Amazon Absurd Dominance Now Attacking Apple, Google and Facebook

Fundamentals

PREFACE Amazon is part of an elite group creating a new era in business where the leaders are both large and nimble, where pioneering businesses optimize revenue streams while simultaneously taking huge risks with time horizons measured in decades.

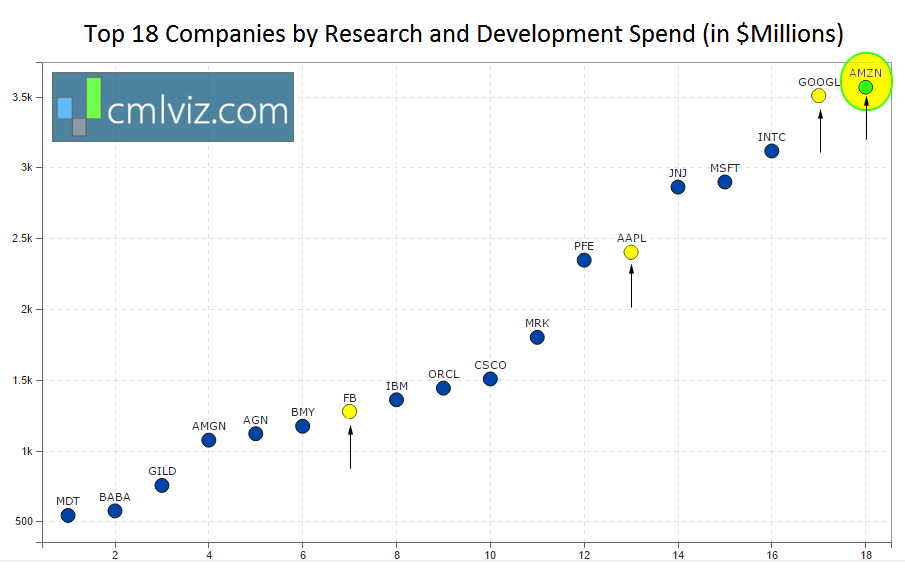

Here is a chart of the largest firms in the world and the amount they spend on Research & Development:

It's the secret hidden in plain day light -- Amazon spends more on R&D than every company in the world in every sector. We have highlighted Alphabet / Google (GOOG, GOOGL), Apple (AAPL) and Facebook (FB) as well.

Amazon's R&D allows them to blaze a trail toward a fundamentally different economy. Most shocking of all is that Amazon's plans for the global dominance of commerce hinge on something so innocuous, so hidden in plain sight, that almost everyone has failed to recognize it. Now that radical shift pivoted yet further toward completion.

ENTER AMAZON PRIME

Amazon prime is at the heart of this transformation, and news quietly broke that takes Amazon one step closer to being the de facto standard for all online business.

Free shipping is a critical part of the frictionless commerce the system is moving toward. Users opt in to the Prime Membership with a simple rationale: "If I order at least 20 things a year that would have cost at least $5 to ship, I'll actually be saving money."

Through this reasoning, the consumer has persuaded themselves to not only pay Amazon $99 per year, but also to buy more goods to ensure they've spent their $99 well.

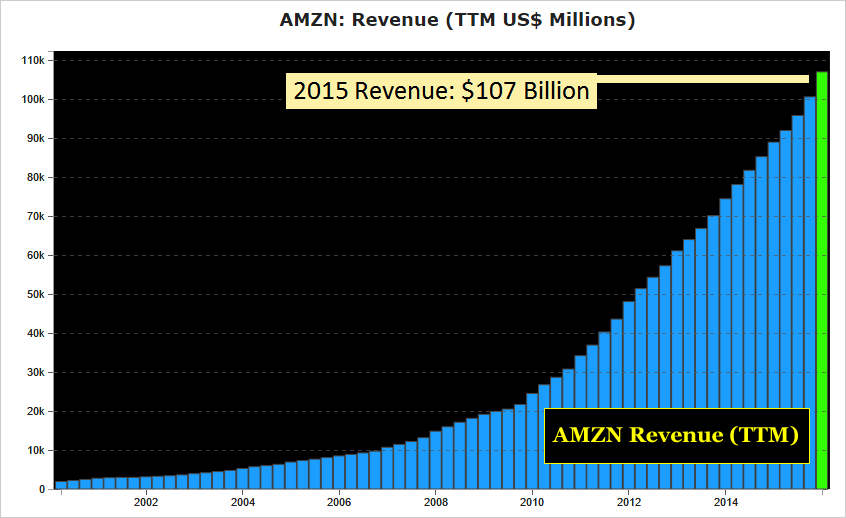

And the effect? CML Pro shows us the staggering Amazon Revenue chart:

