Technical Bearish Momentum Trigger in Logitech International SA

Logitech International SA (NAS:LOGI) : Technical Bearish Momentum Trigger

Date Published: 2020-03-23

Disclaimer

The results here are provided for general informational purposes from the CMLviz Trade Machine Stock Option Backtester as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.Lede

Today, 3-23-2020, Logitech International (NASDAQ:LOGI) has met the technical requirements for a bearish burst backtest trigger.Preface

Using charts and, with them, technical analysis, is the most common form of financial back-testing. It is, at every step, using historical data and trying to draw conclusions from the patterns in the past to extrapolate them into the future. So if you use charts, it's time to use a pattern recognition engine to be robust.After rigorous testing over the periods from 2009-2019 and 2007-2009 (the period that includes the Great Recession) all of which spanned over 100,000 back-tests, today we demonstrate the technical conditions that have provided a strong short-term bearish momentum trigger for Logitech International SA (NAS:LOGI) and broadly speaking, the constituents of the Nasdaq 100.

Logic

The goal is to create a portfolio of option trading backtests with alerts attached to them, so we don't have to watch the market all day, but rather Trade Machine is the work horse to notify when the ideas become actionable.Finding these patterns in Logitech International SA should be straight forward.

The Bearish Option Trade with Technical Analysis and Moving Averages in Logitech International SA (NAS:LOGI)

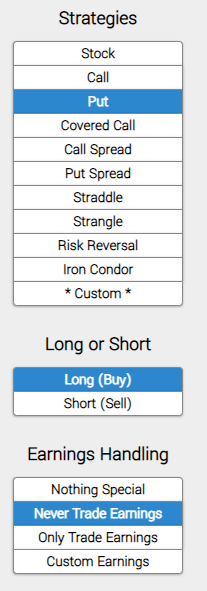

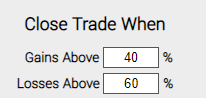

We will examine the outcome of going long an out-of-the-money (strike price is set to the 40 delta) put option, in options that are the closest to 14-days from expiration (using calendar days). But we follow three rules:* Never Trade Earnings

Let's not worry about earnings. Here it is, first, we enter the long put.

* Use a technical trigger to start the trade, if and only if these specific items are met.

* The day that the stock crosses below the 200-day simple moving average (SMA) means that the stock has downward momentum and is in technical failure.

* Stock price is also below the 50-day SMA -- further evidence of a technical breakdown through the moving averages.

* RSI (using 20-days) is above 30, so the stock isn't over sold

Here it is in an image from Trade Machine -- only focus on the settings where the filter is turned to "on.":

You can set an alert in Trade Machine®, which will track all of these moving parts for you, and message you when it triggers. In fact, you can do this with a portfolio of stocks for a portfolio of bearish and bearish triggers. Let Trade Machine do the work for you -- there's no need to stare at the screen.

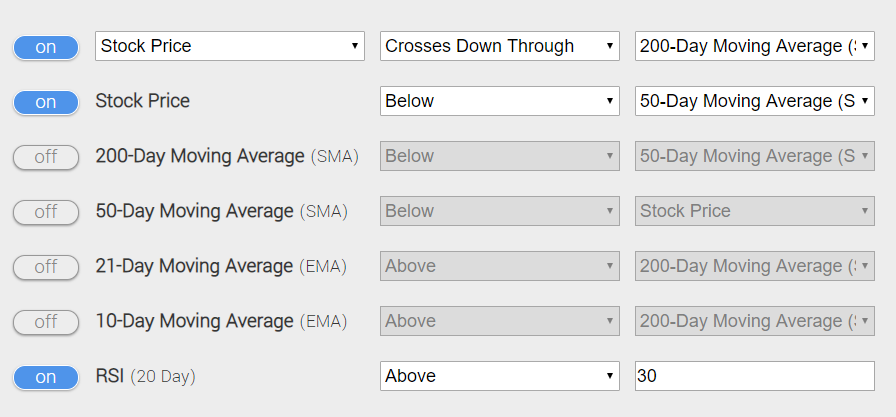

* Finally, we set a very specific type of limit:

* Use a 40% limit and a 60% stop.

At the end of each day, the back-tester checks to see if the long put is up 40% or down 60%. If it is, it closes the position.

We leave more room on the stop side (larger stop than limit) from our discoveries in back-testing -- this was optimal and still led to far larger average winning trades by percent return than losing trades.

OPTION BACKTESTER RESULTS - TECHNICAL ANALYSIS

Here are the results over the last three-years in Logitech International SA:| LOGI: Long 40 Delta Put | |||

| % Wins: | 80% | ||

| Wins: 4 | Losses: 1 | ||

| % Return: | 436.2% | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine® are that it uses end of day prices for every back-test entry and exit (every trigger).

This is not a magic bullet, rather it's a bearish technical analysis momentum strategy predicated on using pattern recognition in charts through moving averages and RSI, rather than manually drawling lines stock by stock.

Setting Expectations

While this strategy had an overall return of 436.2%, the trade details keep us in bounds with expectations:➡ The average percent return per trade was 85.15% for each 14-day period.

Checking the Moving Averages

You can check to see the values of all the moving averages discussed above with real-time daily prices, including live after hours prices, for LOGI by viewing the Pivot Points tab on www.CMLviz.com.Rigor to the Option Backtester and Backtesting

We compared this Technical analysis trigger on the constituents of the Nasdaq 100 versus the results from the baseline. The baseline is simply owning calls and rolling them every two-weeks with the same stop and limit as introduced above (40% / 60%). Here's what we found:* Over the one-year from March 2018 - March 2019, the average trade return was 17% using this technical trigger compared to just 6% using rolling puts with no technical structure.

* Over 2-years, the average trade return was 39% using this technical trigger compared to -5% (negative) for the baseline.

Even further, the win rates by stock were also higher, as were the average winning trade return. The details to this content are reserved for Trade Machine members. But you can rest assured that:

Back-testing Technical Analysis More Time Periods in Logitech International SA

Results from the last year are provided below as well:

| LOGI: Long 40 Delta Put | |||

| % Wins: | 100% | ||

| Wins: 3 | Losses: 0 | ||

| % Return: | 288.3% | ||

Tap Here to See the Back-test

We're now looking at 288.3% returns, on 3 winning trades and 0 losing trades.

➡ The average percent return over the last year per trade was 99.96%.

Next Steps

Apply your skills beyond drawing lines on one chart at a time -- tap here to use pattern recognition. You can do this.Risk Disclosure

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.

You should read the Characteristics and Risks of Standardized Options.