Technical Bullish Momentum Trade and Trigger in Wynn Resorts Ltd

Wynn Resorts Ltd (NASDAQ:WYNN) : Technical Bullish Momentum Trade and Trigger

Date Published: 2020-02-11

Disclaimer

The results here are provided for general informational purposes from the CMLviz Trade Machine Stock Option Backtester as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.Lede

For the risk lover, today, 2-11-2020 as of 9:55am PT, WYNN presents an interesting trigger, but it's not for everyone. A "pass" on this backtest is perfectly reasonable.The stock has been hit hard due to coronavirus fears. A swing trade in this name, in particular with options straddles the line of immediate reward or immediate loss. Any news with regard to the virus' spread or containment will impact the name abruptly, likely.

But, we have a technical trigger in place and for those with a stomach for a "coin flip" probability, with historically a higher payoff for the wins than the losses, we have a trigger.

For a visual representation, it is precisely this situation we are after -- a hard stock drop, then a rally above the 200-day SMA (black line) and the 10-day EMA (red line).

Preface

Charting isn't simply a collection of a few trend charts, or a few indicators that work in one example. No matter how many lines and chart patterns are drawn on it, is not a rigorous backtest -- it's just a chart, at one specific time -- it really is.That's why technical analysis can feel so close to being profitable for a trader, and we can do so much preparation work, but at the same time the results, well, they never quite match up to the expectation.

After rigorous testing over the ten year period from 2009-2019 and the period from 2007-2009, which included the Great Recession, and over 100,000 back-tests, today we demonstrate the technical conditions that have provided a strong short-term bullish momentum trigger for Wynn Resorts Ltd (WYNN) , as well as, broadly speaking, the Nasdaq 100 index constituents.

TESTING SWING TRADING SIGNALS - OPTION BACKTESTER LOGIC WITH TECHNICAL ANALYSIS

The goal is to create a portfolio of option trading backtests with alerts attached to them, so we don't have to stare at the screen all day, but rather use Trade Machine as the pattern recognition work horse to notify when the ideas become actionable.The Bullish Option Trade with Technical Analysis and Moving Averages in Wynn Resorts Ltd (NASDAQ:WYNN)

We examine the result of a long out-of-the-money (strike price is set to the 40 delta) call option, in call options that are the closest to 14-days from expiration (using calendar days). But we follow three rules to test the swing trade:* Never Trade Earnings

That means the backtester never opens a trade between the "black out period" of two before through two-days after an earnings announcement.

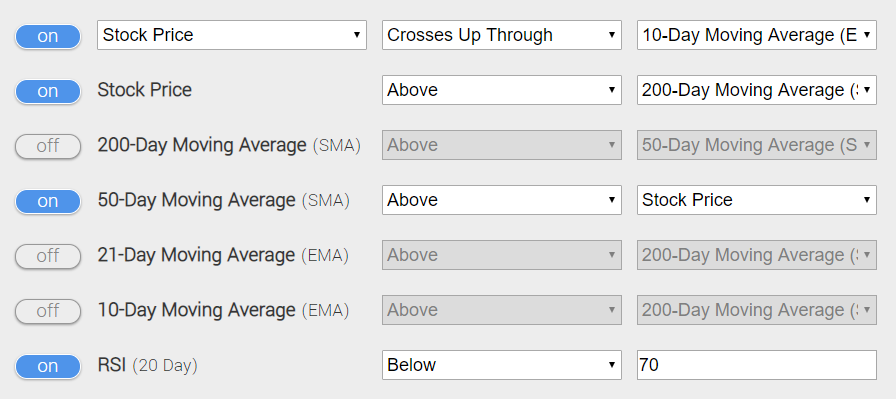

* Use a technical analysis trigger to start the trade, if and only if these specific items are met. This is the trading system:

* Trigger on the precise day that the stock crosses the 10-day exponential moving average (EMA) -- that's a trigger of a momentum breakout right at that moment -- an uptrend.

* The stock is already above the 200-day simple moving average (SMA), which means that the stock is not in technical failure -- we're not after reversals, we are looking for "not a down trend." There is also some sentiment surrounding this particular moving average.

* Stock prices are below the 50-day SMA means that it has room to run to the upside.

* The Relative Strength Index (RSI), using 20-days, is below 70, so the stock isn't overbought -- there is little risk of being oversold with the prior signals in place.

Here it is in an image from Trade Machine -- only focus on the moving average and RSI settings where the filter is turned to "on.":

You can set an alert in Trade Machine®, which will track all of these moving parts for you, and message you when it triggers. In fact, you can do this with a portfolio of stocks for a portfolio of bullish and bearish triggers. Let Trade Machine do the work for you -- there's no need to stare at the screen.

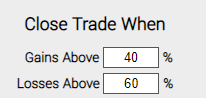

* Finally, we set a very specific type of stop loss and limit:

* Use a 40% limit gain and a 60% stop loss.

At the end of each day, the back-tester checks to see if the long call option is up 40% or down 60%. If it is, it closes the position.

Stock Option Backtester With Technical Analysis Results

Here are the results over the last three-years in Wynn Resorts Ltd:| WYNN: Long 40 Delta Call | |||

| % Wins: | 60% | ||

| Wins: 3 | Losses: 2 | ||

| % Return: | 566.6% | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine® are that it uses end of day prices for every back-test entry and exit (every trigger).

This is not a magic bullet, rather it's a bullish technical analysis momentum strategy predicated on using pattern recognition in charts through moving averages and RSI, rather than manually drawling lines stock by stock.

Setting Expectations

While this strategy had an overall return of 566.6%, the trade details keep us in bounds with expectations:➡ The average percent return per trade was 123.4% for each 14-day period.

Tap here to use technical analysis with pattern recognition. You can do this.

Checking the Moving Averages

You can check to see the values of all the moving averages discussed above with real-time daily prices, including live after hours prices, for WYNN by viewing the Pivot Points tab on www.CMLviz.com.Rigor to the Option Backtester, Swing Trading Technical Analysis and Backtesting

We compared this technical analysis trigger on the constituents of the Nasdaq 100 versus the results from the baseline. The baseline is simply owning calls and rolling them every two-weeks with the same stop and limit as introduced above (40% / 60%).Using rigorous technical analysis, as opposed to "that one chart that looked good that one time," we saw out performance over the 10-year period from March 2009 - March 2019, largely a bull market, as well as 2007-2009, the period which includes the Great Recession bear market. Further, we saw out performance in each sub period of one-year, two-years, three-years, and five-years.

Finally, the win rates by stock were also higher, as were the average winning trade return for every time period. Why look at one chart one time, when you can test technical set-ups across hundreds of thousands of charts at once?

Technical Analysis Back-testing More Time Periods in Wynn Resorts Ltd

Now we can look at just the last year as well:| WYNN: Long 40 Delta Call | |||

| % Wins: | 100% | ||

| Wins: 1 | Losses: 0 | ||

| % Return: | 126.7% | ||

Tap Here to See the Back-test

We're now looking at 126.7% returns, on 1 winning trades and 0 losing trades.

➡ The average percent return over the last year per trade was 126.92%.

Next Steps

Tap here to use technical analysis with pattern recognition. You can do this.Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.