Apple is a Buy, Right Now

Fundamentals

PREFACE

The time has come to dispel with the ridiculous narrative that Apple is no longer growing. Apple stock is a screaming buy. Period.

STORY

It's a fact that over 60% of Apple's revenue comes from the iPhone. It's also a fact that iPhone sales increased every quarter in fiscal 2015 compared to 2014. But if you're really into facts, you'll like these:

FACT: The 'failed' Apple Watch and the 'dead' Mac alone will generate revenue greater than 50% of Google and double Facebook's revenue from 2015.

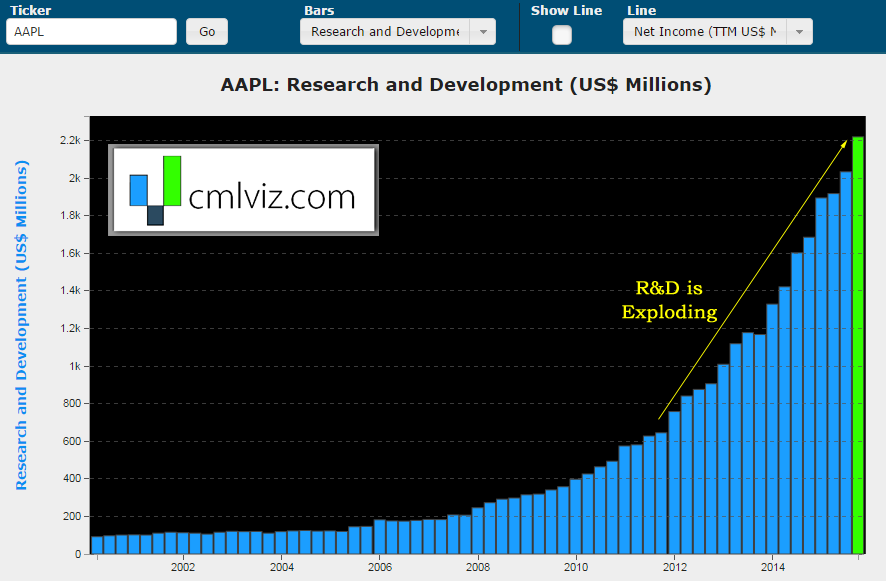

FACT: Apple has increased spending in R&D by 90% over the last two-years. Yes, the largest company in the world has nearly doubled its investment in innovation. Here's the R&D chart over the last 16-years.

Apple has more innovation and new products but the noise in Apple has often been deafening:

The iPhone is nothing more than a luxury bauble that will appeal to a few gadget freaks.

Source: Matthew Lynn Bloomberg, 2007

Source: Matthew Lynn Bloomberg, 2007

Of course we now know the iPhone to be the single best selling technology consumer product in the history of the world.

On July 23, 2013, Dave Logan of CBS wrote:

Apple is a dead company walking. I have to report that a new form of analysis reveals that the best brand in the world is lost.

Since Dave Logan published that report, Apple has added $253 billion to its market cap, which is just about equal to adding the entire market caps of Wal-mart, Netflix and Tesla combined.

On October 27th, 2015, Carl Quintanilla of CNBC tweeted: "A phone company. Now, more than ever. "Wrong. Inexcusably, so. This is why Apple presents one of the most compelling investments in the world right now.

GROWTH AND PRODUCTS

Here is the full story of innovation coming to Apple and the stellar sales results we already see in new products.

I. iPhone

iPhone sales broke every record conceivable in 2014 but, Wall Street couldn't help itself for 2015 detailing how inconceivable it would be for the firm to repeat its success.

Guess what...? For every quarter in 2015 Apple has sold more iPhones than it did last year, and by staggering amounts.

Apple is set to break last year's "impossible" number of 74.6 million iPhones. But there's more.

More Growth?

Rumors have it that Apple will be releasing a 4 inch iPhone. Research suggests there is still substantial demand for a smaller iPhone and all the other handset makers have moved away from smaller phones.

Estimates for 2016 put this new, massively upgraded small iPhone at 20 million - 30 million units. That means Apple will be releasing three new iPhones in 2016. The iPhone 7 is projected to have substantial technological advances driving substantial demand. Remember, Tim Cook in October said that two-thirds of existing customers are still using older phones (Source: 9To5Mac).

Even if we were to be foolish enough to think Apple is a "phone company," the phone is doing quite well. But we're not foolish, and here's why Apple is nothing close to "a phone company."

Here we go...

II. APPLE TV

Contrary to popular opinion, Apple TV is brilliant and selling at a huge scale.

The Apple TV represents a seismic shift of epic proportions for Apple and that's not just my opinion, that's from Goldman Sachs.

Projections

In early September, J.P. Morgan analyst Rod Hall said that he expects Apple to move 24 million next-gen Apple TVs in 2016. He predicts that this product's hardware sales, app sales and subscription fees alone will drive upwards of 3.3% of Apple's earnings in 2016.

The revenue just from this product will be larger than twice of Facebook's entire earnings. Yes, you read that correctly, just this product is twice Facebook's earnings.

But, that's the small news about Apple TV.

Total Game Changer

This device (below) will change everything about your home, security, lighting and so much more and it lives and breathes for the Apple TV. Learn more in the CML Pro Apple TV research dossier.

The promise of Apple TV goes way further than any of this. In fact, it's so big, and so disruptive, that we have an entire CML Pro Apple TV research dossier dedicated to how this product could begin the enterprise changing shift that literally could lift the stock by 50% simply by changing the way the market values the firm.

