The Marvelous Implications of a Stop Loss on iPath S&P 500 VIX Short Term Futures TM ETN (NYSEARCA:VXX)

Date Published 2-15-2017

The Trade That Keeps Working

The iPath S&P 500 VIX Short Term Futures TM ETN (NYSEARCA:VXX) is easily one of the most interesting instruments I have ever encountered as an option market maker physically on the NYSE ARCA floor and CBOE, remotely. It's a bet on contango (or backwardation depending on your position) in the VIX and it has been just unimaginably consistent.

But, while the best keeps on working, the nature of the brief periods where it reverses means large losses can be sustained in a short-period, unless you're prepared.

Understanding the risk profile of VXX has meant massively higher returns.

For the most part, the VXX just goes down all the time... Here is an all-time chart for VXX:

But here is that chart over the last two-years:

For obvious reasons, it has become one of the most crowded trades in the market -- short and short and short again. But, we can also examine this instrument with options.

While buying puts seems like the obvious move, there is a slightly less risky approach -- selling call spreads. With a spread, we hedge one option with another as opposed to a naked long (or short) position.

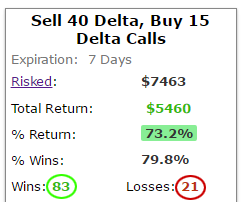

Here is what selling out of the money call spreads has done over the last 2-years, rolling every week (so trading weekly options)

That's a 73% return with 83 winning trades and just 21 losing trades for a 79.8% win rate. Since delta is actually a proxy for probability, owning a 40 delta option should be in the money about 40% of time. And that means that selling it should work about 60% of the time.

What we have discovered here is 79.8% win rate, but the times when the VXX rises are abrupt and can cause portfolio draw downs, even if over the long-term the short call spreads were winners.

It turns that as traders we have a tool for this behavior, and it's called a stop loss. You see, a short call spread can only make 100% in a single trade, but it can lose far more than that. It does not have a symmetric profit loss profile.

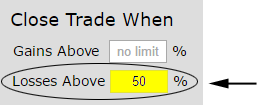

But, if we cut those losses off at the knees and totally reconstruct our profit loss profile, we can actually erase a huge amount of risk and increase returns. Here's what happens when we put a stop loss at 50% for the call spreads every week.

Here's how we do it:

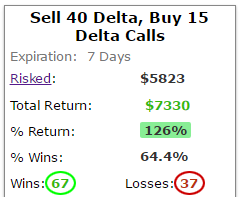

And now the results:

In English, if in any given week a call spread turns against us for a 50% loss, we buy it back and wait for the next week -- not allowing that trade to get worse.

We see a 73% winner turn into a 126% winner and we took massively less risk by using a stop loss. While the win-rate has gone down, the returns have jumped higher.

In in the case of the VXX and its rare but abrupt sporadic up turns, this is a highly sophisticated, albeit very easy approach, way of dealing with this phenomenon.

THE KEY

The key here is to find edge, optimize it -- in this case by putting in a tight stop -- and then to see if it's been sustained through time. For VXX it has, and that makes for a powerful result.

We've just seen an explicit demonstration of the fact that there's a lot less 'luck' and a lot more planning in successful option trading than many people realize. Here is a quick 4-minute demonstration video that will change your option trading life forever: Tap here to see the Trade Machine in action

Thanks for reading, friends.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.