Gilead Just Stunned the World and Did the Impossible, Again

Fundamentals

Follow @OphirGottlieb

Update 11-12-2015

Gilead said on Thursday, November 12th that the U.S. Food and Drug Administration approved the expanded use of its blockbuster hepatitis C drug, Harvoni.

The drug can now be used to treat patients with subtypes of chronic hepatitis C virus (HCV) and in patients who are co-infected with Human Immunodeficiency Virus (HIV), Gilead said in a statement (Source: Reuters).

Update 11-8-2015

Gilead Sciences, Inc.’s GILD announced that the first tenofoviralafenamide (TAF)-based HIV drug, Genvoya, has been approved by the FDA (Source: ZACKS).

I once called Gilead the greatest company in the world, but the impending risk of ending patents and competition from new drugs dulled that praise over the years. Friends, that praise may yet again be due. Gilead is simply unbelievable.

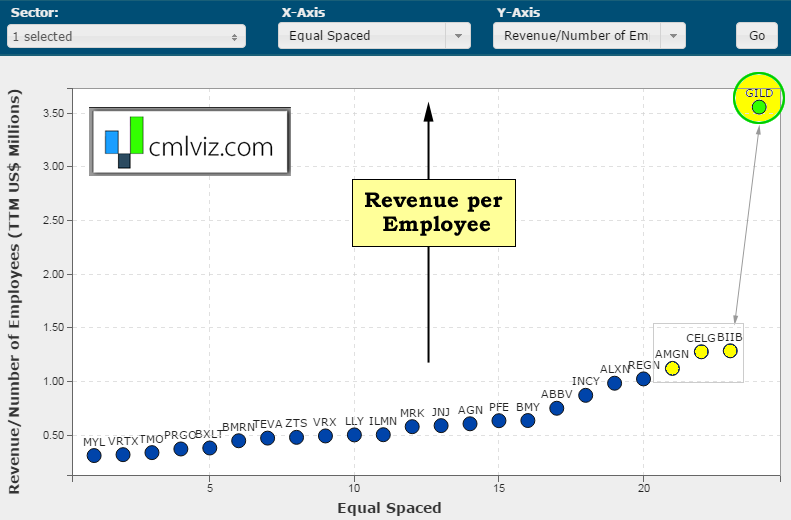

First, we interrupt this discussion with ridiculous chart number one. Here's a chart of revenue per employee in $millions on the y-axis for all bio/pharmas over $15 billion in market cap.

Gilead generates $3.5 million per employee and no other bio/pharma even generates $1.5 million per employee. I mean, are you joking? OK, back to the analysis at hand.

Do you enjoy using visualizations to understand what's really going on in a company? We do too. Get Our (Free) News Alerts Once a Day.

Defending the Greatest Win Ever: Hepatitis C

The bullish argument surrounding Gilead begins with the HCV franchise (Harvoni and Sovaldi). The hepatitis C drug combination is the single largest new drug success in the history of medicine and the combination drugs account for 90% of the Hep. C market. The Sovaldi / Harvoni mix requires patients take a pill for just 12-weeks and the result is a 90% chance that their Hepatitis C is cured. Hello?

Gilead owns 90% of the market for Hep C and its "forever big" in that roughly 3 million Americans suffer from hepatitis C, with 150,000 new cases diagnosed annually. The global total is between 130 million and 150 million, according to the WHO (Source: Forbes).

Do you enjoy understanding what's really going on in a company beyond the headline noise? Then Join Us: Get Our (Free) News Alerts Once a Day.

The Bad

Growth is slowing due to price push back from insurance companies for the very flagship hepatitis C drugs Harvoni and Sovaldi we just discussed. Further, The Motley Fool reported that AbbVie's competing combination drug, Viekira Pak, is starting to capture larger market share. To quote the article, "Put simply, we may have already seen the high-water mark for Gilead's hep C franchise."

Scared yet?... Don't be.

The Win

Hepatitis C is divided into six distinct genotypes and up until now Gilead had a treatment for four of the six types. But, on September 21, 2015 Gilead reported positive results from a Phase II trial on a combination treatment consisting of Sovaldi and an experimental drug. The opportunity is an "all-in-one treatment for all six genotypes of hep C." (Source: Forbes). Gilead says it will file for US approval in the coming weeks.

This regimen that spans all genotypes is also a part of Gilead's strategy to capture market share in developing countries that don't have the technology for genotype testing. Further, Market Realist revealed that in Europe "Harvoni has now been approved for patients that are co-infected with HCV and HIV, advanced liver diseases, post liver-transplant recipients, as well as patients who failed to respond to previous sofosbuvir therapies."

It appears that Gilead has not only defended its $10 billion Hep. C franchise, it may have just expanded it.

