Fastly (NYSE:FSLY) is An Under Appreciated Growth Story

Preface

We acknowledge a lot of risk in Fastly (NYSE:FSLY) but also recognize some of the most impressive technology we have ever seen in any company on our list.

For you quick triggered traders, I would stay away from this stock because I believe it could go nowhere for more than 6-months. For the long-term investor, what a beauty this could be.

The company faces the expiration of a lock up period, which means more selling pressure could come.

We will start with earnings results announced on 11-7-2019, and then move to a much more interesting discussion of bleeding edge technologies and the bullish thesis.

Earnings

A quick review of earnings before a fuller discussion is included below:

* Revenue: $50 million, up 35% from Q3 2018 versus analyst expectations of $48.12 million.

This is a beat.

* Adjusted EPS: -$0.09 million, up 35% from Q3 2018 versus analyst expectations of -$0.13

This is a beat.

* Full Year Revenue Guidance: $194 million – $198 million, up from prior guidance of $191 million – $195 million.

This was a raise.

* Dollar-Based Net Expansion Rate (DBNER): Continued momentum with existing customers demonstrated by a strong Dollar-Based Net Expansion Rate (DBNER) of 135%, up from 132% in the previous quarter.

This is a beat.

The increase in DBNER was driven by further adoption of security features and more complex edge computing use cases by large customers.

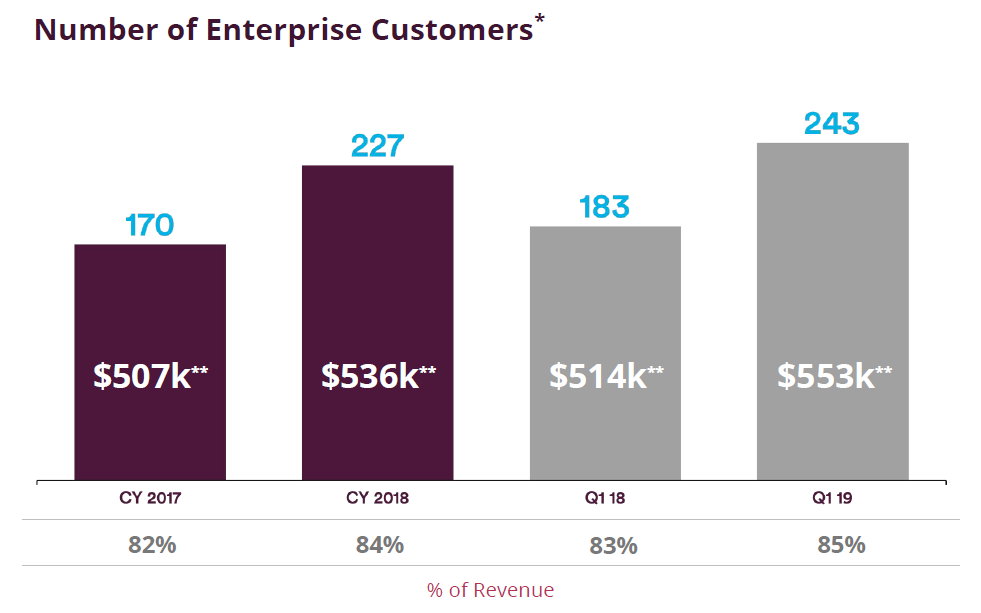

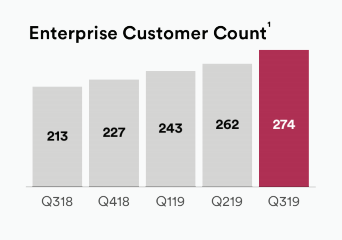

* Enterprise Customer Count: Total enterprise customer count of 274, up from 262 in the previous quarter.

Average enterprise customer spend of approximately $575,000, up from $556,000 in the previous quarter.

Here is the President specifically speaking about enterprise:

In fact, we’re seeing [] an acceleration of customers ramping into that enterprise class faster than historically.

[] I think, overall, it’s a healthy growth, and you’ll continue to see a healthy growth."

As of Q3 2019, 274 of Fastly’s 1,684 customers were enterprise customers. These enterprise customers drove the majority of Fastly’s revenue growth and accounted for 86% of Q3 revenue.

More Metrics

Continued expansion of Fastly’s network to 66 Points of Presence (POPs) with access to 58 Tbps of global network capacity, up from 64 POPs with 52 Tbps in the previous quarter.

What’s Coming

We will now discuss the breaking technology that is coming, and finally, since this is a rather complex technology, we will go back into the guts of it and review it in simple terms, rather than technological jargon.

– Compute@Edge The company announced the beta launch of Compute@Edge, a powerful new language-agnostic compute environment. This major milestone marks an evolution of Fastly’s edge computing capabilities and our company’s innovation in the serverless space.

Huh?…

Over the last two-years Fastly has been building Compute@Edge, which is a serverless offering built for global scale and performance. Remember, edge computing, which we discuss in the following sections, will be the new era of growth in the cloud.

The name of the company should serve as a guiding light as to what they are after: Fastly is about speed.

Fastly claims that Compute@Edge, at 35.4 microseconds it offers a 100x faster startup times than other solutions on the market. This is a legitimate technological feat, buries the competition as of today, and points to just one of the areas where this small (ish) company is simply technologically ahead.

