Biogen's World Changing Drug Is About to be Judged

##Symbol##BIIB

##***Biotech

Biogen has data coming out on a drug called aducanumab which is meant to treat, and potentially cure Alzheimer's disease. On June 19th, I posted an article Why Biogen is Inches Away From Changing the World. I'll reprise some of that report and also focus on the earnings announcement due out July 24th before the market opens. Alzheimer's is the sixth leading killer in the United States and the disease is expected to overwhelm an ageing population by 2050 here in the United States. This drug, which treats the early stages of Alzheimer's and (maybe) prevents it from worsening, could be world changing. Having said that, 243 out of 244 prior attempts by other companies have failed. This is the journey we are about to embark on.

For the first time ever, a drug appears both to significantly remove brain plaques associated with Alzheimer’s disease and to slow cognitive decline. I said it before, and I think it bears repeating, this is "breathtaking, promising and frightening." It's frightening because of the 244 compounds that drug companies have tested for use to treat Alzheimer’s in clinical trials from 2002 to 2012, only one has received FDA approval (Source: Cleveland Clinic). Here's a startling image from Biogen's clinical trial.

Biogen is in totally uncharted waters if this thing goes through. On Friday March 20th, Biogen dropped a bomb on the market (the good kind), when it revealed data that showed "one measure of cognition, known as CDR, for Clinical Dementia Rating, Biogen's drug showed a 71 percent reduction in declines on the highest dose. Analysts said they were looking for 20 percent to 30 percent reductions to qualify as a success" (Source: CNBC). Over 5 million people in the United States have Alzheimer's, and that number could triple by 2050, according to the Alzheimer's Association. It's the sixth-leading cause of death in the United States.

Here are the fine points we must understand because this thing is really tricky.

Biogen is going to present data on the 6 mg usage of the medication. This dosage was added to the clinical trial after the firm has already started with 1mg, 3mg and 10mg dosages (and a placebo). We know that the 3mg and 10 mg group did show statistically significant improvement, which in technical terms means "lowering of amyloid accumulation combined with a slowing of the decline in brain function" (Source: WSJ Blogs).

OK, so why 6mg?

It turns out that increased dosage showed greater success at treating and even curing the disease, but the 10mg dosage had significant safety concerns. So Biogen threw the 6mg dosage into the mix to see if that dosage has improved effects on patients that mirror the 10mg group, but shows fewer side effects and safety issues. This is a fine line, but again, we are starting with a baseline of a drug that does work to a statistically significant level. You can see the excitement and hope that surrounds these new results. Or do we?...

Some doctors have been vocally critical of the results since the sample sizes (the number of people treated in each dosage group) are so small (there are about 40 people in each one). Doctor's have noted that if even a few of people in the sample were removed, the results could look totally different. I'll skip the details and point you to a great article Biogen Drug Could Inspire New Hope For Alzheimer's Treatments.

