First: International is a Thing

When Pinterest went public, it's international revenue was seen as a problem. While the company showed robust user growth as measured by MAUs, ARPU was abysmal.

That narrative has stuck, but the reality paints a different picture.

Rather than think of the entity Pinterest, let's go agnostic and simply look at the facts - some company with these financials:

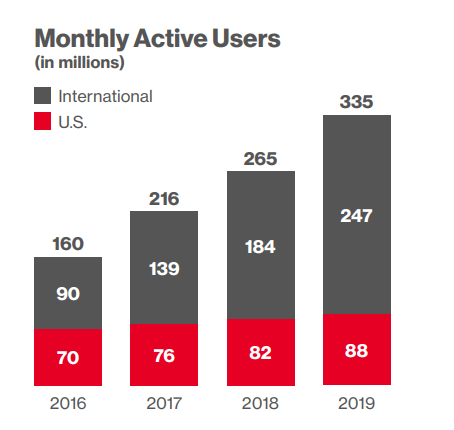

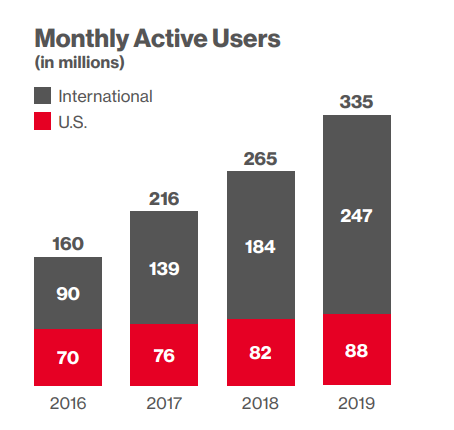

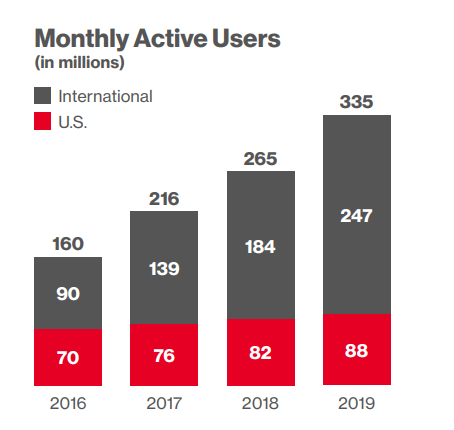

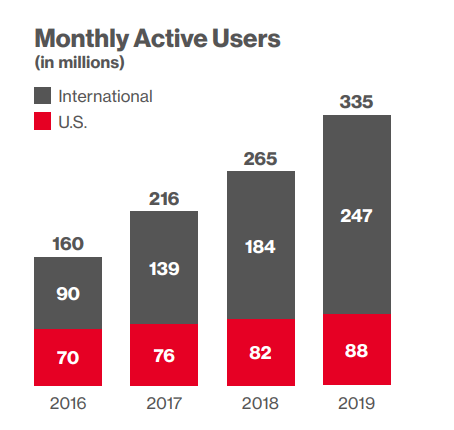

First, here is the company's international user growth:

| Year |

International MAUs |

Int'l User Growth |

| 2016 |

90 |

|

| 2017 |

139 |

54% |

| 2018 |

184 |

32% |

| 2019 |

247 |

34% (accelerated growth) |

Note that there was a re-acceleration of user growth from 2018 and to 2019. Fortunately, Pinterest has peers to which we can compare it, with Facebook as the apotheosis.

There is no argument necessary that Pinterest will become Facebook, but we can use Facebook as a measure of an actual total addressable market (TAM), or total achieveable market if you prefer, as opposed to some hypothetical, likely bloated measure.

Facebook has 2.5 billion MAUs worldwide, with 180 million coming from the United States.

That leaves 2.3 billion MAUs in the international market and 307 million of those MAUs are in Europe, alone.

Pinterest's 247 million international MAUs have plenty of room to grow and assumptions of a substantial slowdown have been unfounded thus far.