Here is the CEO on the speed (our emphasis added):

And so it really takes this idea that write code, write it in the language that you are using in-house that you have tooling for but be able to deploy it in a very safe, secure, efficient manner as close to the user as possible and kind of handle that load globally.

And I think that’s where the really amazing engineering work we have done shines through is that kind of — the efficiency of doing this, not just doing it because that’s been possible in the past with large servers and virtualization, but it is really doing it at scale in a very tight environment.

If you’re looking for market moving news, the company will demonstrate Compute@Edge on November 12th and 13th at the Altitude conference in NYC.

On the earnings conference call, President Joshua Bixby said (our emphasis added):

I think the really exciting part of the Compute@Edge launch, and obviously, it’s still early, is the acceleration of that. And I think we’re going to see more of these things come to light as we allow people a bit more flexibility. So very exciting flywheel, and we’re seeing it in real effect right now.

A part of Compute@Edge is a radical new version of the Internet that’s coming. Through a mass of technical collaboration, the very way code is run on the Internet is changing. As of today, if something runs in the browser (also called client side), there are major performance limitations, which constrains the vast majority of this code to tasks like printing text, showing images, rendering borders, etc.

The continuous expansion of JavaScript as a language and the massive performance increases in the JavaScript interpreters pioneered by Google and others, has made browser / client-side scripting much more common and that means there is less load on the actual servers in the main cloud. After all, if the code uses the CPU power of a local machine, like your desktop, it is not taking the resources from the cloud.

But there is only so far JavaScript can go. I know there are developers reading this with daggers in their eyes, but it’s OK, I’ll stick with that position. I can both appreciate the massive new strength in JS and also appreciate that other languages have to be leaned on to really make this thing we call the Internet move faster.

So, through a consortium, in part lead by Mozilla (better known as the company that created Firefox) there is a new approach to allowing a faster, lower level type of code called assembly language to load client side (aka not in the central cloud). Before I get more technical, here are a few quotes from Fastly’s executives:

This is from CEO Artur Bergman:

And this is attractive to us because browsers, they add a lot of resources, and they are an area where they have to spend a lot of time and money on making sure it’s secure.

And so, we took that, and we have developed some open source technologies to Lucet as a compiler for web assembly. We have then embedded that into our one network, and we will allow customers to upload web assembly and deploy it using all the tools, logs, streaming all the things that make Fastly great, but now they can write much more complex applications in their language of choice.

Initially, we’re supporting Rust, but this is web assembly underneath. Once we are comfortable with that and have that developed, we will expand the tool chain to support other languages, and reception from customers that we’ve been talking to, both before and after the announcement, have been great.

If this is making your head spin, it really comes down to a pretty simple idea: The speed and computation power of the Internet will increase dramatically without adding the burden to the central cloud — which would be the clouds we refer to when we discuss Amazon, Microsoft, Google, and IBM, for example.

The beauty of WebAssembly is that languages that once were used only for real-time robotics applications or high-performance video games, like C++ and Rust, can now be run inside of the web browser with minimal performance loss and minimal additional coding needed from software engineers. This promises to allow billions of devices around the world that are running in the client’s homes and places of business, to contribute massive computational power to applications that currently demand these resources from the cloud.

In the following section we will definitively and clearly discuss the difference between the central cloud and the edge cloud. For now, just stick with the takeaways — faster, more powerful, less stress on the central cloud.

This movement is understood by a few large enterprises, but not all, or even most. But it will be as commonplace as a website, a smartphone, a computer. There will be a make or die moment coming for technology companies running in the cloud and they will move to a vastly superior version of the Internet or they will lose business

With regard to revenue forecasts, which were raised, revenue looking forward, listen to this now, has not been adjusted for the likely influx of new sales from this new serverless compute project. Again, this is the CEO (our emphasis added):

Scaling Up – A Larger Company

it is our view that Fastly is being overly cautious on growth prospects and we get some evidence of this from the executive team when they discuss their sales process.

This is a little funny, really, for a company that is set to hit about $200 million in sales and growing at 35% year-over-year with a DBNE of 135%:

This is from the President, Joshua Bixby:

We’ve started to invest on the marketing side. And so that’s going from near 0. It does take time.

Yep, the President said, out loud, that this $200 million company with substantial growth rates and massive retention numbers doesn’t really even know how to market yet. Hello?

Finally, an analyst went ahead just openly asked about the web assembly transition of the Internet and here is the CEO responding (our emphasis added):

So, the initial — I mean, we announced it yesterday, but the initial response is really — we’re really happy with it. It’s really exciting.

Finally, Wall Street analysts have gotten tied up in their underwear again, associating a commodity business with what Fastly is doing. Whether Fastly makes it or not, it will not be due to a “me too” business. In fact, the risk is that their technology is so forward looking that they won’t reap the rewards, but another company will come in and take it.

Here is the president, again, discussing commodity products:

So, when you think about price compression, obviously, it’s a direct function of how much value you add to customers.

And now, finally, let’s tie a bow around this technology by going backwards to the original thesis.

