It's Happening: This Tech Gem May be the Next Google

Fundamentals

PREFACE

It's coming. In fact, it's already here. A tectonic shift in one of the world's largest and most lucrative markets. We've heard about it in blurbs, headlines, odd tech articles. But now it has come out of the shadows and into plain sight. It's not a $9 billion industry as predicted by most, but potentially a $200 billion industry growing faster than any other segment of technology.

Online video consumption is now measured in billions of views an hour, and with that a thunderbolt like change to the advertising world.

THEME

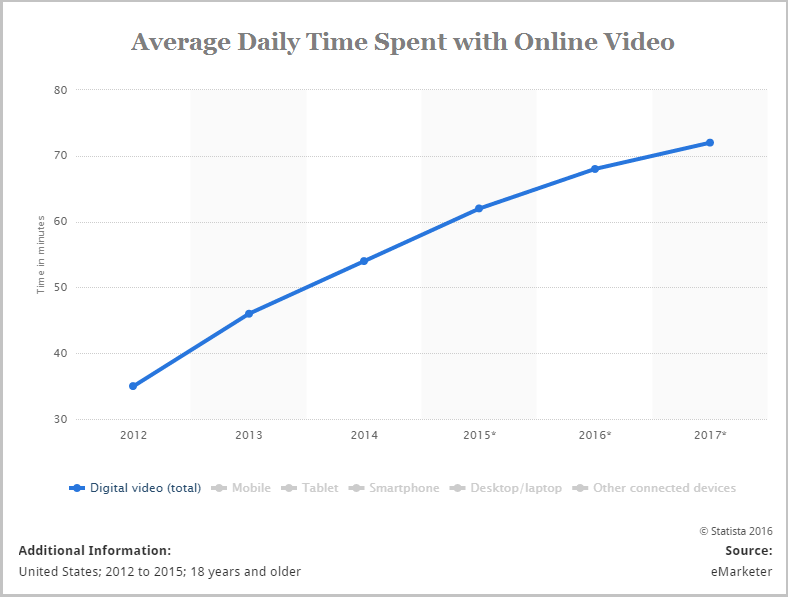

First, let's look at the thematic shift in digital and online video consumption in two charts. First, we plot the average amount of time spent per day for U.S. adults with online video (via Statista):

The trend is decidedly upwards. Even further, eyeballs are moving from regular television to online video:

If we take all of that information together we see without question that online video is a colossal thematic shift still in its growth phase and we need know which companies, or better yet, which single company, is best positioned to benefit.

GOOGLE AND FACEBOOK

If advertising sounds boring then it's time for an update: 97% of Facebook's revenue comes from ads and the company stands at a colossal $320 billion market cap. But that's small.

