do this same analysis but measure R&D expense per dollar of revenue, Facebook towers above the rest.

Friends, this is just the beginning of the battle between Google and Facebook. It's quite possible that both of these companies will hit one trillion dollars in market cap while both owning multiple properties that have over two or three billion users.

We discuss the very real potential for Facebook to reach 3 billion users in the next few years in the CML Pro research dossier: Why Facebook's Impossible Growth is Still Going.

WHY THIS MATTERS

The top 1% are keenly aware of the deep data that will move markets.

CML Pro research goes deeper than anything the main stream media can produce and sits side-by-side with research from Goldman Sachs, Morgan Stanley and Merrill Lynch on professional terminals.

The difference is that CML Pro was built to break the information asymmetry that has transferred masses of wealth to the top 1% simply because of access to data.

This is just one of the fantastic reports CML Pro members get along with all the charting tools, top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.