Apple versus Google: Head to Head the Better Buy

Apple versus Google

Our purpose is to provide institutional research to all investors and break the information monopoly held by the top .1%.PREFACE

With Apple and Google we are looking at the two most powerful and influential companies ever with totally different views of the world and the stakes couldn't be higher. The firm that wins will shape worldwide innovation and technical architecture for generations to come.

We could live in a seamlessly staged, beautifully styled ecosystem that creates a home for you, or an architecture that focuses on utility, search and speed which connects all of human thought instantaneously while entering into your home to connect with your technical DNA. Both firms are so far ahead of the curve that they see a straight line.

So which stock has more upside potential?

Discover the undiscovered:

Get Our (Free) News Alerts Once a Day.

THE BATTLEFIELD

When it comes down to it, Apple (NASDAQ:AAPL) and Alphabet (GOOG:NASDAQ) span enormous thematic segments of transformative technology. The current businesses have some overlap, but the future is rife with direct, head-to-head competition.

First Apple

Apple's colossal success has been achieved through a seamless ecosystem that focuses on ease, style, product and marketing. We start with smartphones:

SMART PHONES

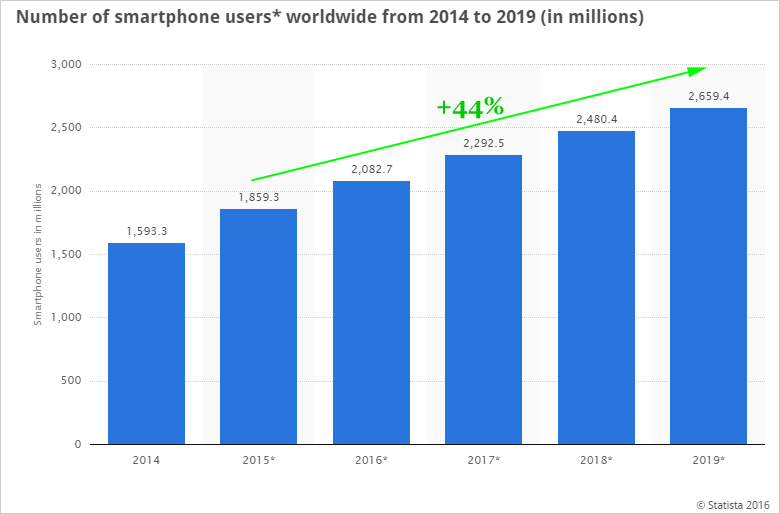

We're looking at 44% growth in the smart phone market and Apple's iPhone SE is the conduit to India, which represents a market larger than the United States as of this year. We refer you to the CML Pro dossier surrounding Tim Cook's secret handshake with the Prime Minister of India that has changed everything. Breaking news reveals that the SE is already a big hit, with demand outpacing supply and wait times hitting up to three weeks.

