Date Published: 2017-03-02

Preface

Apple (NASDAQ:AAPL) Inc has been on a historic run of late much to the dismay of the doubters on Wall Street, and there is an exceptional way to use options to profit from the run.

Apple Inc Stock Tendencies

Buying an at-the-money call (also known as a 50 delta call) is a bullish stance on a stock, but the real secret behind successful option strategies is found in the nooks and crannies of the trade. Let's take a look. First, here is how buying a 50 delta call every week for the last 2-years has done.

This strategy has returned 53.2% in the last two-years while the stock has risen just 12%. But this is not the end of the analysis -- it's the beginning. The strategy we just looked at must be improved upon, and we start by addressing the risk.

A smart approach to optimizing the reality of Apple's stock dynamics is to let the winners run, but cut the losing calls off early. We can do this by putting in a stop loss. While a long call can lose 100% of its value, what we can do is put in a rule:

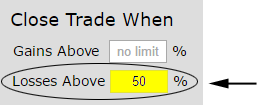

In any week, if the call loses 50% of its value, let's cut it off, and trade the next week. We are effectively removing half of the downside risk by doing this:

We can do this with the tap of the mouse:

And here are the results. We have put the old strategy on the right and the new, risk adjusted strategy, on the right:

We took that 53.2% return and nearly doubled it to a 89.8% return -- but more importantly we substantially reduced the risk.

Seeing it Clearly

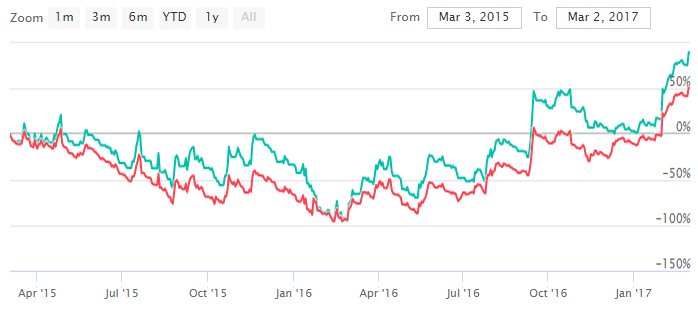

Here is the return chart of both strategies for AAPL, where the red line is the long call without a stop loss, and the blue line is the strategy with a stop loss.

What we can see is the incremental change we have imposed on the strategy. There was no magic bullet, but rather a systematic risk reduction based exactly on the dynamics of Apple Inc's stock price tendencies. Over time, the returns grew vastly better even though we took half the risk.

Now, if our analysis is correct, this stop loss implementation of owning calls should have worked better than the normal strategy of just buying and holding for all time periods.

It turns out that this is exactly what we find. Here are the results, side-by-side, for one-year for AAPL:

With Apple Inc's (NASDAQ:AAPL) new found rally, the returns are gigantic either way, but it's not the big numbers that we are focusing on, rather it is the systematic adjustment to the strategy that took less risk and created more wealth.

What Just Happened

The key to option trading is actually pretty simple -- understanding the dynamics of the stock you're looking at allows you to adjust the option strategy to reflect those dynamics.

This could have been any company -- like Amazon or Facebook, or any ETF and any option strategy. What we're really seeing is the radical difference in applying an option strategy with analysis ahead of time, whether that's a stop loss or avoiding earnings, or both. This is how people profit from the option market -- it's preparation, not luck.

To see how to do this for any stock, for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work

Thanks for reading, friends.

The author is long Apple (NASDAQ:AAPL) stock at the time of this writing.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.