Thematics

One of the most powerful trends we follow is the move to the cloud. That is, the move of hardware and software to a centralized compute center powered by some of the largest companies in the world, starting with Amazon and Microsoft, then moving to Google and IBM as the four public cloud titans. Of course, Apple and Facebook have enormous clouds themselves, but they are private (for their own use only).

In the cloud came software that could run there — centralized and connected. With the cloud has come data. Not a little data, and not a nice linear growth in data, but a spectacular parabolic rise in data. We are creating as much data in a day than we did from the dawn of civilization through 2003, or so says ex Google CEO and executive Chairman Eric Schmidt.

With that data, a new possibility arose — to create inference models using artificial intelligence (AI) and deep learning that are data hungry to move the ball forward in the evolution of humankind. That’s hardware and software.

But in all of this, another change has come — let’s call it an evolution. As the world of technology has moved to embrace the centralization of data, so the load on the cloud has increased enough to create a new problem — latency.

Latency – The Need for Speed

Latency can mean many things, but in technology it simply means the amount of time between a request and a reply from that request. For example, the time it takes from pressing a key on your keyboard to the time it shows up on your screen. That latency is extremely small because it happens locally.

Another type of local latency is the same practice as above, but done on your smartphone. This too feels nearly instantaneous.

A latency on our phones that we can tangibly feel, for you iPhone face recognition users, is the time you hold the phone up to see your face and the time it takes for the phone to open as it recognizes your face.

Training versus Inference

But there are more pressing issues to latency. Imagine a self-driving car communicating with the cloud, when it suddenly faces a dangerous situation — let’s call it life or death — turn left, right, or stop. In this case one second would be devastating and would virtually eliminate the possibility of self-driving.

So, self-driving features are trained in the cloud, where the heavy lifting is done, but the inference is done locally, with a computer in the car.

Training involves the development of an algorithm’s ability to understand a data set, whereas inference is when the computer acts on a new data sample to infer an answer to a query.

With all of these new demands coming into the technology sphere, names have changed. What was once called the cloud, is now called the central cloud.

And with that comes a new idea — the space in between the massive data collector and training engines in the central cloud, and the spot that does the immediate actions with inference. This space is called the edge cloud.

The Edge – It’s Speed and Flexibility at a New Level

In our iPhone example, the edge computing is the phone. In our self-driving example, the edge computing is done in the car itself. But the edge cloud sits in between the hardware (a phone or car) and the gigantic central cloud.

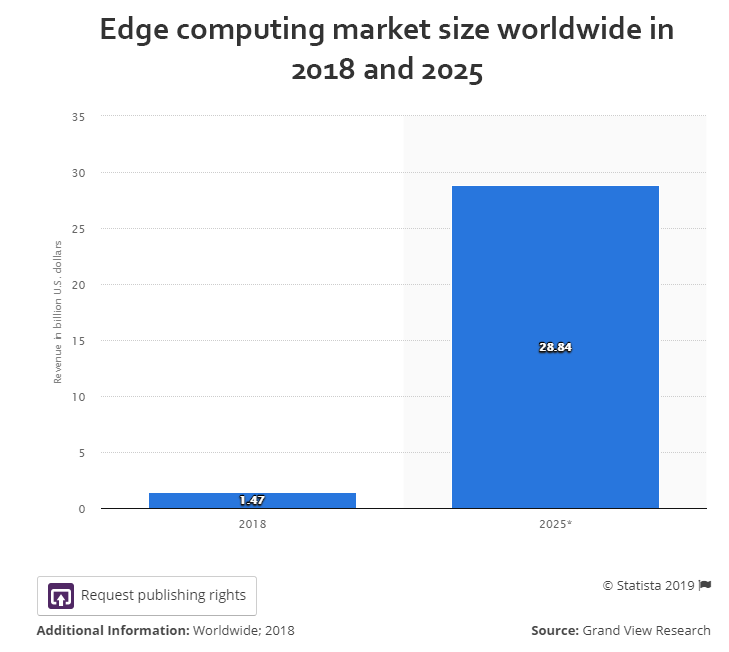

This idea — this movement — is just now happening, but it is a new enormous shift coming to our world. Here is an image of the edge computing market size worldwide in 2018 and 2025.

This is nascent, but my goodness, it will be a massive disrupting force in the relatively near-term.

Recall, we also have a new mobile network coming forward called 5G, where the ‘G’ just stands for generation. Today we are on 4G or even 4G LTE (where ‘LTE’ stands for ‘Long-term Evolution’). With 5G will come unheard of speeds from simply a mobile connection.

5G is expected to support 1 million connected devices per square kilometer and deliver up to 20 gigabits per second of peak data download rate for each cell site (20 gigabits are 20,000 megabits).

So, in English, we could download a full-blown high definition movie in about 3 seconds on our cell phones. A single music file could be downloaded in under one second — in fact, 500 songs would take one second. That’s not Wi-Fi, that is standard mobile network speed.