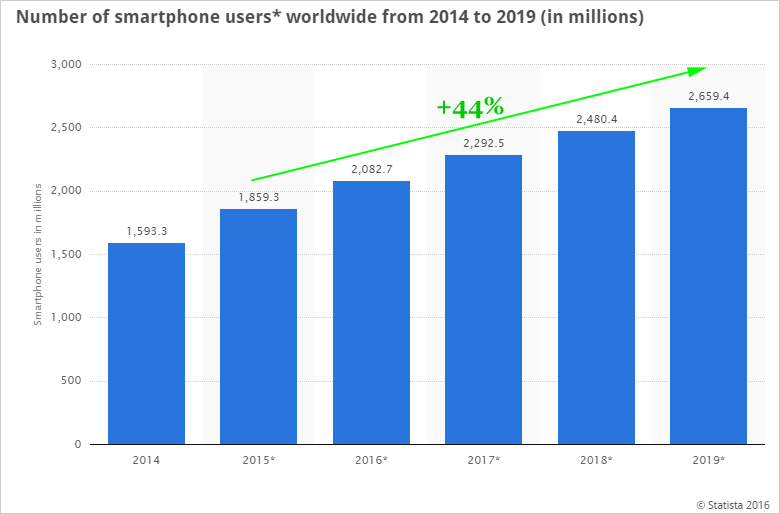

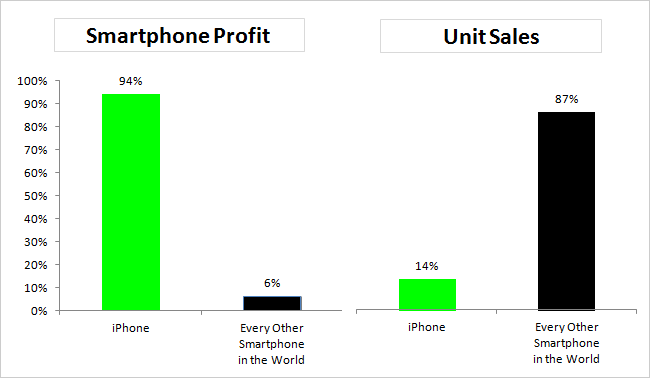

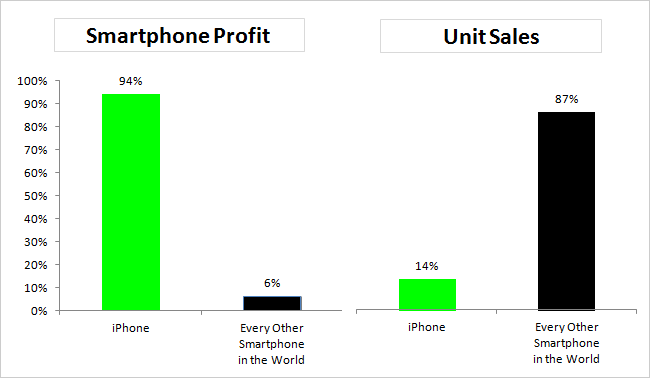

While phones carrying the Google operating system, Android, proliferate, Google actually has little control over its OS and that has proven to be a bit of problem. Check out this chart of smartphone profitability:

SMART PHONE PROFITS

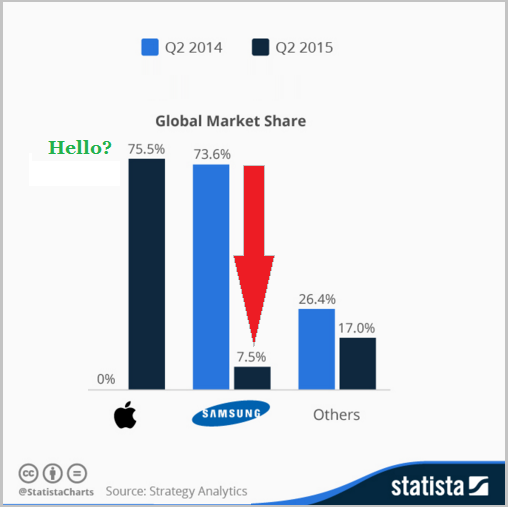

Apple takes home 94% of smart phone profits on just 14% of sales. A nearly identical dominance is occurring in smart watches. We can see the radical change in market share once the Apple Watch was introduced. This is simply the market share of smart watches from last year to this year via Statista:

SMART WATCH MARKET SHARE

The Apple Watch didn't exist in 2014 so it carried no market share, while Google's device held nearly 75% of the market. Then 2015 happened and Apple jumped to 75% of the market while Alphabet / Google (GOOG, GOOGL) fell to single digits.

Next, the Apple TV is the technology that will make Apple the largest cable company in the world.