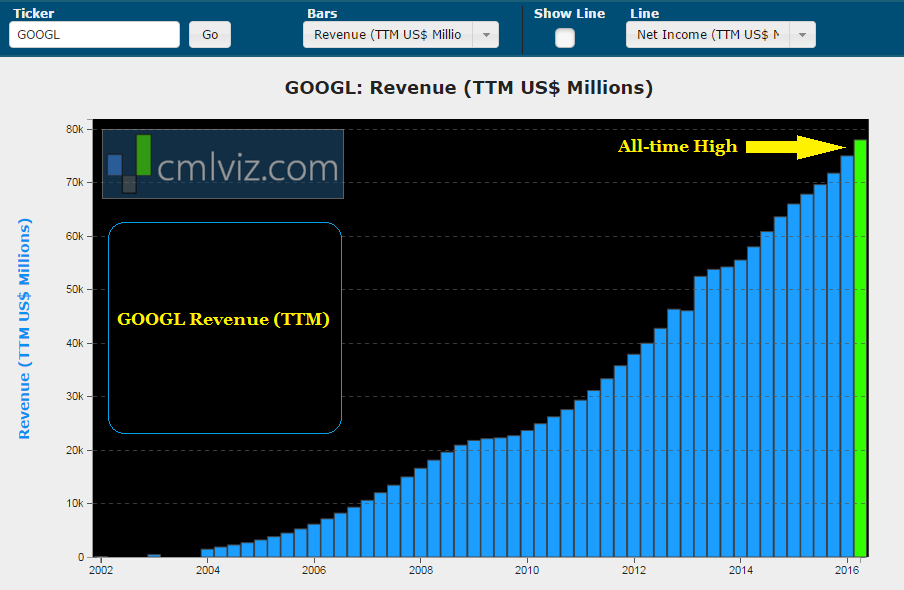

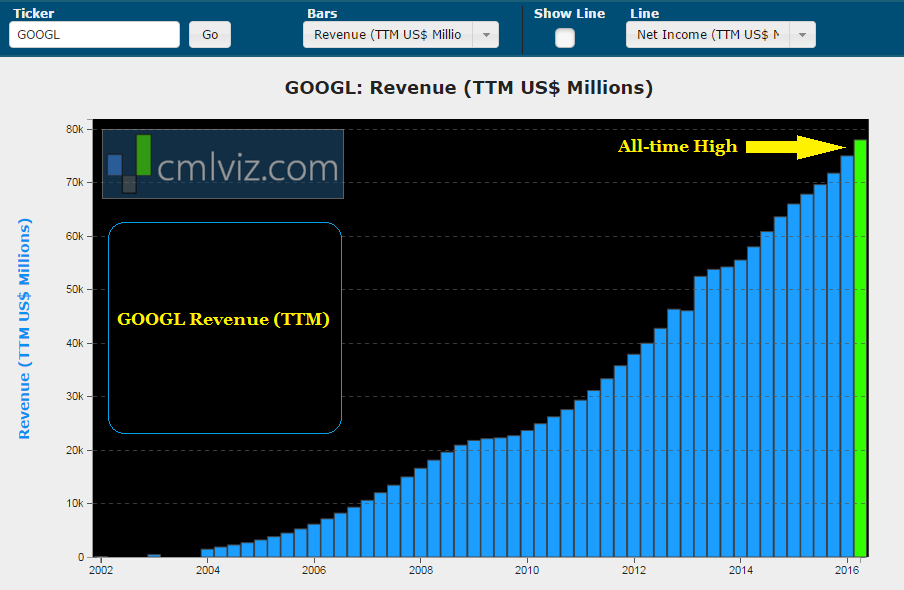

Google changed the world with its AdWords advertising platform for Google Search. It has made Google the largest, most successful advertiser ever, with a market cap nearing half a trillion dollars. In fact, here is Alphabet's all-time revenue chart:

ALPHABET REVENUE (TTM)

But the next salvo isn't text advertisements, it's video -- one of the most powerful themes driving technology today. And there's one firm whose founders believe it can be the Google of video advertising.

Facebook (NASDAQ:FB) recently announced that it receives 10 billion video views a day and Snapchat reported 8 billion views a day. Twitter (NASDAQ:TWTR) reported online video consumption by 90% of its users. Google's YouTube numbers are yet more staggering:

“

YouTube on mobile alone now reaches more 18 to 34 and 18 to 49 year olds in the U.S. than any TV network, broadcast or cable.

YouTube on mobile alone now reaches more 18 to 34 and 18 to 49 year olds in the U.S. than any TV network, broadcast or cable.

”

While the main stream media and Wall Street analysts thought they had a handle on this booming trend, it turns out it could be 20x larger than expected and this time, it may not be mega cap technology company that gets the real prize, but rather an up and coming gem that has aspirations that are borderline unspeakable.

Let's first understand the landscape which has created radical demand for this service, and then we'll look at the company that has its sights set at the highest possible prize.