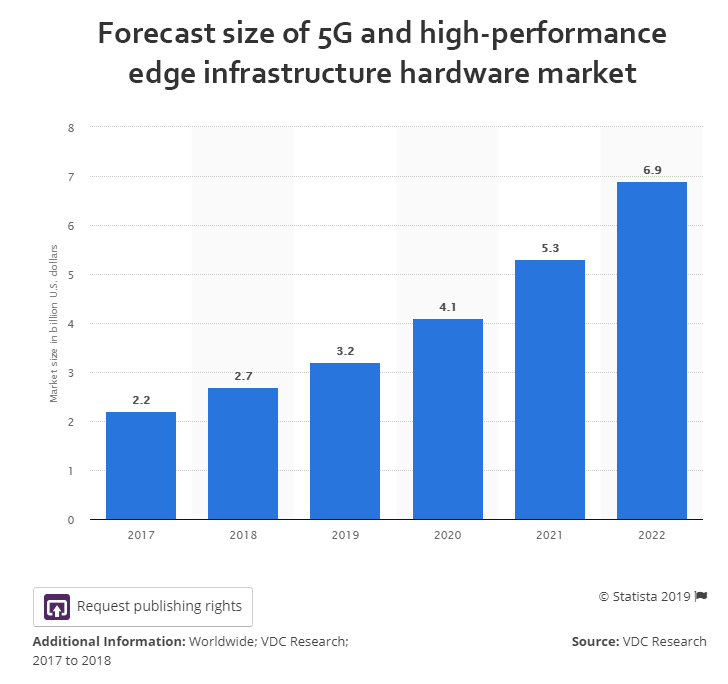

As the edge cloud moves forward, there will be hardware needs. Here is the forecast size of 5G and high-performance edge infrastructure hardware market worldwide from 2017 to 2022.

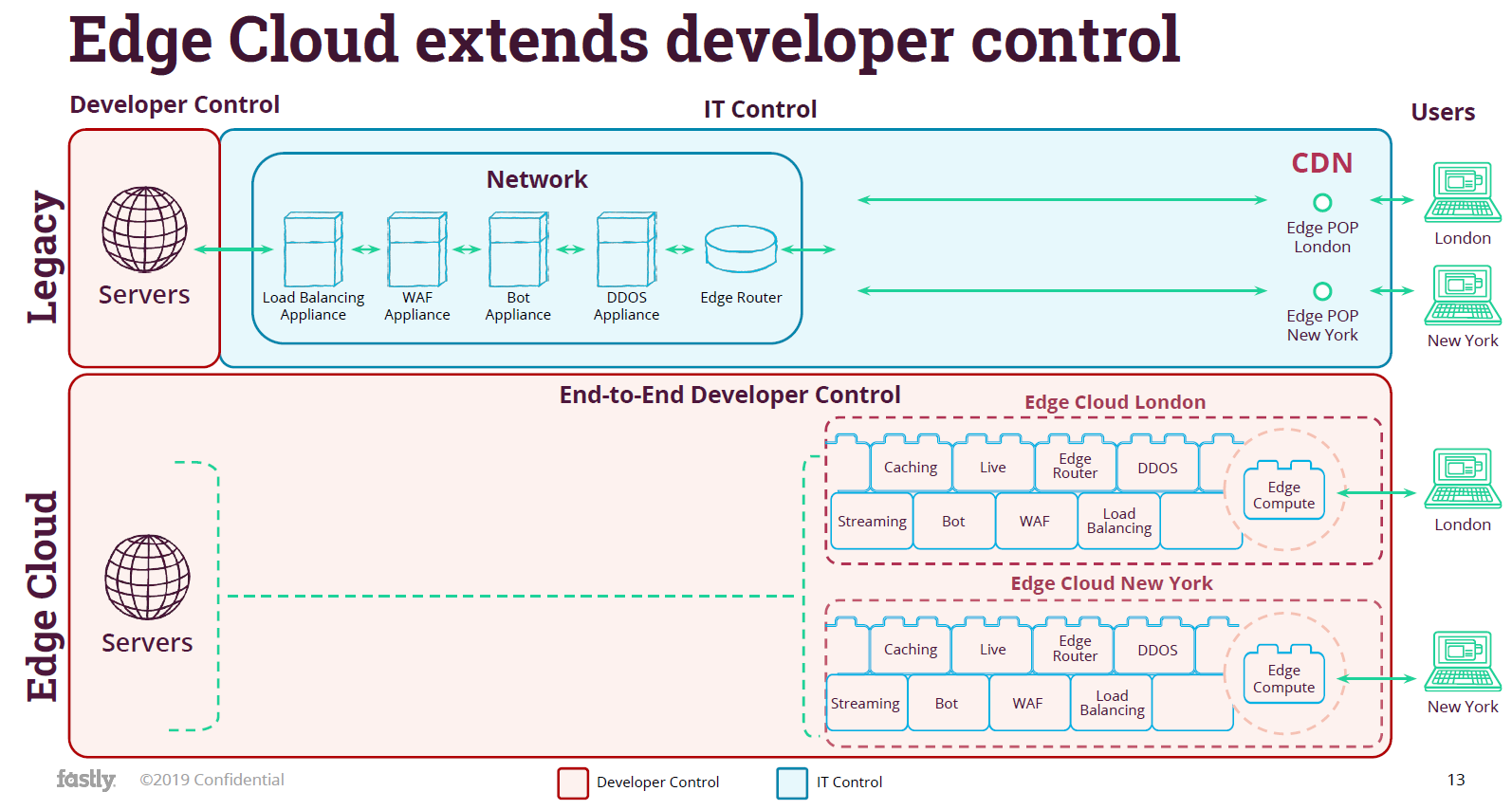

Finally, Fastly does a nice job of illustrating the edge versus legacy.