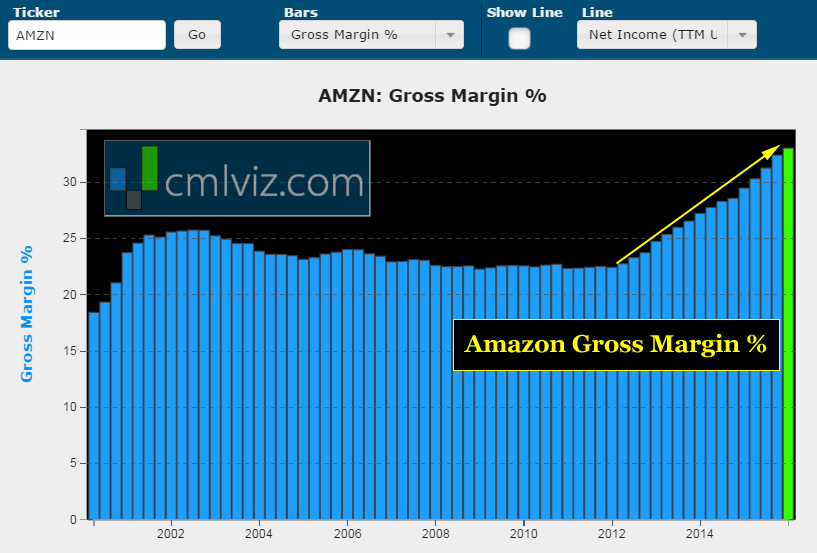

The growth is so explosive it looks made up, topping $107 billion in the last twelve months. Further yet, Thomson First Call estimates look for revenue to hit $150 billion in two-years. Yes, 40% growth in two-years. And just so we're clear, margins are increasing as revenue has increased:

Further, what's of paramount importance to the new development, is that Amazon has control over a critical lever influencing consumer adoption of Amazon Prime. We found out in February that Amazon just cranked the lever in their favor:

"Less than three years after Amazon increased the minimum purchase threshold from $25 to $35 for customers to qualify for free "Super Saver Shipping," the world's largest e-retailer is hiking the minimum purchase requirement again — this time to $49."

source: Time Money

Amazingly, that's all it takes. By cranking up the minimum order for free shipping without the Prime membership, the Amazon user automatically adjusts expectations for the cost of not being an Amazon Prime member, and new Prime memberships and additional orders flow in.

The latest figures from the company put Prime at a staggering 60 million subscribers, growing at 50% year-over-year. When Prime was first launched for just $79, analysts expected 25 million members by the year 2017. Oops...

TOTAL AND UTTER DOMINANCE

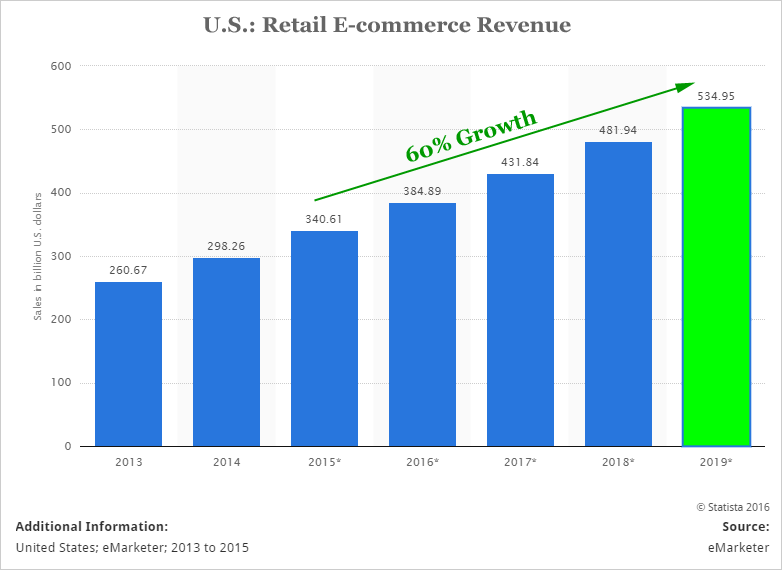

With $70 billion of its $107 billion in revenue coming from online sales, e-commerce is still the revenue driver. Here's the e-commerce theme trend over time from Statista:

But now, check out this tidbit from Macquarie Research:

"Of every additional $1 Americans spent for items online this year, Amazon captured 51 cents."

