Tesla's Risk is Exploding

Fundamentals

PREFACE

Just two days ago, Brad Erickson of Pacific Crest just said that he sees demand for Tesla's cars is not pacing with company projections. While supply side issues have also plagued the company -- those in large part have been nothing but conversation.

Demand side erosion the other hand, is simply stated, absolutely enterprise viability risk.

WATCH FOR THIS

In the CML Pro research dossier we said:

"If Tesla misses forecasts on an earnings call because of supply chain and manufacturing issues, that's short-term noise and if the stock goes down on that news, it may be a buying opportunity.

But, if the company misses sales estimates because the demand is no longer above 100% of the firm's capacity while it's still just selling tens of thousands of cars a year (as opposed to hundreds of thousands), then the risk is cataclysmic. We simply don't believe in Tesla as a niche player. Tesla is only compelling if it hits its grand goals. And if it does, the stock price will take care of itself."

RISK

It's really this simple: In our CML Pro research dossier "Cracking the Code: Is Tesla a Buy?," we discussed the single most important valuation measure for Tesla:

Is Tesla nothing more than a luxury good manufacturer that has risen to fame because of the economic phenomena that have driven our bull market and wealth redistribution to the top 1%, or is destined to be a mass market creation?

Friends, if we can answer this single question, then we have cracked the mystery surrounding Tesla.

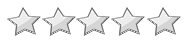

If demand is already fading for Tesla as it aims to sell ~ 70,000 cars this year -- the entire enterprise is at risk. Here's the all-time free cash flow chart:

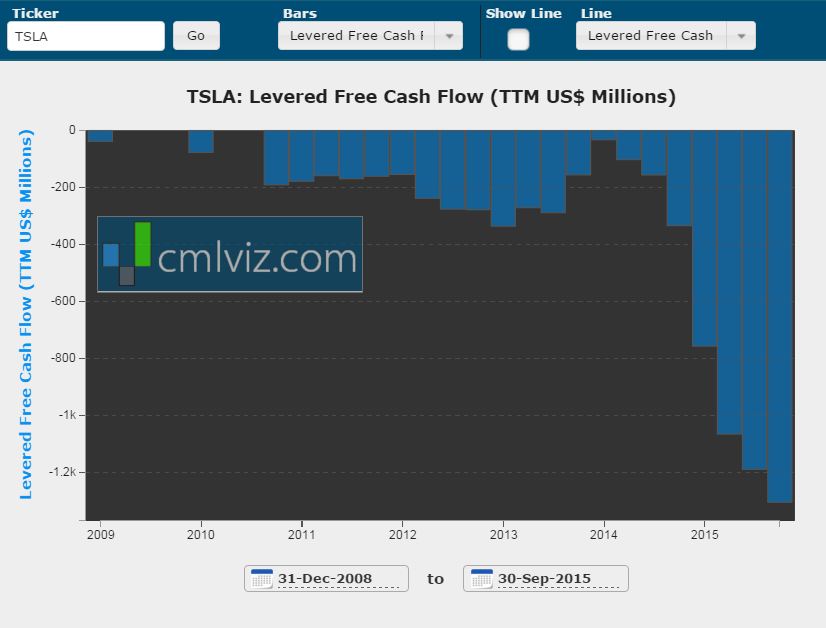

We're looking at negative free cash flow of over $1.2 billion in the last year and the losses are accelerating at frightening rates. As a juxtaposition, here is the revenue chart:

This is it -- the moment of truth. Does Tesla actually have demand for its products outside of the ultra-wealthy?

WHAT WE KNOW

Tesla announced Sunday, January 3rd that it shipped 50,580 cars in 2015, hitting the lower range of its target for the year for 2015. Tesla reported total deliveries of 17,400 for the quarter, representing 78% year-over-year growth.

Wall Street hit the stock hard but the media missed everything. But this isn't the story.

THE MEDIA TOTALLY MISSED THIS

I'm not sure how this goes missed, but other than a few shrewd analysts, the biggest news Tesla reported was totally overlooked. Read this carefully, because it's almost impossible to believe.

First, we know that Tesla's total revenue in the trailing-twelve-months is $3.8 billion. And here's what was also reported but somehow missed by everyone just reading the headlines:

Tesla reported a backlog of 33,000 Model X reservations. That's $4 billion in order backlog.

Yes, the company has a larger backlog in one product than all of its revenue in the last year. And friends, that doesn't include the Model S, which is its best selling car (Source: Benzinga).

Read that again. The company has a backlog in its newest product that is larger than its total revenue for the year of 2015.

We break news everyday. Discover the Undiscovered. Get Our (Free) News Alerts Once a Day.

MORE

Tesla has market moving news coming out on several fronts that will detach it from the broader stock market and move it into a stock that gyrates on its own news.

I. The company will give the world a preview of its Model 3 car -- this is the vehicle that is supposed to take the company from 50,000 unit sales in 2015, to 500,000 by 2020. Yes, a 1,000% sales increase in five years.

It's way too early to make a judgement, but if Tesla comes out in a few months and reports that Model 3 sales backlog is as overwhelming as the Model X, friends, the stock could absolutely explode. Equally, if the Model 3 is met with a thud, the stock will likely tumble as valuation calls from every brokerage on planet Earth will come out.

II. The second market moving news we will get is larger than even the first above. It is the seminal moment for Tesla as a company.

Get the full research report, The Breaking Technology That Everybody Missed, in CML Pro to find out what's coming within three-months.

This is the time to watch Tesla -- it could very well detach from any market noise, and trade on its own news entirely, and that is looking more and more bullish by the day.

We break news every day. Discover the Undiscovered.

Get Our (Free) News Alerts Once a Day.

WHY THIS MATTERS

If any of the information we just covered feels like a surprise, in many ways it is. The mainstream media doesn�t have the vocabulary to understand breaking technology and the top analysts that represent the wealthiest 1% of Americans have no interest in sharing the data they are keenly aware of.

Here is the two-year Tesla stock chart, for some perspective on the recent stock drop.

CML Pro has a research dossier on Tesla that goes deeper than anything the main stream media can produce and walks exactly the line of when, how and why to buy Tesla stock. It's just one of the fantastic reports CML Pro members get along with all the charting tools, top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.