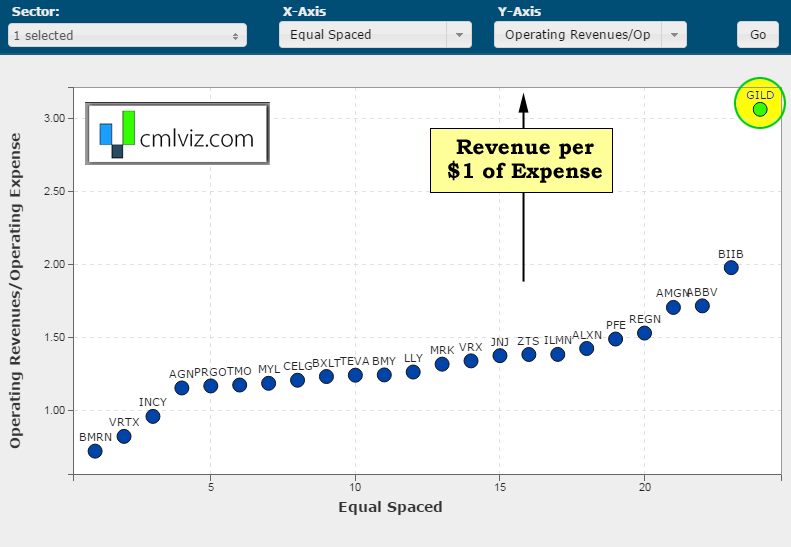

We interrupt this discussion with ridiculous chart number two. Here's a chart of the amount of revenue generated per $1 of expense on the y-axis for all bio/pharmas over $15 billion in market cap.

Yeah. Gilead generates $3.06 of revenue for every $1 in operating expense. No other bio/pharma even generates $2. For context, Apple generates $1.40 in revenue per $1 of operating expense. Google generates $1.34 and Facebook generates $1.47. OK, back to the analysis, again.

Do you thrive on seeing data that goes way beyond headlines and turns you into an expert? Try CML Pro. No credit Card. No Payment Info. Just the Power.

Defending the Largest HIV Franchise Ever

Gilead owns 87% of the HIV market which accounts for nearly $10 billion in sales and it has dominated this market for nearly a decade.

The Bad

But, Gilead's HIV drugs have their critical patents expiring in the period 2018 to 2022. When patents expire, those same drugs become available under generic labels. The entire franchise is at risk.

The Win

In late October, Gilead reported positive test results for its new Genvoya HIV drug. Check this out. Genvoya is as effective as Stribild (current drug) but has milder side effects. According to Forbes, an FDA decision is imminent. Check this out:

A recent trial demonstrated that Genvoya suppressed HIV as well as Stribild, but unlike the other drug, it did not reduce a patient's bone mineral density as much. Genvoya also did not have the renal toxicity associated with Stribild.

Source: MedScape

Source: MedScape

Update 11-8-2015

Gilead Sciences, Inc.’s GILD announced that the first tenofoviralafenamide (TAF)-based HIV drug, Genvoya, has been approved by the FDA (Source: ZACKS).

We write one story a day to uncover new opportunities and break news. Come on in: Get Our (Free) News Alerts Once a Day.

On September 25th, European Union regulators already recommended approval of Genvoya and a part of that approval surrounded the fact that the once a day treatment is gentler on a patient's bones and kidneys than an earlier version of the drug (Source: MedScape). Nausea is the most common adverse effect for Genvoya. Quite a change.

It appears that Gilead has taken another $10 billion franchise that was in fact expiring, and has now bettered it and added a new patent cycle on top (that's about twenty years).

Do you thrive on understanding what's really going on in a company beyond headlines? Get Our (Free) News Alerts Once a Day.

More

As if two massive franchises aren't enough, Gilead has entered the oncology market with its first drug, Zydelig, along with a number of its Phase III trials inside the cancer treatment realm. This is a firm with a history of unmatched innovation.

Gilead also has 12 products in Phase II trials and 7 products in the Phase III trials, both numbers are the second largest of any biotech in the United States. Two of the Phase III treatments are pending FDA approval.

Further, Gilead has an unmatched pile of cash to make acquisitions, if necessary.

The media simply isn't equipped to understand the stock market beyond headlines. Try CML Pro. No credit Card. No Payment Info. Just the Power.

Conclusion

Gilead did the impossible twice with its two mega franchises for Hep. C and HIV. It appears it has topped itself by defending those franchises, not through acquisition, but through science and innovation. I suppose we need to ask again: Is Gilead the best company in the world?

Do you thrive on understanding what's really going on in a company beyond headlines? Get Our (Free) News Alerts Once a Day.