Pre-earnings Momentum Trade With a Technical Trigger in Wix.com Ltd

Wix.com Ltd (NASDAQ:WIX) : Pre-earnings Momentum Trade With a Technical Trigger

Date Published: 2020-04-30

Disclaimer

The results here are provided for general informational purposes from the CMLviz Trade Machine Stock Option Backtester as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.Lede

Today, 4-30-2020, WIX has triggered a pre-earnings momentum backtest if it can hold the 50-day SMA by the close.If you are not already a Trade Machine member, use algorithmic pattern recognition like the institutions - find today's option triggers, right now.

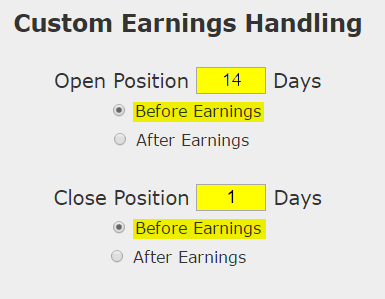

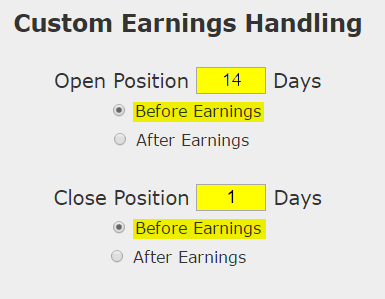

Here's the set-up in great clarity; again, note that the trade closes before earnings, so this trade does not make a bet on the earnings result.

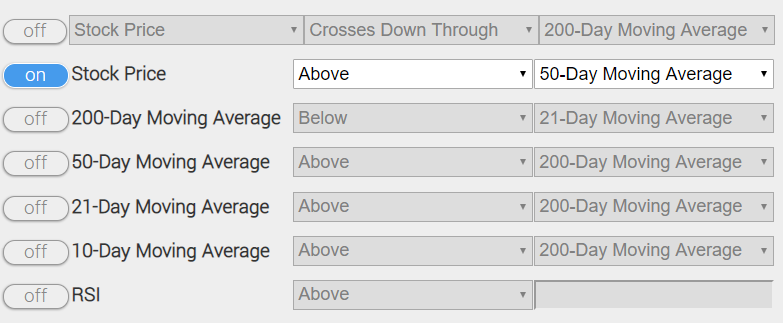

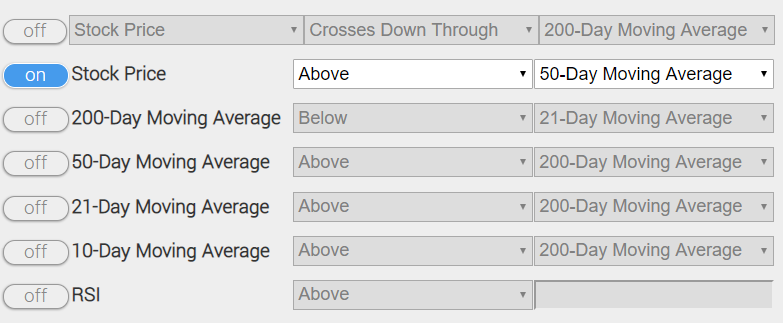

And here is the technical analysis requirement -- note only one is "turned on," and that is the 50-day moving average requirement.:

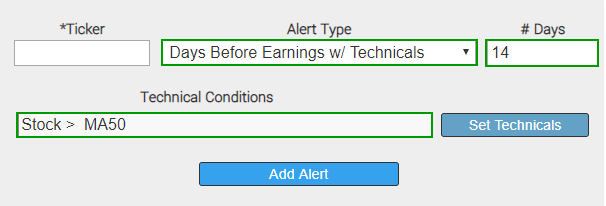

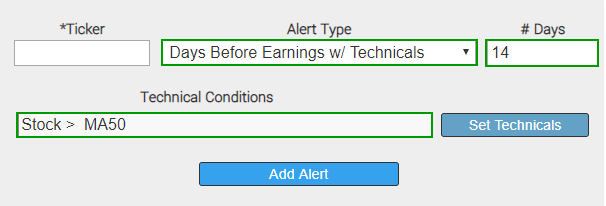

If the stock price fails the technical requirement, it's fine, we just put a pin in it and check next quarter. Even better, we can set an intra day alert in Trade Machine that will email and/or text you when both requirements are met, just like this:

In English, at the close of each trading day we check to see if the long option is either up or down 40% relative to the open price. If it was, the trade was closed.