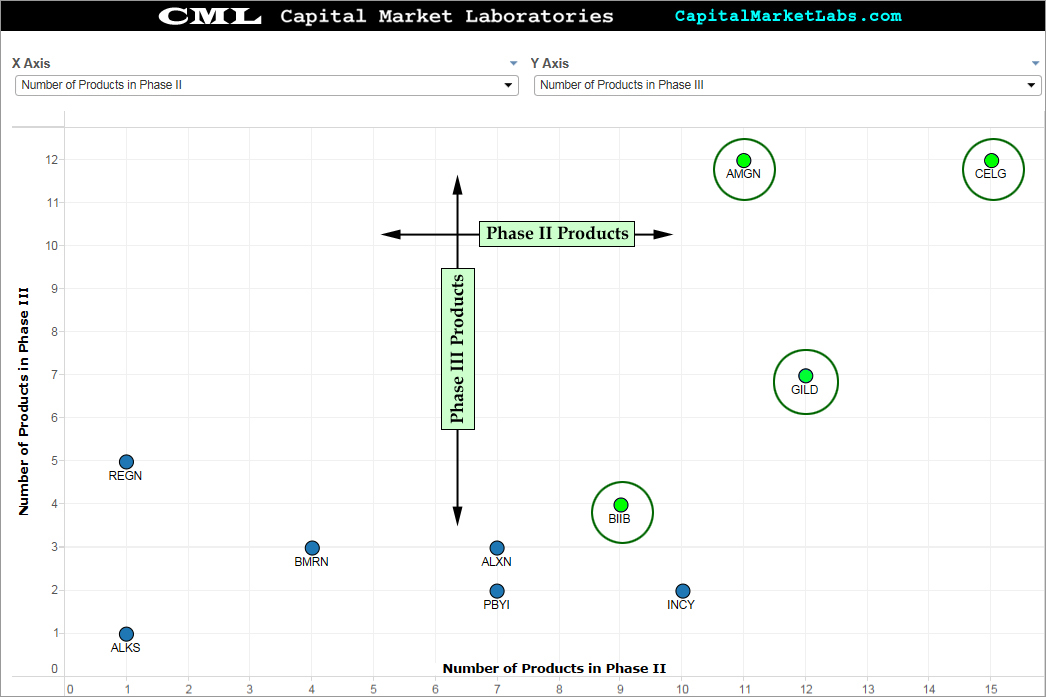

Aside from this massive clinical test, Biogen as a going concern biotech is doing everything right. The company has 9 products in Phase II trials and 4 products in the Phase III trials with one of the richest pipelines in the world. I earlier wrote that "Gilead May be the Strongest Company in the World. Biogen may be the second strongest biotech. In fact, if we look at all biotechnology and pharma companies with market caps above $10 billion that have both a five star fundamental rating and strong technicals, there are only six such companies. Biogen ranks third out of those six. Here is the scan result in an image.

Click Here to Power Scan

The company has seen revenue (TTM) grow to new all-time highs for 20 consecutive quarters and net income (TTM) grow for 11 consecutive quarters as operating margins have been rising. Biogen is a leader in multiple sclerosis (MS) research and therapies with five approved products in this field that accounted for $2.1 billion in sales in Q1 2015 (out of a total of $2.6 billion in sales). The company discloses its rich pipline for all phase products on its website. In the image below, we have plotted the number of Phase III trials on the y-axis and the number of Phase II trials on the x-axis for large cap biotechs. Note that BIIB does have a smaller pipeline (in terms of pure number of products) than the other big four (AMGN, CELG, GILD).

While biotech stock valuations are at highs as overall market valuations rise, if we take a step back and look at the fundamentals, we see a very powerful firm with a rich present and future.

Technicals | Support: 299.1 | Resistance: 475.98

BIIB also has a five bull (top rated) technical rating meaning that it is trading above its 10-, 50-and 200- day moving averages and the stock is up on the day.

Here are the consensus estimates for next quarter. Note that last quarter's actual result is included at the far right.

| EARNINGS ESTIMATES | |||||

| Earnings Date | EPS | Revenue (Mean) | Revenue (Median) | Last Quarter (Actual) | |

| 2015-07-22 | $4.07 | $2.8 billion | $2.8 billion | $2.6 billion | Provided by ZACKS |

Let's look at the core elements that drive the company's fundamental rating.

|

|

|

Fundamentals Rating Summary |

|

|

| METRIC | CURRENT | 1YR AGO | 2YR AGO | DIRECTION |

| Revenue (TTM US$ Millions) | 10,126 | 7,645 | 5,640 |  |

| Operating Margin (QTR) | 1.788 | 1.49 | 1.56 | RISING |

| Net Income (TTM US$ Millions) | 3,277 | 1,916 | 1,504 |  |

| Levered Free Cash Flow (TTM US$ Millions) | 2,791 | 1,913 | -1,537 | RISING |

| Research and Development (US$ Millions) | 461 | 529 | 284 | FALLING |

| Research and Development Expense/Revenue | 0.180 | 0.248 | 0.201 | FALLING |

|

|

| Stock Returns and Chart |

|

|

Before we dig into the fundamental trends that drive the star rating, let's look at a two-year stock chart with regression channel and 10-day momentum (on the bottom).

Click here to interact with this stock chart

Now let's examine the visualizations of the critical financial measures.

| METRIC | CURRENT | 1YR AGO | 2YR AGO | DIRECTION |

| Revenue (TTM US$ Millions) | 10,126 | 7,645 | 5,640 |  |

Just about everything we're going to look at is very strong for Biogen, but we must remember this event that's approaching. The firm does have a lot riding on this drug, as does the rest of the world. Revenue (TTM), which is trending higher meaning that it has increased for at least five consecutive quarters (in this case it's been more than 30 straight quarters). BIIB has grown revenue 32% year-over-year and any number over 20% has an added impact on the fundamental (star) rating. Keep in mind, this is a $96 billion market cap company that's growing like it's a small cap and that's without the new big drug.

What do all these numbers mean?

BIIB's fundamental rating benefited these results:

1. The one-year change was positive.

2. The one-year change was greater than +20% (an extra boost to the rating).

3. The two-year change was positive.

Finally, the up trend (consecutive quarters) in revenue benefited the fundamental (star) rating.

Let's look at Revenue (TTM US$ Millions) in the chart below.

Click Here to Interact With This Chart

| METRIC | CURRENT | 1YR AGO | 2YR AGO | DIRECTION |

| Operating Revenues/Operating Expense | 1.788 | 1.49 | 1.56 | RISING |

This is a critically important metric but has zero sex appeal like revenues or earnings. Operating revenue over operating expense simply shows us how much revenue (in dollars) is generated for every dollar of expense. The ratio must be (at a minimum) above 1.0 in order for a company to turn an operating profit. For the latest quarter BIIB showed a ratio of 1.79 which is absurdly high. For context, Facebook is at ~$1.3, Apple is at ~1.45, while "Gilead the Great" is a staggering 3.41. The fact that this margin is increasing in the face of a massive push for this new drug is remarkable, and does remind us that Biogen is not some small tech biotech with a "one trick, one bet, hold your breath and pray" drug, rather it's a powerhouse with a very healthy business that is looking to add another huge building block.

