Being Better is Not an Accident

Date Published: 2017-02-07Written by Ophir Gottlieb

Being Better is Possible

Being a better trader, a more profitable one, is possible. If you're methodical, and patient there's a good chance you will find opportunities that others will not.

This is one of those glaring cases where the vast majority of people likely missed this trade -- and they likely missed it badly.

You will not.

You will not.

Selling a put spread in Apple Inc over the last two-years has looked like a loser -- a bad one. In fact, here's exactly how trading weekly options would have looked if we sold an out of the money put spread for the last two-years.

First the set-up:

And now the results:

That's a -21.3% return over two-years while Apple Inc stock is actually up. Now, this is where the vast majority of traders stop -- and this is where you will not.

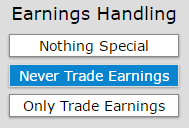

Let's next take that same Apple Inc strategy, but avoid the risk of earnings -- that is, we simply close the position two-days before earnings, and re-open it two-days after earnings. Here is the set-up -- just tap a button.

And here are the results:

The return is still negative, but it's now at -10% from -21%, and we have actually taken less risk to get better returns.

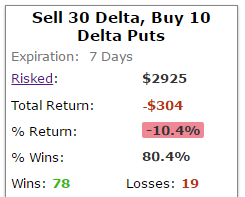

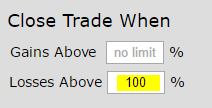

But there's more -- and this where we find the truth in option trading. Let's take the same approach, avoid earnings, and this time put a stop loss on trades at 100%.

Said simply, if we ever face a put spread that is down 100%, we close it right then, and wait for the next week to start a new position. Here is how that affected the results:

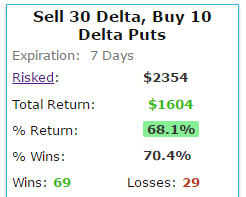

Here's the setup:

And then the results for Apple (NASDAQ:AAPL):

It might seem odd, but we have now taken two risk-off moves -- avoiding earnings and implementing a stop loss, but with less risk we have found vastly better returns. Yes, we went from a 21% negative return to a 68% positive return. How many traders see this trade? Whatever the number, it's small -- and now you are one of them.

Just to make sure we're not "cherry picking" a good timing of the trade, here's how that short spread did avoiding Apple (NASDAQ:AAPL) earnings, with a stop loss over the last year.

Now we can see that while 99% of traders likely dismissed this trade as a loser right at the start, they were wrong. It turns out this analysis goes way beyond just Apple inc, to every stock, every ETF, and ETNs like the VXX. The analysis go further than just short puts to dozens of options strategies including covered calls. And this is why...

We've just seen an explicit demonstration of the fact that there's a lot less 'luck' and a lot more planning in successful option trading than many people realize. Here is a quick 3-minute demonstration video that will change your option trading life forever: Tap here to see the demo movie

The author is long shares of Apple (NASDAQ:AAPL) at the time of this writing.

Thanks for reading, friends.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.