Source: NY Times

source: NY Times

That's a staggering result. But even further, in the entire United States, for all of retail sales both online and off-line, there was a total of $94 billion in growth. Of that $94 billion, Amazon accounted for $22 billion. Yes, Amazon accounted for 25% of US retail growth from every store, resource and platform available to mankind. This is almost entirely due to the success of Amazon Prime.

This is what Robbie Schwietzer, vice-president of Amazon Prime said way back in 2010:

"In all my years here, I don’t remember anything that has been as successful at getting customers to shop in new product lines."

source: Time

MORE ENTICEMENTS

For any users who were on the fence about becoming part of the new, frictionless economy, Amazon Prime has simply tacked on for free for Prime members, what is the entire business line of companies as vital as Netflix (NASDAQ:NFLX) and Spotify.

Using Forbes reporting of Netflix (NFLX) users at 62 million, Amazon prime has the second most customers with access to streaming video and it’s a "side-business." This is just another demonstration of the power and reach of this pioneering company.

Netflix, so far, has fought off every attack attempted by media companies, but a technology innovator as diverse as Amazon is a totally different caliber of competitor.

THE FUTURE

Amazon's aspirations are nearly limitless, and if successful, they will fundamentally change the way consumers shop. Consider a perfect example: "Prime Now" - Amazon delivery in less than 60 minutes. If that sounds ridiculous, try this: the company has already launched it in 17 cities, including San Francisco and Bloomberg reported that the company is satisfied with early results from the initial offering and expanding.

And after all of that, this is only the starting line:

ONLY THE BEGINING

Amazingly, this is only the beginning. Through our research we've uncovered a whole new business line Amazon looks to be entering that has huge implications for the company's future.

APPLE, GOOGLE, FACEBOOK AND TESLA

Of all the technology companies attempting to replicate Apple's successes, perhaps only Amazon can truly compete with Apple (NASDAQ:AAPL) directly for a simple reason: Amazon is the only other technology company that has created an entire ecosystem from device, to application store, to streaming media, to delivery of products to your home. With "The Amazon Echo" they are even making inroads into the device you stream content through.

Google (NASDAQ:GOOG) and Facebook (NASDAQ:FB), in large part, still depend on someone else's ecosystem, someone else's device, someone else's services.

And the real problem for Google and Facebook just popped up: We learned from Bloomberg that Amazon is now getting into web advertising, yet again, surrounding Prime Now.

There is simply no more valuable advertising space than that which sits right in front of a consumer ready to make a purchase. Google and Facebook can make any argument they like about the relevancy of their ad platforms, but an advertisement that sits next to the "buy button" is incomparable.

And just for yet more avenues of growth, we learned from Reuters that Amazon is investing in self driving cars. Let's add Tesla (NASDAQ:TSLA) to the list of soon to be competitors.

FOR GOOD MEASURE: THE CLOUD

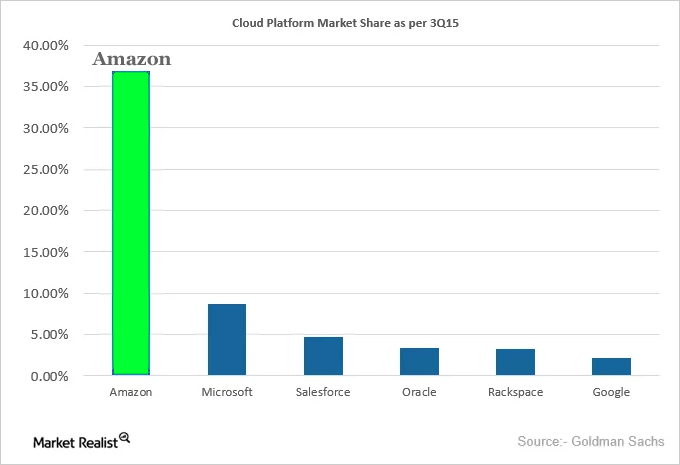

Since we're on the topic of dominance, here is the market share that Amazon has accumulated in its cloud computing business, called Amazon Web Services (AWS):

While AWS nears 40%, the second largest player, Microsoft (NASDAQ:MSFT) sits at 8%. No other firm is above 5%.

We'll stop the story short here, with a few last words:

SEEING THE FUTURE

We have really just started the analysis. There's so much going on with Amazon it's impossible to cover in one report but to truly understand it we must span almost all of technology's transformative themes. And inside each of these transformational themes live smaller tech gems that are quietly powering the guts behind the technology. So, to find the 'next Amazon' or 'next Apple,' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.