The important part here is the coloring. That pink color shows where developers have control versus that blue color where IT has control. Again, Fastly is a company built for developers — that’s what the edge is for.

And now, finally, we move to Fastly.

Valuation

As of this writing FSLY is trading at a $1.89 billion market cap on forecast full year sales of $193 million (at the midpoint), which leads to a price to sales ratio of 9.8.

If the company hits 35% revenue growth next year, we have a forward P/S of 7.25.

I would be happy to buy this anything below a 10:1 P/S for forward 2021. And, in that vein, I have – twice.

Fastly

Fastly (FSLY) operates an edge cloud platform for processing, serving, and securing its customer’s applications. This is a new stock to the public market, with an IPO just months ago and just one earnings report as a public company.

Fastly defines the edge as the point in the network just before you lose control of the data. Their edge cloud platform moves data and applications closer to users, at the network edge — so you can meet rising customer expectations, deliver secure, competitive online experiences, and bring innovative ideas to life, faster.

Technology is the muscle behind user experiences, and it directly relates to an enterprises bottom line. By leveraging the right infrastructure, enterprises can scale smarter, improve security, and optimize the user experience. With Fastly powering things in the background, they say enterprises can get back to focusing on what matters most for your business.

Incidentally, as we move from the central cloud to the edge cloud, we now introduce another cyber security pain point. So, while we introduce Fastly as the edge cloud innovator, we also introduce it as another cyber security Top Pick.

In fact, the CEO claims that one quarter of its business is security and he rightly points out that security and delivery cannot be disentangled. If you have a cloud, even an edge cloud, you need security — that’s it.

The company’s customers are developers. Its entire corporate DNA is focused around the developer and in that vein it’s working well.

Business Nuts and Bolts

It’s not the sexiest part of a Top Pick dossier but for an introduction it is necessary, so here we go with some nuts and bolts.

Fastly servers (its edge cloud) do not sit in the centralized public clouds (although they are in the same building), rather they sit in a point-of-presence (PoP) room. A PoP typically houses servers, routers, network switches, multiplexers, and other network interface equipment, and is typically located in a data center.

ISPs typically have multiple PoPs. PoPs are often located at Internet exchange points and colocation centers.

An easy way to understand it is the room where Internet world gets connected. Fastly is in all major metro areas, 60 to date, across all geographies, with an aim to get to 100 locations in the longer-term. In the PoP, Fastly delivers custom BGP (Border Gateway Protocol), custom load balancing, custom (cyber) security, and SDN (Software defined networking) enabled management.

For those keeping score at home, Border Gateway Protocol is the routing protocol used to route traffic across the internet. It’s often times referred to as “the routing protocol that makes the internet work.”

For more score keeping, SDN is an approach to using open protocols, to apply globally aware software control at the edges of the network to access network switches and routers that typically would use closed and proprietary firmware.

The company has 45 terabytes of capacity in all of its geographies combined, and has issued 30 patents.

Now, onto the bullish thesis and progress.

Customers

With a company so new to the public domain, we need to start with customers, not financials. While it is certainly the case that dozens or even hundreds of customers would not want their name shared, what we do have is still an impressive list.

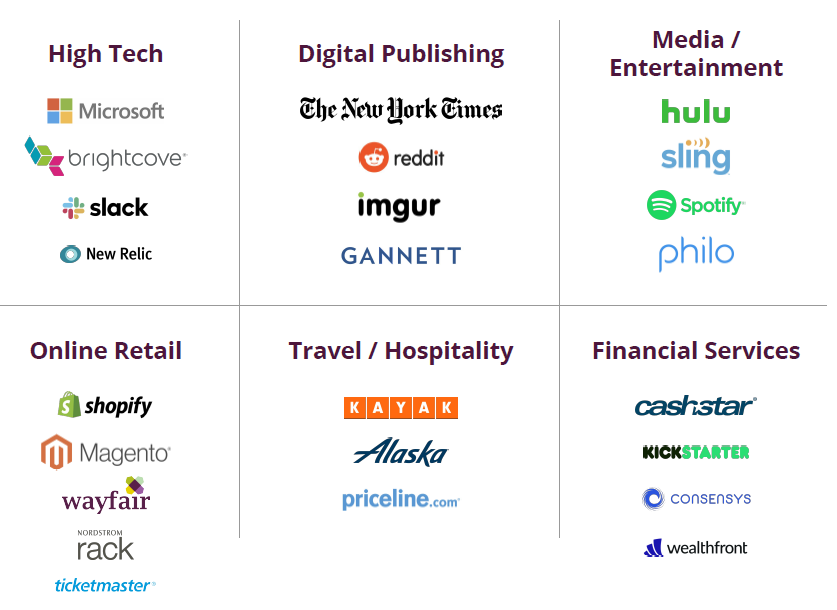

We’re looking at Shopify, Microsoft, hulu, reddit, slack, The New York Times. Not seen on this list are others like Uber Eats, Spotify (streaming music), and MLS (major league soccer).