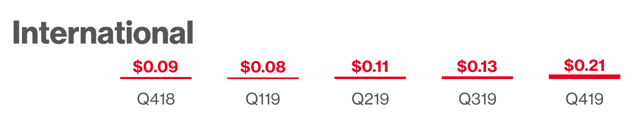

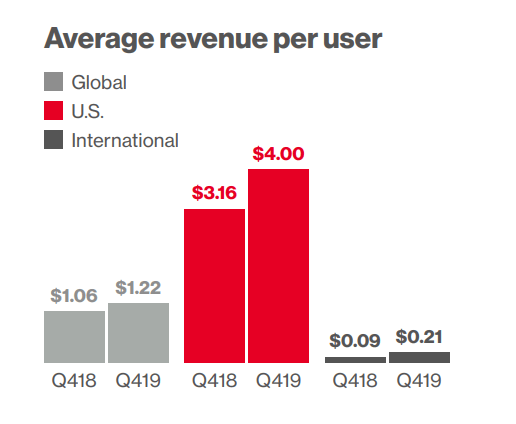

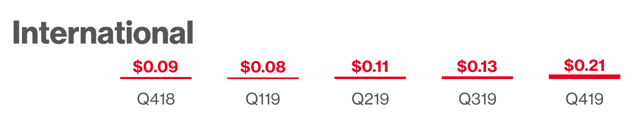

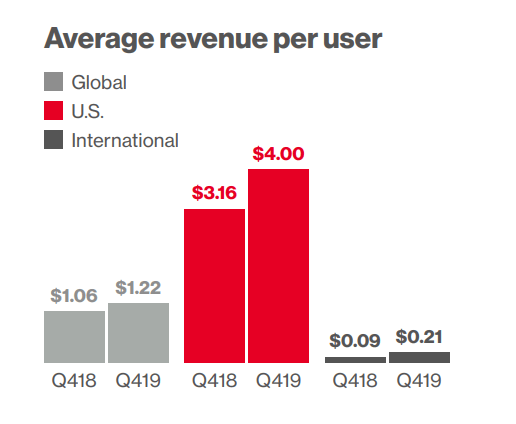

But, the consternation surrounding Pinterest's international business surrounded the monetization of those users. Here is an image shared by Pinterest displaying the ARPU for the international market space:

Pinterest lands on $0.21 for Q4 2019 ARPU. For our TAM measure, that is not realistically achievable but some sort of benchmark, we use Facebook again, which shows ARPU of $13.21 in Europe, $3.57 in Asia Pacific, and $2.48 in the rest of the world.

Yes, Pinterest's benchmark is substantially larger than 10-fold higher.

While 122% year-over-year ARPU growth is impressive, we have more data.

Ultimately revenue is simply a function of MAUs with ARPU, and since the former grew 34% last year and the latter grew 122% (both accelerating from the prior year), we have a net 202% growth in international revenue comparing Q4 2018 to Q4 2019.

We can look to full years, rather than annual quarter to quarter comps as well.

| Year |

Int'l Revenue ($M) |

Revenue Growth YoY |

Percent of Total Revenue |

| 2016 |

7 |

|

2% |

| 2017 |

24 |

243% |

5% |

| 2018 |

41 |

71% |

5% |

| 2019 |

117 |

185% (accelerating growth) |

10% |

Yet again we see accelerating revenue growth.

If we take this piecemeal, how much is a business with $117 million in revenue growing at 185% and a total addressable market more than 10-fold the current size worth?

Hold that thought.

We can do the 'spreadsheet thing' and try to build guard rails around the next five-years, knowing full well this practice could be tragically flawed.

We can extend the growth rates out and measure the resulting revenue base. In this case we have modeled (it's not really a model, but yah know) a drop in international revenue growth from 185% in 2019 to 100% in 2020, then precipitously down to 50% and below for the following years.

| Year |

Int'l Revenue ($M) |

Growth YoY |

| 2016 |

7 |

|

| 2017 |

24 |

243% |

| 2018 |

41 |

71% |

| 2019 |

117 |

185% |

| 2020 |

234 (projection) |

100% (projection) |

| 2021 |

351 (projection) |

50% (projection) |

| 2022 |

491 (projection) |

40% (projection) |

| 2023 |

663 (projection) |

35% (projection) |

| 2024 |

896 (projection) |

35% (projection) |

| 2025 |

1,164 (projection) |

30% (projection) |

As we see it, the international side of Pinterest's business is going to drive more than $1 billion in revenue within six-years while still growing at 30% a year.