APPLE TV

Apple TV just had its best quarter ever. We learned that as the provider, the hardware, the interactor, the bundler, the ecosystem to TV, Apple will find hundreds of millions of subscribers paying our $30-$40 a month for cable and apps and the checks go to 'Apple, Inc.' This is an attempt to crush Google's (NASDAQ: GOOGL) YouTube and Netflix (NASDAQ:NFLX) by relegating them to 'apps' rather than destinations. All signs point to an early, and frightening success. Amazon's (NASDAQ:AMZN) Prime service is also threatened.

Now let's look forward for Apple -- the future that will ram heads with Google.

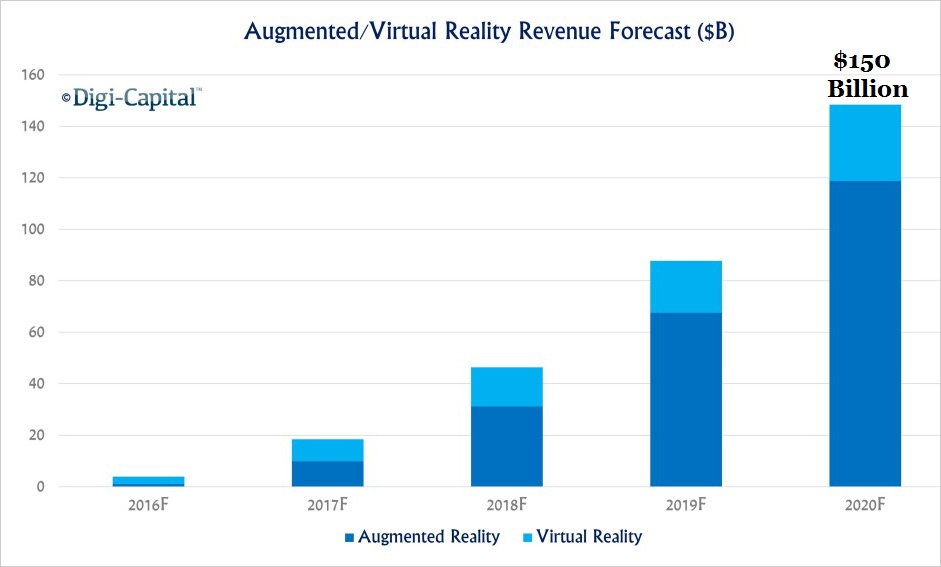

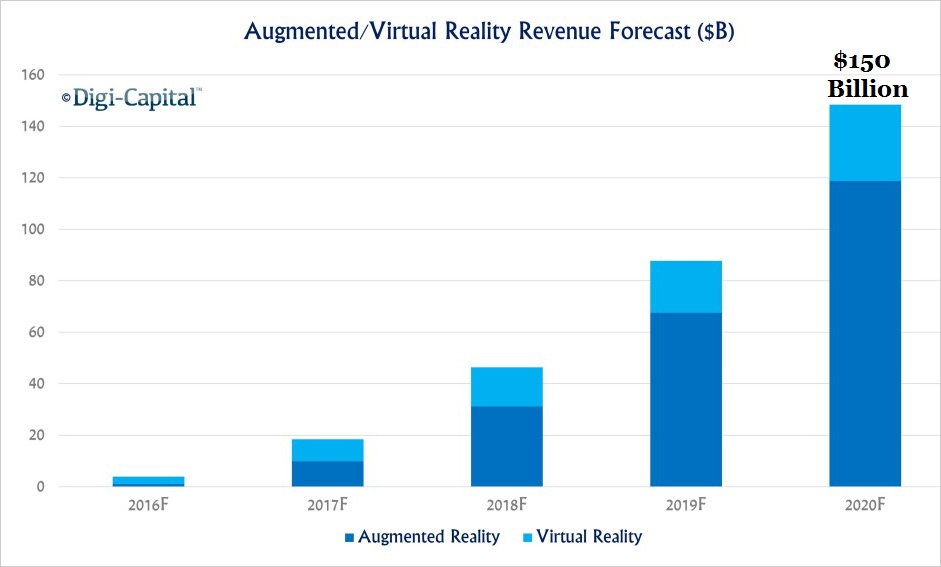

VIRTUAL AND AUGMENTED REALITY

This is a market whose "customer base looks increasingly like all of humanity" according to Dave Thiel at Forbes, and he's right. Apple has made waves through company and talent acquisition.