The company looks directly at the following verticals for customer growth:

* Live streaming <-- major focus

* E-commerce & publishing

* Fintech

* Gaming

The company is focused on enterprise, but through that it indirectly serves small and medium sized business (SMBs), like those powered by Shopify. It also powers retail customers indirectly, through hulu, Spotify, The New York Times, etc.

Here is an image of customers by logo by vertical:

Further, all four cloud titans are partners — that is, data can be sitting in any of those centralized clouds and still use Fastly on the edge.

Details

86% of Fastly’s revenue is enterprise and as of the last earnings report, the average enterprise customer spends over $570,000 a year. One of Fastly’s fantastic advantages over the cloud titans that may endeavor into the edge is that it employs a multi-cloud strategy.

That means it is data agnostic. So, an enterprise can have data stored with any of the cloud titans, and the software layer they use for Fastly is unchanged; developers do it once, and that’s it.

And if you’re wondering if that matters, try this: Forrester Consulting found in 2018 that 86% of enterprises have adopted a multi-cloud strategy. Further, IDC predicts that 90% of companies will be multicloud by 2021.

This is a trend that the cloud titans either point to as a point of strength, essentially noting that everyone will be a customer at some point, no matter where they started, or it’s a point they discuss very little, trying to emphasize their moat.

To Fastly, it’s a fantastic trend. It’s an obvious trend. It’s a trend that builds its moat and lessens any future competitive strikes from the cloud titans when (it’s a when not an if) they get into the edge cloud realm.

Now let’s turn to some financials and the way this company actually makes money.

Financials, et Cetera

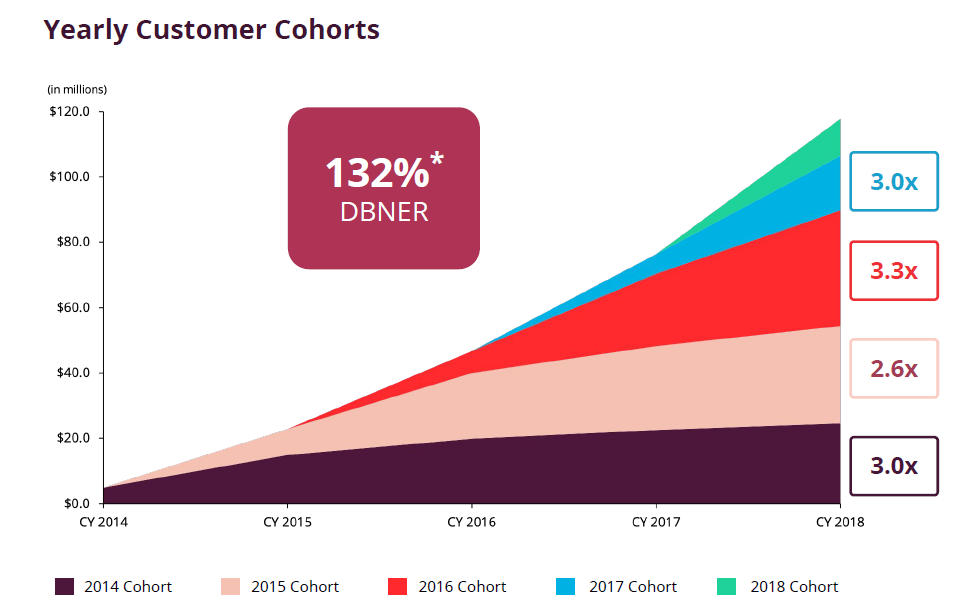

Fastly makes money through usage, just like Spotlight Top Pick Twilio. That means the company has an embedded growth rate in its current user base. To that point, Fastly has a mind bending 135% dollar based net expansion rate (DBNER).

That means, with no customer additions or subtractions, the company has an embedded 37% growth rate. Now, as the company scales it will be impossible to keep that rate so high, but in a world where retention rates used to be measured as something less than 100%, this is another wunderkind that has a dollar based retention rate above 100%.

Here is a chart of that DBNER, and how it impacts growth, in and of itself from existing customers. I find this to be extremely instructive. But, note that this chart is from last quarter and the DBNER is now 135%.