How much is that business worth?

Hold that thought.

U.S. Business is Already a Monster

Aside from the disbelief that international revenue can become a meaningful part of the business, the slowing U.S. business also has analysts apprehensive.

Now, here is the company's domestic user growth:

| Year |

International MAUs |

Int'l User Growth |

| 2016 |

70

|

|

| 2017 |

76 |

9% |

| 2018 |

82 |

8% |

| 2019 |

88 |

7% |

Yes, domestic user growth is slowing, but it has room to grow.

Again, there is no argument that Pinterest will become Facebook, but we can again use Facebook as measuring stick.

Facebook has 180 million users coming from the United States while Pinterest sits at 88 million.

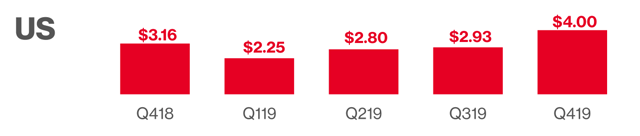

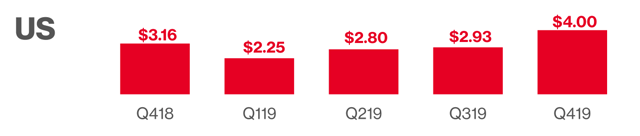

Revenue growth from the domestic market is growing much more quickly than MAUs, and that has been driven by ARPU growth.

Pinterest lands on $4.00 for Q4 2019 domestic ARPU. For our TAM measure, that is not realistically achievable but some sort of benchmark, we use Facebook again, which shows ARPU of $41.41 in the United States.

Yes, Pinterest's benchmark is more than 10-fold higher (again).

We can look to full years, rather than annual quarter to quarter comps as well.

| Year |

U.S. Revenue ($M) |

Growth YoY |

Percent of Total Revenue |

| 2016 |

292 |

|

98% |

| 2017 |

449 |

54% |

95% |

| 2018 |

715 |

59% |

95% |

| 2019 |

1026 |

43% |

90% |

So, if we take the domestic business piecemeal as well, how much is a business with $1.03 billion in revenue growing at 43% and a total addressable market more than 10-fold the current size worth?

We can do the 'spreadsheet thing' and try to build guard rails around the next five-years for domestic as well.

We extend the growth rates out and measure the resulting revenue base. In this case we have 'modeled' a drop in domestic revenue growth from 43% in 2019 to 32% in 2020, then precipitously down to 28% and below for the following years.

| Year |

U.S. Revenue ($M) |

Growth% YoY |

Percent of Total Revenue |

| 2016 |

292 |

|

98% |

| 2017 |

449 |

54% |

95% |

| 2018 |

715 |

59% |

95% |

| 2019 |

1,026 |

43% |

90% |

| 2020 |

1,354 |

32% |

85% |

| 2021 |

1,727 |

27.5% |

83% |

| 2022 |

2,158 |

25.0% |

81% |

| 2023 |

2,644 |

22.5% |

80% |

| 2024 |

3,173 |

20.0% |

78% |

| 2025 |

3,808 |

20.0% |

77% |

As we see it, the domestic side of Pinterest's business is going to drive over $3.5 billion by 2025.

Combined Entity

If combine these two (flawed) 'models' we get an entity with $4 billion in revenue by 2024 and $5 billion by 2025, growing at over 22%.