Tap Here to See the Back-test

The mechanics of the TradeMachine® stock option backtester are that it uses end of day prices for every back-test entry and exit (every trigger).

Notice that while this is a 3-year back-test and we would expect four times that many earnings triggers (4 earnings per year), the technical requirement using the 50-day moving average has avoided 3 pre-earnings attempts. In other words -- it's working.

We see a 200.8% return, testing this over the last 9 earnings dates in Wix.com Ltd. That's a total of just 126 days (14-days for each earnings date, over 9 earnings dates).

➡ The average percent return per trade was 20.27%.

Back-testing More Time Periods in Wix.com Ltd

Now we can look at just the last year as well:

Tap Here to See the Back-test

We're now looking at 36.1% returns, on 2 winning trades and 1 losing trades.

➡ The average percent return over the last year per trade was 9.78%.

Risk Disclosure

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.

You should read the Characteristics and Risks of Standardized Options.

Preface

There is a bullish momentum pattern in WIX stock 14 calendar days before earnings. Further, we use moving averages as a safety valve to try to avoid opening a bullish position while a stock is in a technical break down, like the fourth quarter of 2018.The Bullish Option Trade Before Earnings in Wix.com Ltd (NASDAQ:WIX)

We will examine the outcome of getting long a monthly call option in Wix.com Ltd 14-days before earnings (using calendar days) and selling the call before the earnings announcement if and only if the stock price is above the 50-day simple moving average.Here's the set-up in great clarity; again, note that the trade closes before earnings, so this trade does not make a bet on the earnings result.

And here is the technical analysis requirement -- note only one is "turned on," and that is the 50-day moving average requirement.:

If the stock price fails the technical requirement, it's fine, we just put a pin in it and check next quarter. Even better, we can set an intra day alert in Trade Machine that will email and/or text you when both requirements are met, just like this:

RISK MANAGEMENT

We can add another layer of risk management to the option trading back-test by instituting and 40% stop loss and a 40% limit gain. Here is that setting:

In English, at the close of each trading day we check to see if the long option is either up or down 40% relative to the open price. If it was, the trade was closed.

RESULTS

Here are the results over the last three-years in Wix.com Ltd:| WIX: Long 40 Delta Call | |||

| % Wins: | 67% | ||

| Wins: 6 | Losses: 3 | ||

| % Return: | 200.8% | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine® stock option backtester are that it uses end of day prices for every back-test entry and exit (every trigger).

Notice that while this is a 3-year back-test and we would expect four times that many earnings triggers (4 earnings per year), the technical requirement using the 50-day moving average has avoided 3 pre-earnings attempts. In other words -- it's working.

We see a 200.8% return, testing this over the last 9 earnings dates in Wix.com Ltd. That's a total of just 126 days (14-days for each earnings date, over 9 earnings dates).

Setting Expectations

While this strategy had an overall return of 200.8%, the trade details keep us in bounds with expectations:➡ The average percent return per trade was 20.27%.

Checking the Moving Average

You can check to see if the 50-day MA for WIX is above or below the current stock price by using the Pivot Points tab on www.CMLviz.com.Back-testing More Time Periods in Wix.com Ltd

Now we can look at just the last year as well:

| WIX: Long 40 Delta Call | |||

| % Wins: | 66.67% | ||

| Wins: 2 | Losses: 1 | ||

| % Return: | 36.1% | ||

Tap Here to See the Back-test

We're now looking at 36.1% returns, on 2 winning trades and 1 losing trades.

➡ The average percent return over the last year per trade was 9.78%.

WHAT HAPPENED

There's a better way to find winning option trades -- try pattern recognition.Risk Disclosure

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.

You should read the Characteristics and Risks of Standardized Options.