IT'S TOO BIG TO MEASURE

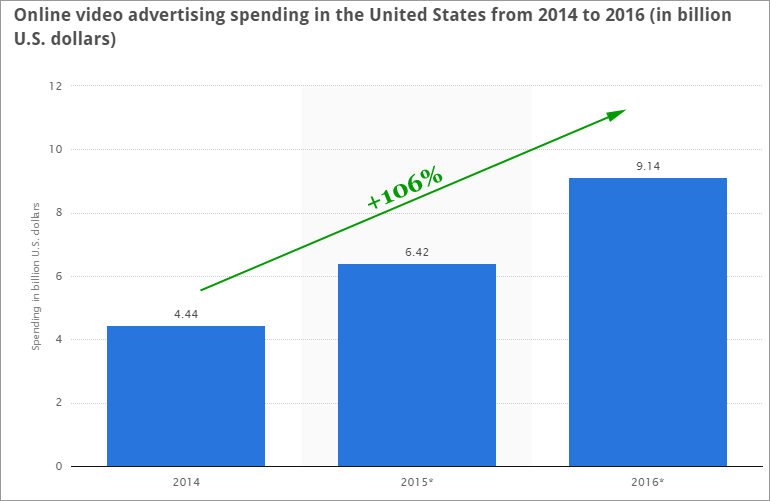

As of just a few days ago, this is what the world was expecting from online video ads:

ONLINE VIDEO AD REVENUE

But even that fantastical growth rate appears to be severely understated, and here's why:

We reported last week that advertising buying juggernaut Magna Global that is responsible for around $37 billion in marketing investments on behalf of clients like Johnson & Johnson and Coca-Cola just announced that it has moved $200 million in ad spends away from TV ads and to Google's YouTube for online video ads.

The niche online video market isn't going to be a niche, it's going to be the largest advertising conduit on the planet. TV ad spends are over $200 billion a year, and we just saw the beginning of that mountain shifting to online video with Magna Globals' move.

The opportunity is so large that Amazon.com (NASDAQ:AMZN) just announced its own online video service to compete directly with Google's YouTube:

“

Amazon.com Inc launched a service on Tuesday that allows users to post videos and earn royalties from them [] to compete directly with Alphabet Inc's YouTube.

Source: Yahoo! Finance.

Amazon.com Inc launched a service on Tuesday that allows users to post videos and earn royalties from them [] to compete directly with Alphabet Inc's YouTube.

”

Source: Yahoo! Finance.

THE WINNER

There's an investing philosophy we have at CML Pro and it goes something like this:

“

You can mine for gold hoping to be one of the lucky few to win the gold rush lottery, or you can sell pickaxes and shovels to the gold miners and guarantee you've won the lottery several times over.

Source: CML Pro

You can mine for gold hoping to be one of the lucky few to win the gold rush lottery, or you can sell pickaxes and shovels to the gold miners and guarantee you've won the lottery several times over.

”

Source: CML Pro

Google, Facebook, Twitter, Amazon, Snapchat, even Apple will battle for the online video ad space, but we don't care which firm wins and how the market share is distributed. That's hunting for gold. We want the pick-axe and the shovel and it turns out there is a company that very well may be the guts to this incredible booming thematic shift.

TUBEMOGUL

TubeMogul (TUBE) provides self-serve software that allows advertisers to plan, buy and measure the effectiveness of video ads. The company website reads:

“

TubeMogul's advertising solution is powered by the company's unprecedented data platform that tracks billions of video streams every month from the Internet's top publishers. This unique technology enables TubeMogul to help advertisers find consumers who want to watch their videos – and watch them longer.

Source: TubeMogul

TubeMogul's advertising solution is powered by the company's unprecedented data platform that tracks billions of video streams every month from the Internet's top publishers. This unique technology enables TubeMogul to help advertisers find consumers who want to watch their videos – and watch them longer.

”

Source: TubeMogul

The company just released earnings and friends, we may have our early evidence that this small gem is ready to accomplish exactly what its stated goal is: To be the next Google.