III. APPLE PAY

News broke on December 18th that Apple and China's state-owned credit card processor announced plans to launch Apple Pay in China. While Google, Facebook and Amazon have been totally locked out of China, remember that Apple grew 99% year-over-year in China per its latest earnings report and fully 50% of its operating income came from that country.

We know that Mobile payment transactions in China increased by 134 percent last year while the middle class in China will grow from 50 million people in 2010 to half a billion people by 2020.

Apple Pay is not just a small adjunct, this is a huge future business line. Here's a chart of global mobile payment transaction volume from Statista, forecasting out to 2017. This is in billions of dollars.

Apple Pay, like Apple TV, is such a large business line, we had to dedicate another full CML Pro research dossier just to cover the opportunity. As a teaser, here's just one short snippet from that report:

The total value of mobile payment transactions in the US will grow 210% in 2016 from $8.7 billion in 2015 using their mobile phone as a payment method to $27 billion.

Source: eMarketer

Source: eMarketer

Find out about the opportunity for Apple Pay, here.

IV.APPLE WATCH

Here's anther jaw dropping moment for those of us forced to endure the banality of main stream media. Canalys stated:

Apple has shipped nearly 7 million smart watches since launch, a figure in excess of all other vendors' combined shipments over the previous five quarters.

That's right. Two fiscal quarters' worth of Apple's version one Watch is larger than the rest of every other smartwatch in the world over five quarters. While Apple Watch unit sales will be in the 7 million range, no other producer has sold more than 300,000 in a single quarter.

Apple is introducing version 2 of the Watch in March of 2016, and it's the generations after version one of Apple products that really start to sell in huge numbers. A middle of the road estimate for Apple Watch revenue in 2016 would project 20 million devices sold and beat about $10 billion in revenue.

So a "failed product" appears ready to deliver sales the size of 15% of Google's total revenue. That's right, Google has delivered just over $70 billion in revenue in the last year, and the Apple Watch alone is set to deliver $10 billion. The optimistic end of the spectrum would put Apple Watch sales at 30 million units, or $15 billion. That would mean Apple Watch alone is as large as 20% of Google.

V. APPLE MUSIC

To keep it short and sweet, forecasts for Apple Music call for 15 million to 30 million subscribers by the end of 2016. The service costs $9.99 a month, which would translate into about $2.5 billion in annual revenue -- again, that's the size of all of Facebook's profit in 2015.

VI. MAC

While people never talk about the Mac because, ya know, main stream media would have you believe it's a dead product, try to digest this chart of Mac revenue by quarter from Statista.

Mac sales alone in the last four quarters have hit $25 billion. This product alone is are lager than all of Facebook's sales ($16 billion) and are 35% of all of Google's revenue. Yes, the 'dead Mac' is 35% of Google.

And, while PC sales are down double digit percentages on the year, Macs are seeing 6%-10% growth. That's right, Apple is starting to gain significant market share in the PC world.

VII. APPLE CAR

This is the first product we are discussing that won't impact sales in 2016 but is a major component of the Apple investment thesis.

On September 21st the Wall St. Journal reported: "Apple Inc. is accelerating efforts to build an electric car, designating it internally as a "committed project" and setting a target ship date for 2019, according to people familiar with the matter" (Source: WSJ).

In the comprehensive CML Pro Apple research dossier, we show the Apple Car will live in a segment that could easily be an entire company in and of itself..

Do you enjoy discovering new companies and opportunities and really understanding them? Get Our (Free) News Alerts Once a Day.

VIII.VALUATION

As of this writing Apple has a market cap of $587 billion with $206 billion in cash. If we account for debt, that makes Apple's enterprise value a meager $446 billion on sales of $234 billion and earnings of $53.3 billion in the last year. That's an enterprise value to sales ratio of 1.9 and an enterprise value to earnings ratio of 8.4.

I think this chart sums it up best. Here are the mega cap technology companies ranked by price to earnings:

I had to remove AMZN because it's P/E is so high it basically renders the chart useless. AAPL has a price to earnings ratio of ~11. Now if you want to argue that Google and Facebook deserve higher P/E's because of growth, go ahead.

But don't tell me that Microsoft is the bastion of growth (earnings shrank this year) or that somehow the firm has a wave of innovation coming. Yet somehow, Microsoft's P/E is 37. Yes, 3.5x larger than Apple. Or, does Apple show less growth prospects than QCOM or CSCO?

If you don't like to compare Apple to technology firms, try this: The P/E for the S&P 500 is 17. Yes, Apple trades at a 40% discount to the S&P 500.

CONCLUSION

While the headline noise will have you thinking everything is going wrong with Apple, the reality is, everything is going right. Its "side businesses" drive more revenue than Facebook times 250% and equate to over 60% of Google's revenue.

Apple has more products growing at double digit growth than it has ever had and we still haven't even discussed its other major R&D project, covered in CML Pro.

Apple is a compelling buy even if priced at the S&P 500's price to earnings ratio, since its growth forecasts exceed S&P 500 growth forecasts. But with the P/E 40% below the S&P 500 and the firm turning to revenue streams beyond hardware sales and more subscription based (read Apple TV research dossier and Apple Pay research dossier), the company could see a substantial price appreciation by the end of the year, even if the beginning of the year is still clouded by hyper focused iPhone sales and a misplaced belief that the firm is a one trick pony.

The top 1% of wealth owners in the United States and their hedge fund managers are keenly aware of the opportunities we just shared that very few "non one-percenter's" know of. If we're not using the same data and information, then we're trading against people that simply have more information than we do. It's time to stop the wealth transfer to the top 1% simply because of unfair access to data.

This is just one of the fantastic reports CML Pro members get. For a (very) limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. And yes, we do have a "top picks for 2016" that is based on empowering our members. It's based on knowledge. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.