What do all these numbers mean?

A year ago Operating Revenues/Operating Expense was "just" 1.49 so in the last year we can a large operating margin increase.

BIIB's fundamental rating was affected from the operating margin numbers in two ways:

1. The current value is above 1.0 (the firm generates an operating profit).

2. The one-year change was positive (raises the rating).

Let's look at Operating Revenues/Operating Expense in the chart below with the total assets in the orange line.

Click Here to Interact With This Chart

Before we move onto earnings, let's look at revenue per employee in $ millions for the large cap biotech/pharma sector. On the x-axis we have equal spaced the companies (we rank them) and on the y-axis we have revenue per employee ($millions).

Click Here to Interact With This Image

Gilead obviously throws the whole thing off, but outside of GILD, Biogen's $1.29 million in revenue per employee is the second highest. Celgene is close behind with $1.28 million in revenue per employee. Again, if we focus on Biogen as both a company with a huge opportunity (and risk) as well as a company with a substantial ongoing business, we can see a strong and compelling argument for it as an investment thesis.

| METRIC | CURRENT | 1YR AGO | 2YR AGO | DIRECTION |

| Net Income (TTM US$ Millions) | 3,277 | 1,916 | 1,504 |  |

The wonder with all of these great large cap biotechs is how they can continue to grow revenue at insanely fast paces for company's of their size yet at the same time generate profits (unlike a lot of fast growing technology companies). Net Income (after tax profit) over the trailing twelve months (TTM) for BIIB is up to $3.3 billion, an increase 71% year-over-year. Can you imagine the pipeline of sales and earnings if this drug goes through? Or, alternatively, can you see how even if it doesn't go through, this company is crushing it?

Net Income (TTM) (aka annual earnings) is trending higher meaning that annual earnings have increased for at least five consecutive quarters (in this case 10 quarters).

In our next chart we plot Net Income (TTM US$ Millions) in the blue bars and the quarterly results in the gold line.

Click Here to Interact With This Chart

| METRIC | CURRENT | 1YR AGO | 2YR AGO | DIRECTION |

| Levered Free Cash Flow (TTM US$ Millions) | 2,791 | 1,913 | -1,537 | RISING |

Levered Free Cash Flow (TTM US$ Millions) is a critical determinant of stock price since market cap is the present value of all future free cash flows. For BIIB the metric is rising (it was $1.9 billion last year). For the most recent trailing-twelve-months the company reported Levered Free Cash Flow (TTM US$ Millions) of $2.8 billion, so an increase year-over-year of 46%.

This cash metric is up $4.3 billion from -$1.5 billion (negative) two-years ago.

For our next chart we plot Levered Free Cash Flow (TTM US$ Millions) in the blue bars through time.

Click Here to Interact With This Chart

| METRIC | CURRENT | 1YR AGO | 2YR AGO | DIRECTION |

| Research and Development (US$ Millions) | 461 | 529 | 284 | FALLING |

R&D is so interesting for Biogen. While the raw number is generally rising (though down from a year ago), the spend per dollar of revenue is dropping rather significantly. R&D is down ~13% year-over-year but is up 62% from two-years ago. All of the focus is on the Alzheimer's pipeline (as it should be right now), but there is a lot going on at Biogen that will soon get headlines, no matter what happens with this upcoming trial.

R&D per dollar of revenue for the latest quarter is $0.18. Last year this measure was $0.25. Normally that could be a warning sign for under investment, but BIIB has such a massive pipeline, we can't really go there with this company.

In our final time series chart we plot Research and Development (US$ Millions) in the blue bars and R&D [per dollar of revenue in the orange line.

Click Here to Interact With This Chart

Summary

Well, here we stand ready for a huge clinical trial result. So far the science looks good; increased dosages (from 1mg to 3mg to 10mg) have increased efficacy and increased toxicity. While the very early stages of the 6mg trial showed that dosage to be ineffective (i.e. it was not different than the placebo), there wasn't a big worry as the data needs to be tested over a 55 week (ish) time horizon. I haven't mentioned it yet, but i would be remiss if I didn't mention it now. Eli Lilly (LLY) also has a potential blockbuster Alzheimer's drug and it too is releasing data this week. For those affected by Alzheimer's in whatever way, this week is very promising, and beyond stock prices and revenue and earnings and money, I think everyone is cautiously optimistic on the outside and downright ready for jubilation on the inside, if either (or both) of these drugs turn out to be treatments.

In terms of the current company's mode of operations, Biogen is doing everything right. This earnings report due out on the 24th will certainly focus on the last quarter, revenue, EPS and the like, but I think we all know, Biogen stock is going to move abruptly on this Alzheimer's drug test data; regardless of the quarter's earnings results.