Understanding Option Skew -- What it is and Why it Exists

Written by Ophir Gottlieb

While earnings season is a great time to look at option volatility, it's always a good time to understand the implications of skew in the option market, even if you're not an option trader.

While the first chart below won't make much sense yet, by the end of the article it will mean everything. Here is how Google's option skew looked two days before earnings.

As we know, Google's stock did smash new all-time highs off of earnings, and we will soon understand that the option market reflected that possibility rather clearly.

What Does Skew Mean?

Volatility is often discussed as a single number. In the real market, the volatility of each strike price and in each month is different than the neighboring one. Skew is simply the volatility curve formed by plotting the individual volatilities of each strike. The shape of this curve is often referred to as the volatility "smile" or "smirk."

Normal Skew Shape

Normally the skew forms a downward smile (or smirk) -- lower strikes have higher volatility than higher strikes.

We can see the lower strike prices (OTM puts) have higher volatility than the ATM options and the OTM calls. This volatility smile shape exists for two reasons:

First, because of a basic real-life principle about the investing market: The vast majority of the equity positions are long. This is driven by rules that govern pension funds, mutual funds, 401(K)s, and the retail public, as well as a general phenomenon that investors prefer to own securities in the expectation that they will rise in price rather than sell them in the expectation that they will decline. These realities have a direct impact on options prices (and therefore volatilities).

A long investor makes two general options trades to hedge his or her long stock. The first is to purchase downside puts as insurance against a portfolio drop. This increases the demand for downside puts. Like all free-market prices, increases in demand create increases in price. Ceteris paribus, the only way to make an option more expensive is to raise the volatility.

The second hedging trade is to sell calls against long stock (covered calls). This acts both as an income-generating strategy and as a hedge for downside moves. Call sellers imply a decrease in demand for upside calls. This decreased demand lowers prices (volatility).

The second reason a volatility skew exists is that the market moves down faster than it moves up. Historically, bear markets are much more abrupt and realize outlying returns faster than bull markets. The more expensive OTM puts compared to OTM calls is simply a reflection by the options market that downside risk is greater than upside risk.

On a side note: Remember that the stock market doesn't create new rules, it simply reflects the rules of the universe. Our universe imposes on us the reality that creation takes longer than destruction -- so bear markets (destruction of wealth) are faster and more abrupt than bull markets (creation of wealth) and option skew reflects that reality.

Implications on Strategies

A direct impact of skew can be seen on some common option strategies, like an iron condor.

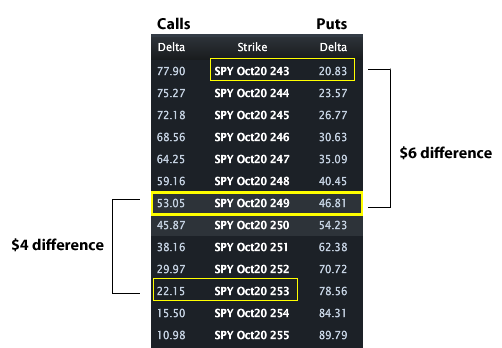

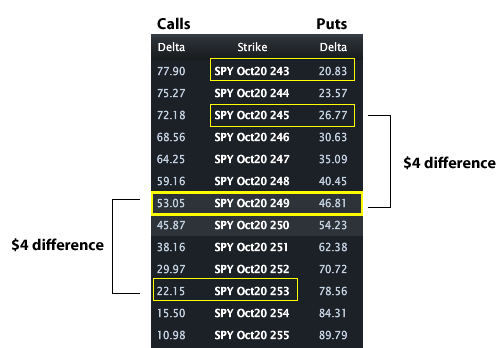

While it feels like, for example, that a 30 delta / 10 delta iron condor would use calls and puts that are equally out of the money, the existance of skew changes all of that. Here's a real world example from 9-17-2017m for the Octovber 18th options in SPY:

Note that the underlying price is ~$249, so we can consider those options 'at the money.'

Now, we we wanted to sell a 50 delta / 20 delta iron condor, that would end up being these strike prices:

50 delta call: 249

50 delta put: 249

20 delta call: 253

20 delta put: 243

Here is the image again for ease of reference:

So we can see that the difference in strike prices between the 50 delta call and the 20 delta call is 253 - 249 = 4.

But, the difference in strike prices between the 50 delta put and the 20 delta put is 249 - 243 = 6.

So, what would have appeared, at first glance, to be a symmetrical iron condor (where the calls and puts have the same distance between strikes) is in fact not. If we wanted our puts to also be $4 away from the 50 delta option, we would need the 245 strike, which is infact 26 delta.

So, while a 50/20 iron condor is not symmetric, a 50 delta / 20 delta call and 50 delta / 27 delta put makes it symmetric. In other words, with 'normal slew,' you would need to raise the delta of the furthest out of the money put.

Stock Price and Volatility Movement

Normally, when stocks go down, vol goes up because investors that are long stock buy puts for protection which creates greater demand for options.

Alternatively, when stocks move up, vol goes down because investors that are long stock sell OTM calls for income which creates less demand for options.

Abnormal Skew

For certain types of companies, the demand for upside calls is so great that the skew (vol) bends up for OTM calls as well -- this can either be speculative call buying (like a takeover rumor or earnings speculation) or a company where the upside risk is perceived to be as great as the downside (like Solar companies and Bio-techs).

Yahoo! was a company that has been a speculative favorite of late for a possible buyout.

Note how the skew for YHOO is parabolic. The downside bends up due to the phenomena presented prior. The upside skew bends up due to the order flow, which is pre-dominantly speculative call buying on takeover rumors.

For the naturally curious reader, solar companies and bio-techs can be great examples of the second type of company -- those that exhibit an upside skew shape (the market reflects as much upside risk as downside).

Here's an image of Facebook's skew, just a week before earnings are due out.

Note that the highest strike prices do show elevated volatility relative to the at-the-money strikes but those strikes are WAY out of the money. This phenomenon may simply be a reflection that market makers are more willing to buy than to sell far OTM calls in Facebook ahead of earnings. This should not necessarily be read as an indication of a large upside move because the strike prices are so far out of the money.

For the record, Apple (AAPL) has a nearly identical skew shape as Facebook coming into earnings with the exact same commentary. Here is that image.

No we're done, so take a look back at our first image above for Google. Do options share information about probabilities?.. yes.

This is trade analysis, not a recommendation.

Legal Stuff:

Options involve risk. Prior to buying or selling an option, an investor must receive a copy of Characteristics and Risks of Standardized Options. Investors need a broker to trade options, and must meet suitability requirements.

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information.