Even before all of this, Apple was filing patents like this one:

"Method and system for creating an image-based virtual reality environment utilizing a fisheye lens"

As the virtual reality landscape heats up, Apple is fighting to ensure they are at the cutting edge. Best of all, a new wave of VR headsets are being created as mounting devices for existing smartphones.

Patent: US5960108A

Google also recently created a virtual reality department, headed by Clay Bavor (source: recode.net). Bavor was previously in charge of Google's experimental, low cost "Cardboard" device that allowed users to mount smartphones as VR devices.

GOOGLE'S CARDBOARD

We also can't forget that Google has already made one huge bet in the space of augmented reality with their Google Glass line. While they proved to be too early for mass market appeal, they've undoubtedly learned from the failures and successes of this effort.

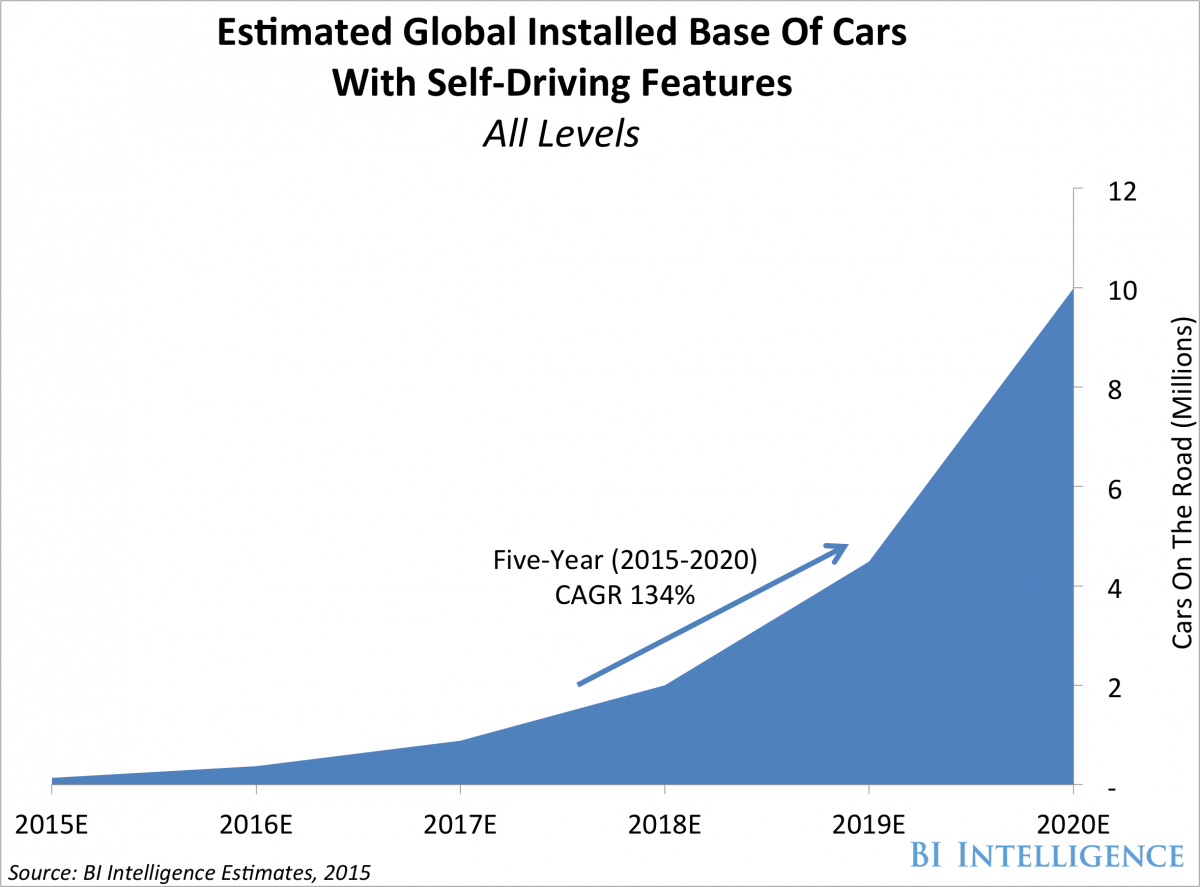

Finally we look to cars with self-driving features:

CARS WITH SELF DRIVING FEATURES

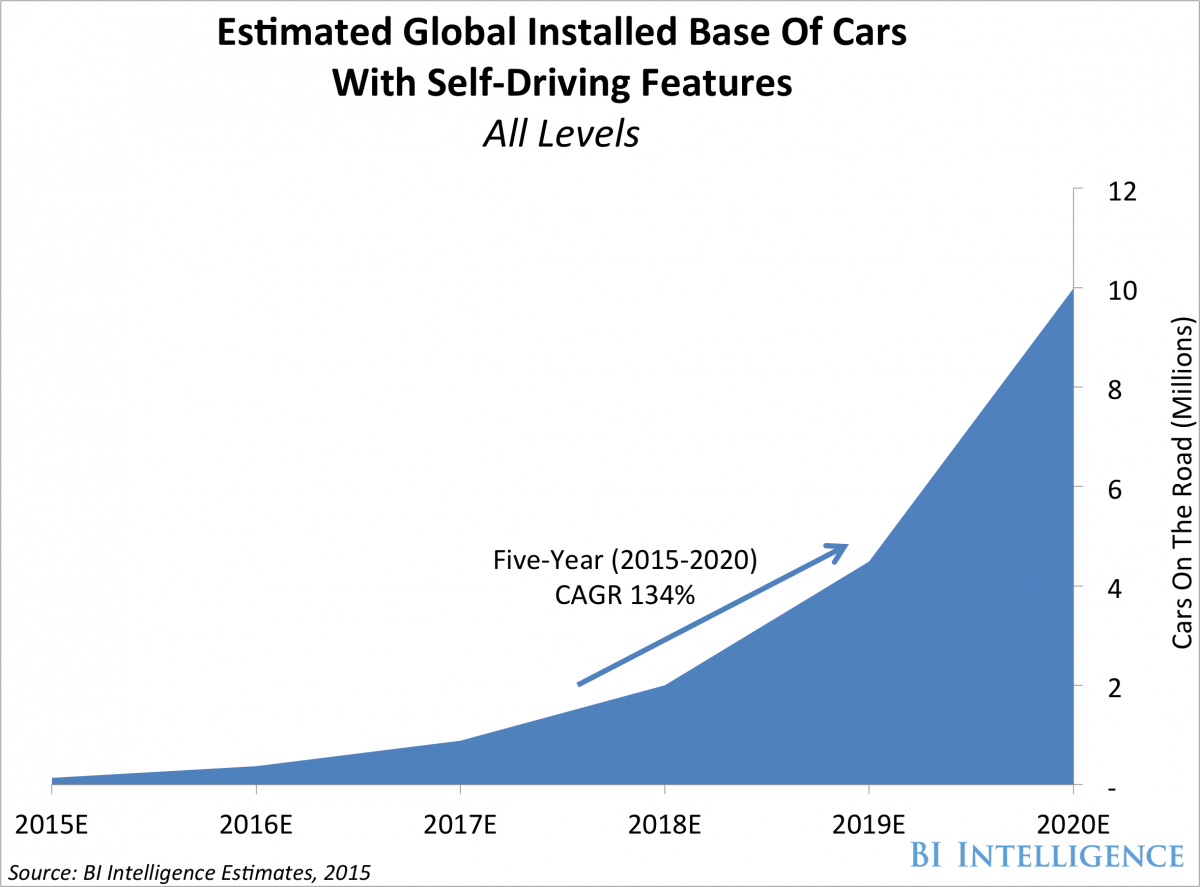

We're looking at 134% compounded-annual-growth rate for the next five years ending at 10 million cars by 2020. While Tesla (NASDAQ:TSLA) is the current undisputed champion, even Elon Musk calls Apple's entry into the auto market "an open secret." The San Francisco Chronicle reported that Musk met with Apple's acquisition chief, Adrian Perica, in 2013, and likely CEO Tim Cook as well.

Over a thousand engineers are now said to work within "Project Titan", according to CNBC and another report states that enough engineers have been drawn away from Tesla as to impact Tesla's product roadmap, according to Apple Insider.

For its part, Google has openly declared its goal to create totally self-driving vehicles. The company is rattling the cages of politicians and law makers now, in order to accomplish its goal in several years. Google is also reported to be working with Ford, which would presumably be manufacturing the cars.

