DigitalOcean (NYSE:DOCN) Continues on its Path to Generational Opportunity

Snapshot of Most Recent Earnings Report and Guidance

• Revenue grew 37% in Q4 2021 versus the year ago period, beating analyst estimates of 36% growth.

• Adjusted EBITDA grew 39% in Q4 2021, beating analyst estimates of 32.6% growth.

• Gross margins came in at 81.4% beating analyst estimates of 79.2%.

• Cash from Operations (TTM) rose 129% in 2021.

• Net retention rate (NRR) spiked to an all time high of 116%.

• Average revenue per user (ARPU) hit an all time high.

• Full year 2022 guidance came in at 32.3% growth beating analyst estimates of 31.8% growth.

• Revenue growth has accelerated as has and net retention rate (NRR)

Preface

DigitalOcean (NYSE:DOCN) gives investors unhedged exposure and risk to growth in the central cloud and SMBs. The company has the potential for substantial growth, is under appreciated in several areas from analyst estimates, stock price, earnings potential, and recognition of its community moat.

The total addressable market is substantial, and DOCN continues to grow significantly faster than the SMB cloud industry at large.

The CEO noted that the company has fundamentally altered the level of NRR it can achieve and the durability of its overall revenue growth rate.

Most Recent Quarterly Results for DOCN

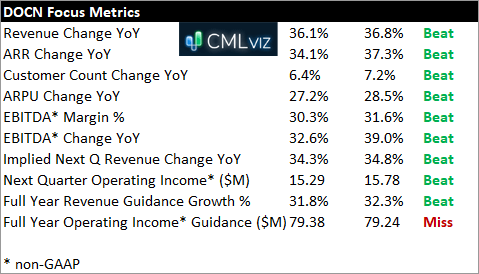

We follow 24 metrics for DOCN of which 10 we consider to be focus metrics.

Our focus metrics are:

• Revenue change YoY

• Annual Recurring revenue (ARR) change YoY

• Customer Count Change YoY

• Average Revenue per User (ARPU) Change YoY

• non-GAAP EBITDA Margin

• non-GAAP EBITDA Change YoY

• Implied Next Quarter Revenue Change YoY

• Implied Next Quarter non-GAAP Operating Income

• Implied Full Year Revenue Change YoY

• Implied Full Year non-GAAP Operating Income

DOCN beat all of the first nine metrics, and fell within rounding error short of the last one, with full year non-GAAP operating income guidance at the midpoint of $79.24 million versus estimates of $79.38 million.

Here are the ten-focus metrics versus estimates presented in a table:

DOCN wasn’t supposed to able to do any of these things — revenue growth was supposed to be in the 20’s, retention can’t rise in a company that serves SMBs, and certainly there is no way that a CapEx heavy company could deliver margins comparable to AWS.

But we don’t care what people believe; we care about what is not believed and happens anyway.

And that’s the DOCN story — what was not believed, but is happening anyway.

The full story and opportunity can only be told by the CEO himself.

Enter your email address below, and gain exclusive access to our one-on-one interview transcription.