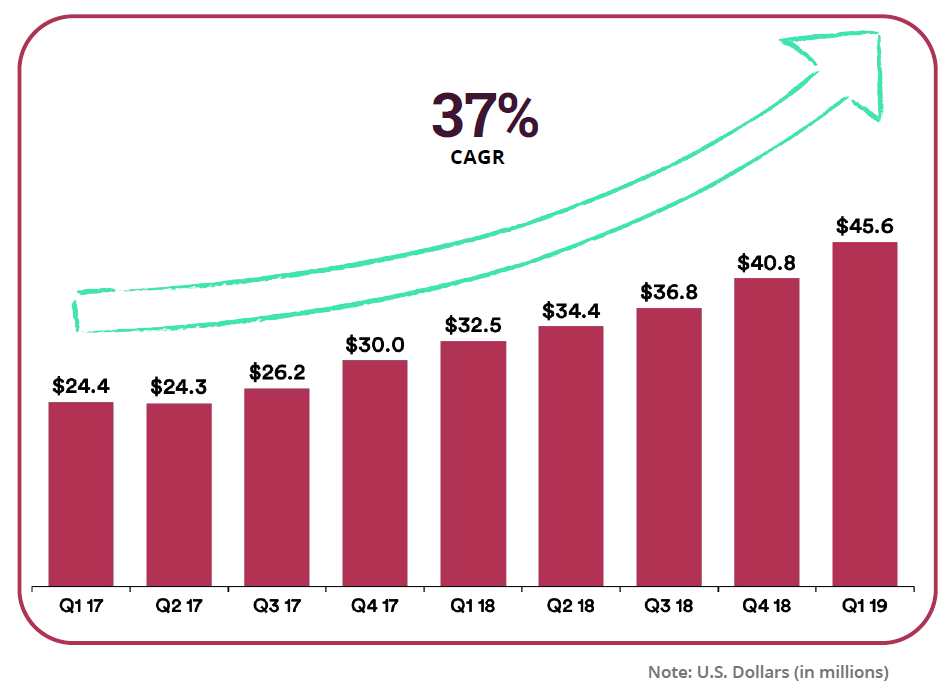

Here is the company’s revenue chart, but again, this is from last quarter, so the newest bar reads $50 million.

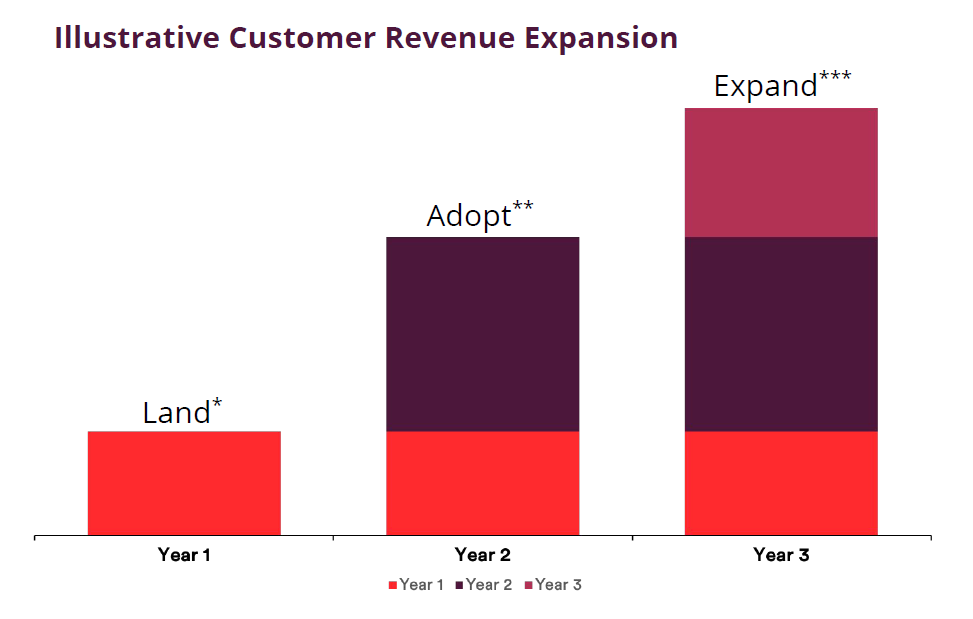

It’s the “land and expand” strategy known to most software companies that gives Fastly its strategic approach to new customers and growth from them moving forward:

Fastly’s enterprise customer count is growing rapidly, as is the average account size. But, again, this chart is now from two quarters ago. So, the number of enterprise customers is now 274.

Here is the quarterly updated chart:

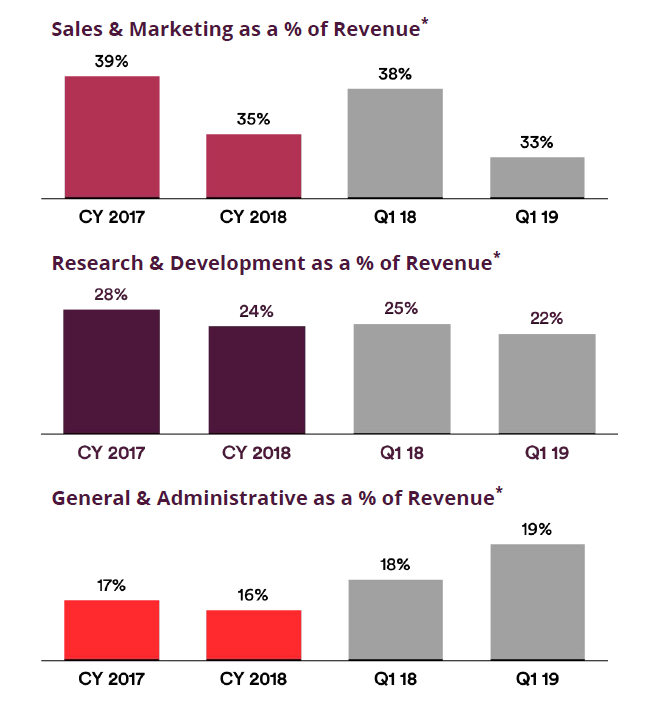

We can look at operating leverage explicitly. You will see:

* Sales and marketing as a percent of revenue dipping.