But both VR and self-driving cars are the future for Google, the present is still enormously profitable:

Now Google

Google's success has been achieved through a focus on speed, utility and search which has become the entirety of connection and human knowledge through the Internet.

For now, Google's ecosystem is based on search and that means Google draws 80% of its revenue from advertising. Google is the king of desktop ads with its search engine and ad words platform which has turned it into the most successful advertising company ever.

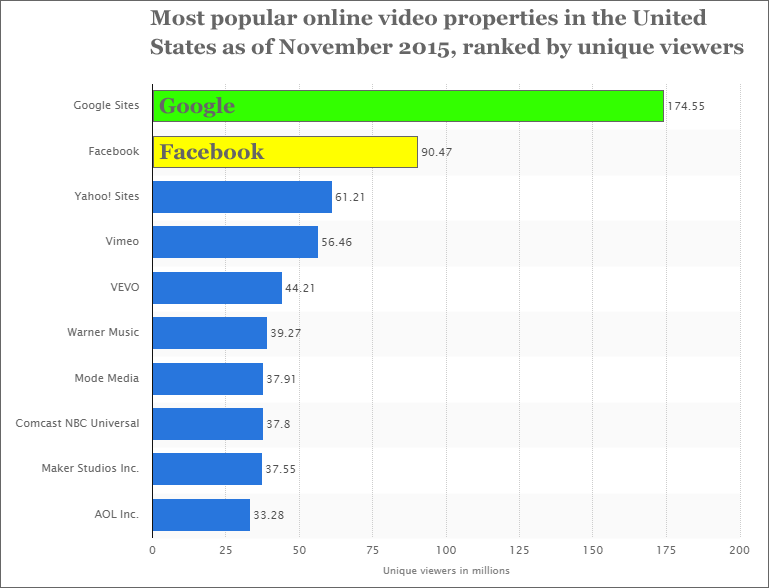

But now it's online video that has become the hottest battlefield. While Facebook claims it receives 8 billion video views a day, we know that Google's You Tube has more viewers aged 18-49 on mobile alone than any U.S. cable network. In fact, we can rank the top used video sites from our friends at Statista:

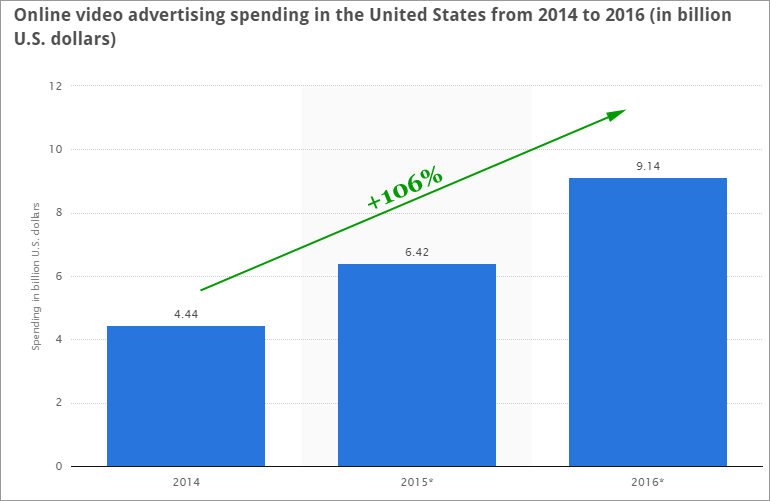

And here is the revenue growth that's being generated:

Google is in a war with Facebook over online videos and online advertising. Facebook (NASDAQ:FB) is the undisputed king of mobile and Google has turned to a “co-opetition” with Twitter to challenge Facebook's death grip on social media.

HEAD-TO-HEAD

In the present, Google has greater growth prospects -- online advertising is growing, and Google is the leader. Looking forward, we can make an argument that Apple's ecosystem is more holistic and with its one billion active device install base, it's dominant right now.

The Apple and Google cars will be a guessing game for now, but if it comes down to brand, Apple is still the winner. Virtual reality will be a battle, but if it's hardware driven, again, the edge likely goes to Apple -- although we can't forget the current leader, Facebook's Oculus.

Apple's device business is turning the corner by all accounts, from iPhone to Watch and the transformative Apple TV. Apple has a clearer path to disruptive enterprise changing upside than Google, but in reality, picking a winner here is a practice in futility.

APPLE'S EDGE

There is one point we must sort out. Google is pushing hard to gain share in mobile advertising, but unlike Facebook, it isn't as protected with an app -- rather searches happen often times through a web browser. And here's the problem with that:

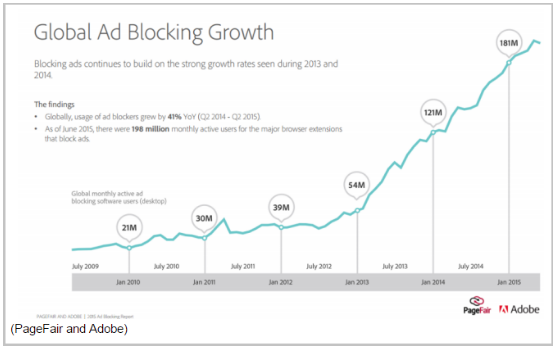

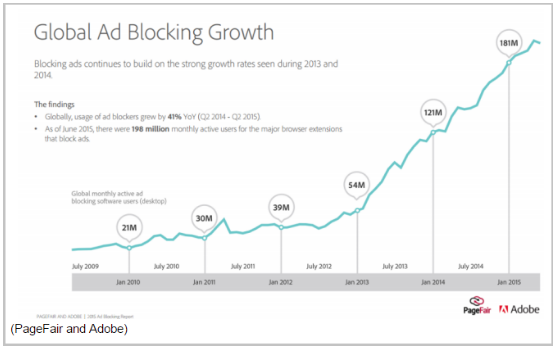

According to a report published by PageFair and Adobe, ad blocking software worldwide has increased 41% year-on-year to 198 million monthly active users and is expected to cost publishers more than $21.8 billion in 2015 in lost revenue (BusinessInsider).

Here's the incredible chart:

PROLIFERATION OF AD BLOCKING

This is a reality to be aware of because the trend will rise substantially higher as this becomes a normal part of the technical vernacular surrounding mobile devices. But, of course, these are two of the best mega cap technology companies in the world. Google is an absolute marvel, while Apple's position for future growth and an unbreakable death grip on hardware that will power much of the future.

WHY ANY OF THIS MATTERS

As we said, together we have just started the analysis. But, to find the 'next Apple,' 'next Google,' or 'next Amazon,' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.