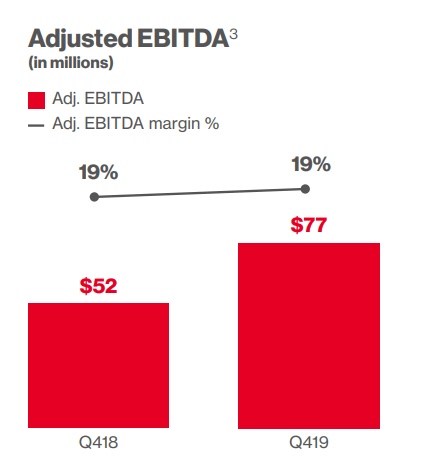

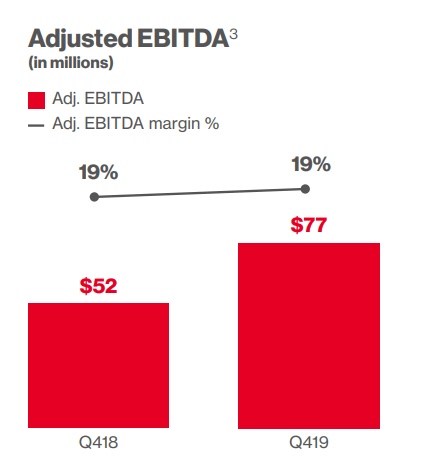

Pinterest has already delivered 19% adjusted EBIDTA margins in the last two Q4 reports, so, while erasing stock based compensation isn't exactly an earnings metric for the long-term, it gives us direction on a profit margin.

Facebook (FB) currently stands at $70 billion in revenue and (un)adjusted EBITDA of $30.5 billion, or a staggering 43% EBITDA margin.

That's it. The rest is left to the reader.

Back to Earnings

Let's review the latest quarterly (and full year) print.

* Revenue: $400 million, up 46% year-over-year, versus analyst expectations of $367.4 million.

(This was a beat)

Total revenue for 2019 was $1.14 billion, an increase of 51% year-over-year compared to 2018. Revenue growth was driven by an increase in advertising demand from new advertisers and to a lesser extent existing advertiser.

This mix largely reflects higher growth from international markets and advertisers. Higher demand resulted in an increase year over year in the number of advertisements served as well as an increase in the price of advertisements, but the impact of the latter was not significant.

Revenue from conversion optimization and video ad products contributed to growth.

The company also said it’s expanding shopping ads and working with more commerce platforms, such as Shopify, to help merchants sell on its site.

Yep, Pinterest will become the Google (search) of social media and the Shopify (SHOP) (e-commerce) of social media.

Here is an image of revenue growth from the company:

Note that International markets yield far lower average revenue per user (ARPU), but Pinterest continues to demonstrate that it can and will grow that number, showing 185% international revenue growth year-over-year.

Also note that international revenue went from 5.4% of total revenue last year to now over 10.2%. The globalization of Pinterest is happening with hyper growth in those regions.

* Adjusted EPS: $0.12 versus analyst expectations of $0.08.

(This was a beat)

The company delivered 48% year-over-year adjusted EBITDA growth. Here is an image:

* Full Year Revenue Guidance: $1.52 billion versus analyst expectations of $1.50 billion.

(This was a beat)

* Monthly Active Users (MAUs): Now reaching 335 million versus analyst expectations of 331.3 million.

(This was a beat)

The company saw 8% year-over-year growth in MAUs in the United States, 35% international growth for a 26% total year-over-year growth.

International MAUs were 247 million, an increase of 35% year over year in comparison to the 184 million in the same period of the previous year.

Here is an image from the company:

* Average revenue per user (ARPU): $1.22 versus expectations of vs $1.14.(This was a beat)

ARPU rose 26% in the United States and 122% internationally. Here is an image from the company:

As a point of reference, Facebook boasts an ARPU of $41.41, meaning yet again, Pinterest's benchmark is still 10-fold higher in the United States.

As another point of reference, Trefis estimates that Twitter’s ARPU is about $10.

How Do We Know if It’s ‘Working?’

We know the bullish thesis is working for Pinterest if MAUs continue to grow and if ARPU grows with it (up 26% in the U.S. and 122% internationally).

Keep a long-term eye out for 500 MAU and $2 ARPU or any two numbers that make $1 billion in product. That would be $4 billion a year in revenue and massive scale (read: operating margins).

Progress

Pinterest has a unique space in social media in that it isn’t particularly social and it exists as a virtual search engine for shopping. The social aspect comes from the 335 million monthly active users each posting images and tagging their subjects — these images are called “pins.”

As we see it, this is a quietly brewing storm. A social medium that is not infected by trolling and fake news. A social medium that is built for commerce. A social medium that is remarkably good at converting ads into sales. A social medium that is just getting started with markets.