* Research and development (R&D) as a percent of revenue dipping.

* General and Administrative costs dipped for full year 2017 to full year 2018, but there was a rise from Q1 2019 relative to Q1 2018.

We can update those bars a bit for Q3.

* Research and development expense was $12 million in Q3 2019, or 24% of revenue.

* Sales and marketing expense was $18 million in Q3 2019, representing 35% of revenue.

* General and administrative expense was $11 million in Q3 2019, or 21% of revenue.

Each of these measures ticked up a bit as we would expect but operating leverage is still well demonstrated.

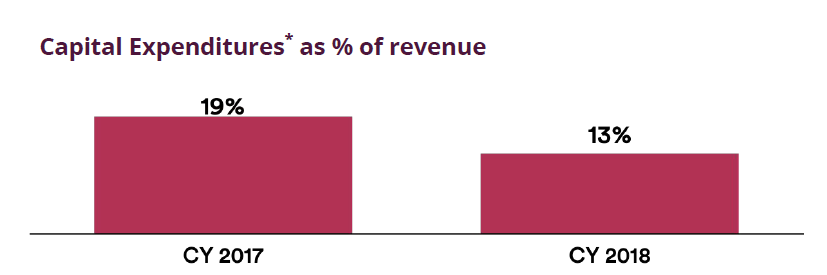

There is an investment part to this business. Fastly has to spend money on capital expenditures (CapEx) to build its servers. But we see signs of scale rather clearly taking hold:

The long-term goal for Fastly is a 10% CapEx to revenue ratio and it appears it is well on its way to getting there.

Cash Flow

Fastly, like most young companies, is not cash flow positive. The company sees positive EBITDA in three to four years and positive cash flow the year after that.

Risk

There is risk everywhere with this company.

* It is not cash flow positive.

* It is virtually guaranteed to face competition from the largest cloud providers in the world.

* It’s valuation is bordering on absurd with a $2.5 billion market cap and CY 2019 forecasts of $193 million in revenue.

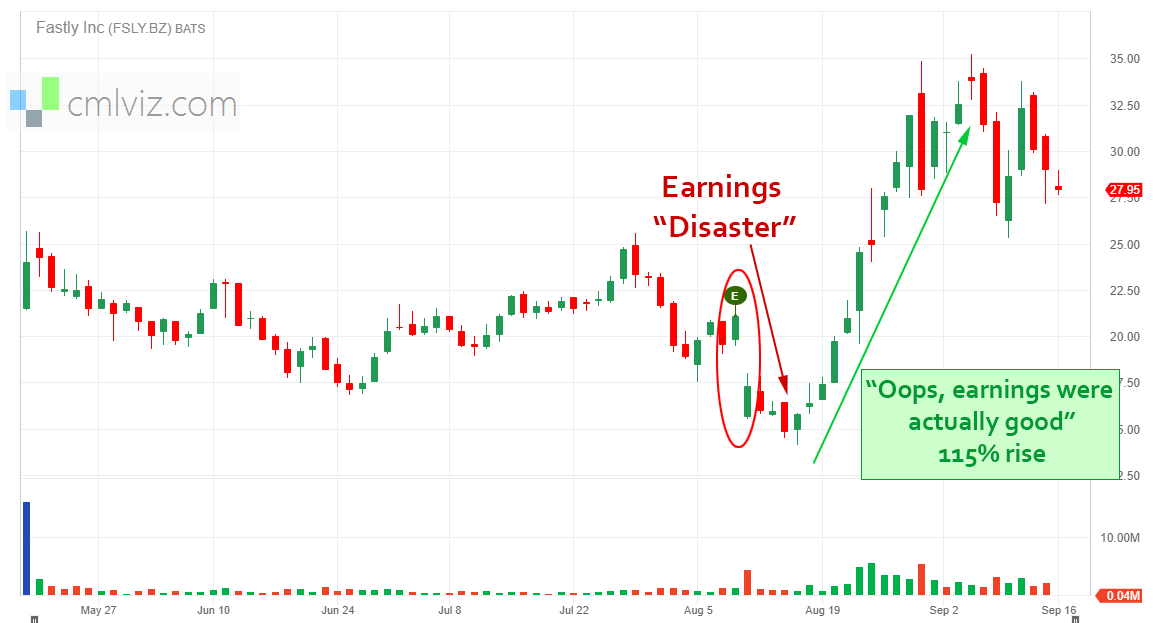

* The market in general doesn’t understand it. Check out this absurdity.

When its first earnings were reported the stock got utterly crushed. The market was beside itself. But…

… then, in the following days, all the analysts said, “wait, this was a great quarter,” and the stock rose 115%. Like I said, “the market in general doesn’t understand it.”

WHY THIS MATTERS

It's understanding technology that gets us an edge to find the "next Apple," or the "next Facebook." This is what CML Pro does. We are members of Thomson First Call -- our research sits side by side with Goldman Sachs, Morgan Stanley and the rest, but we are the anti-institution and break the information asymmetry.

The precious few thematic top picks for 2018, research dossiers, and alerts are available for a limited time. Join Us: Discover the undiscovered companies that will power technology's future.

Thanks for reading, friends.

The author is long shares of FSLY at the time of this writing.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.