EARNINGS NOTES

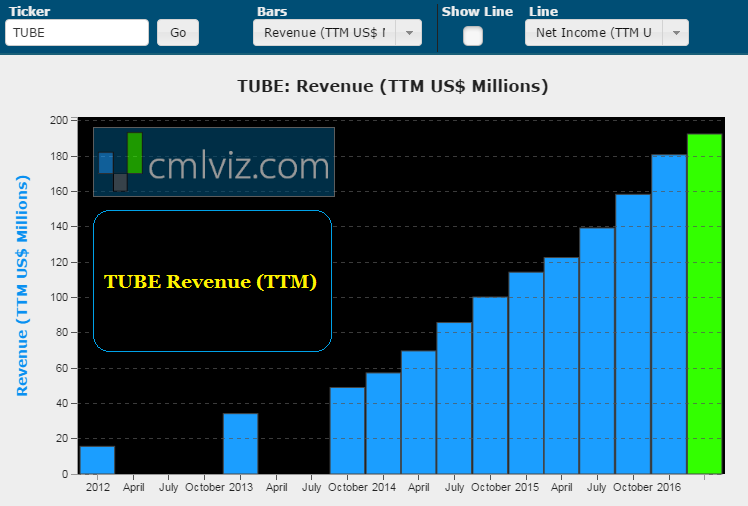

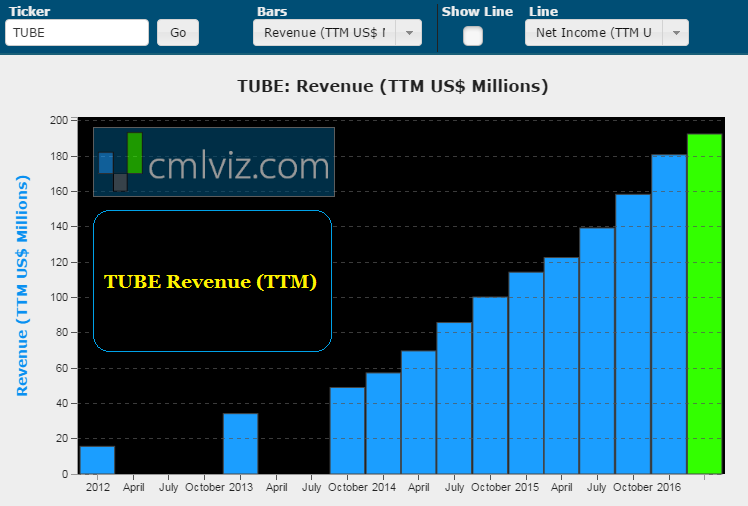

First, here is TUBE's all-time revenue chart:

TUBE REVENUE (TTM)

We can see that the company continues to make all-time highs in revenue. But the future looks yet brighter. Here are comments from the company's conference call:

“

Total spend increased 58% year-over-year to $112.8 million.

Gross profit grew 38% year-over-year, and gross margin was 72.3%, an increase from 61.7% in Q4.

Source: TubeMogul

Total spend increased 58% year-over-year to $112.8 million.

Gross profit grew 38% year-over-year, and gross margin was 72.3%, an increase from 61.7% in Q4.

”

Source: TubeMogul

Further, the company raised its full year forecast to the range of $226 million to $232 million, from a prior forecast of $220 million to $228 million.

But perhaps the most bullish news came in a list of highlights -- here is the critical snippet:

“

Our software enables advertisers to seamlessly plan and execute ad buys across all screens and media channels, including televisions, and now on Facebook and Instagram, as well.

Source: TubeMogul

Our software enables advertisers to seamlessly plan and execute ad buys across all screens and media channels, including televisions, and now on Facebook and Instagram, as well.

”

Source: TubeMogul

Yeah, that Facebook.

THE FUTURE

There's even more going on with TUBE, including technology and automation advances that should push margins, revenue and customer counts yet higher. We leave the rest of the remarkable details that we uncovered in our research for CML Pro members but we do note that this company could also be an attractive takeover candidate for Apple (NASDAQ:AAPL), as the tech behemoth watches its three largest competitors reap multi-billion rewards from one of the largest technology shifts we have ever seen.

WHY THIS MATTERS

Online video is one of the major thematic trends that will shape the future and will soon be the life blood for Facebook, Google and even Amazon. Now, to find the 'next Apple' or 'next Google,' to find the "shovels that will power the gold miners," we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.