Advanced Earnings Option Trade in Facebook Inc

Advanced Earnings Option Trade in Facebook Inc

Date Published: 2017-06-29Preface

There is an advanced option trade in Facebook Inc (NASDAQ:FB) ahead of earnings that takes no stock direction risk, carries a tight stop loss and reduces even the volatility risk which as won 11 of the last 12 pre-earnings cycles and returned more than 320% in annualized returns over the last three-years.

This is it -- this is how people profit from the option market. Identifying strategies that are tightly risk controlled, take no stock direction risk and no earnings risk. Strategies that are immune from a bull or bear market.

TRADE TIMING

This is for the advanced option trader, just note that this has a few steps to it. First we start with the timing:

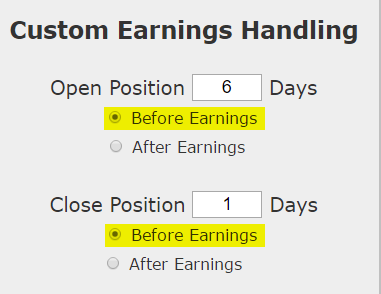

We want to look at a very short window, specifically opening a trade six-days before an earnings announcement and closing it the day before. Here it is plainly:

So, to be clear -- this trade does not take on the risk of earnings, it closes before earnings.

TRADE SET-UP

With the timing set, we now construct the trade with these rules:

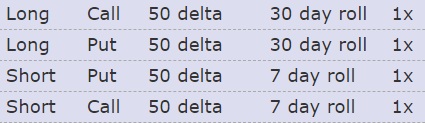

* Buy the at-the-money straddle with a 30-day expiration (or closest to it)

* Sell an at-the-money straddle with a 7-day expiration (or closest to it)

* Both of these straddles have expirations after earnings.

* Use a 25% stop loss so if the trade goes bad, we protect against any really large losses

Here's how this looks, plainly:

And here is the reasoning behind the trade, before we get to the results:

TRADE REASONING AND RESULTS

The idea is to own the straddle with a longer expiration and sell the straddle with the closer expiration to benefit from the time decay in the shorter-term options. It's a fine cut to try to make this work, but this trade does not take earnings risk, does not take stock direction risk and take very little volatility risk.

Now, here are the results of this trade in Facebook Inc over the last three-years:

| FB: Long & Short Straddle | |||

| % Wins: | 91.7% | ||

| Wins: 11 | Losses: 1 | ||

| % Return: | 80.5% | ||

While the set-up took a while to describe, the results are easy. We see a 80.5% return over the last three-years, which was 12 earnings cycles. This option trade won 11 times and lost just 1 time. Even further, each period of this trade is just six-days, so that 80.5% return is actually just 12 weeks of trading, and if we annualize that, it makes for more than a 320% return.

Now we can look at the results over the last year:

| FB: Long & Short Straddle | |||

| % Wins: | 100% | ||

| Wins: 4 | Losses: 0 | ||

| % Return: | 105% | ||

The trade has returned 105%, and won all four times it was triggered. It bears repeating, there is a 25% stop loss on this trade, there is no stock direction risk, there is no earnings risk and there is very little implied volatility (vega) risk.

That's 40.1%, winning both of the last two pre-earnings trades.

WHAT HAPPENED

For the expert option trader, or the option trader that wants to take the next step in the evolution of trading, this is it. This is how people profit from the option market.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.