Now, we can turn to some company specific details.

At 335 million MAUs, Pinterest now ahead of Twitter’s most recently available number of less than 330 million MAU. Note that Twitter has stopped reporting MAUs altogether, in a slight of hand that has fooled no one — Twitter is shrinking.

But we know that growth from users is coming from international.

The explanation comes straight from the company:

We initially built our business with large CPG and retail advertisers in the United States who typically have large marketing budgets and had the greatest affinity for our core use cases at that time.

We then scaled our sales force to support these advertisers and grew their spend with us over time while broadening the mix of advertisers across verticals. As these advertisers scaled their investment on our platform, we have increased our focus on building the product and measurement tools required to serve mid-market and unmanaged advertisers.

Recently, we have also begun to focus on expanding our international advertiser base. We believe that increased international monetization presents an important opportunity for growth, and we are working on localizing our product and expanding our business operations to better serve our international user and advertiser base.

It’s a simple question and belief system you will need to answer: Do you believe Pinterest can monetize the international markets as other social media have or do you believe it somehow has such a niche offering that it cannot grow that to any real scale?

However you answer that question, even after all of the data we have presented, likely answers whether or not you like this company as a long-term investment.

For now we see an invisible business that was $7 million in 2016 that is now 15x that scale at $117 million growing at 185% year-over-year and accelerating.

In the End Game

In the end we have a company that has accelerating user growth with accelerating ARPU growth and room to grow should it execute.

And Some More Data to Help the Bullish Thesis

72% of Pinners use Pinterest to decide what to buy offline. In some data collected way back in 2015, we find that 93% of active pinners said they use Pinterest to plan for purchases.

Now, sure, that’s old data, but if you look around the edges, then start tugging at them to look under the hood, Pinterest does in fact appear to have a special place in the social media world with no data disasters, no trolling, no fake news, and a lot of e-commerce.

The S-1 noted that 8 out of 10 women ages 18 to 64 who have children are on its platform. Between fall 2013 and spring 2014, the percentage of 18- to 29-year-olds using Pinterest rose from 25% to 33%, a greater adoption increase than Snapchat’s.

And now, five years later we know that millennials use Pinterest as much as Instagram and 1 of 2 Millennials uses Pinterest every month.

Final Thoughts

We wrote back in May:

Pinterest notes that “People often don’t have the words to describe what they want, but they know it when they see it. This is why we made Pinterest a visual experience. Images and video can communicate concepts that are impossible to describe with words. We believe that Pinterest is the best place on the web for people to get visual inspiration at scale.”

It’s easy to miss, but Pinterest hasn’t really turned into a video platform. Perhaps it never may, but it seems like a natural progression, and if it does so, it opens itself to the most dominant media Internet users consume in the world.

And then we noted a TechCrunch story which read that Pinterest has incorporated new features to make it easier for creators and brands to upload videos directly to the visual search engine.

Pinterest is taking an active role in making video a larger part of the platform — exactly as we said it would (and needed to) do in our introductory Top Pick dossier.

Risk

Risk is everywhere.

The company is going head to head with Facebook’s Facebook app and Instagram. The company is going head to head with Google — the end all be all for search.

The company is also competing with the “left overs” for digital advertising with Twitter, Reddit, LinkedIn, and a few others.

If the company cannot continue to show differentiation, it could be a disaster.

More About Pinterest

It’s finding the technology gems, like Pinterest before they are household names, that can turn into the 'next Google,’ or 'next Apple,’ where we have to get ahead of the curve. This is what CML Pro does, with an auditor verified track record, because of course it's verified.

Each company in our 'Top Picks’ has been selected as a future crown jewel of technology. Market correction or not, recession or not, the growth in these areas is a near certainty.

The precious few thematic top picks, research dossiers, and alerts are available for a limited time at a 30% discount.

Thanks for reading, friends.

The author is long Pinterest shares and call spreads at the time of this writing.

Please read the legal disclaimers below and as always, remember, we are not making a recommendation or soliciting a sale or purchase of any security ever. We are not licensed to do so, and we wouldn’t do it even if we were. We’re sharing my opinions, and provide you the power to be knowledgeable to make your own decisions.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.